Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Compute the total consideration for this business combination. If any payments described above are not included in your calculation of consideration paid, explain why

a. Compute the total consideration for this business combination. If any payments described above are not included in your calculation of consideration paid, explain why they are not included and specify the appropriate accounting for these payments.

b. Compute the goodwill recognized for this business combination.

c. Prepare the journal entry to record this business combination as a merger.

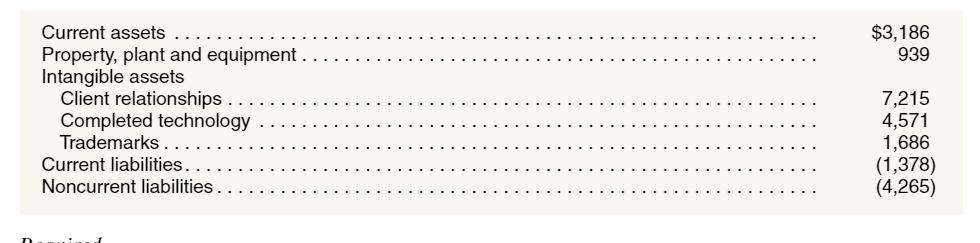

In July 2019, IBM Corporation acquired Red Hat, a provider of open-source and cloud technologies. Cash paid for outstanding Red Hat stock totaled $34,801 million. In addition, stock-based compensation awards attributable to pre-combination services had a fair value of $174 million, and stock issued to holders of vested performance share units were valued at $105 million. Acquisition-related legal and advisory fees of $189 million were paid in cash. Compensation related to employee retention plans for the period following the acquisition, paid in cash in 2019, totaled $230 million. An estimated $185 million associated with these retention plans remains to be paid in future years. Fair values of Red Hat's identifiable net assets at the date of acquisition are as follows (in millions):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a The total consideration for this business combination can be calculated as follows Cash paid for o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started