Question

A. Compute the cost of not taking the following cash discounts. (Use a 360-day year. Do not round intermediate calculations. Input your final answers as

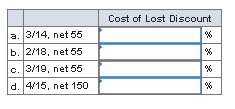

A. Compute the cost of not taking the following cash discounts. (Use a 360-day year. Do not round intermediate calculations. Input your final answers as a percent rounded to 2 decimal places.)

B. A pawnshop will lend $6,500 for 45 days at a cost of $25 interest. What is the effective rate of interest? (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

C. Mary Ott is going to borrow $7,300 for 90 days and pay $221 interest. What is the effective rate of interest if the loan is discounted? (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

D. Mr. Hugh Warner is a very cautious businessman. His supplier offers trade credit terms of 2/11, net 90. Mr. Warner never takes the discount offered, but he pays his suppliers in 80 days rather than the 90 days allowed so he is sure the payments are never late. What is Mr. Warner's cost of not taking the cash discount? (Use a 360-day year. Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.)

Cost of Lost Discount a. 3114, net 55 b. 2118, net 55 c. 3/19, net 55 d. 415, net 150Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started