Question

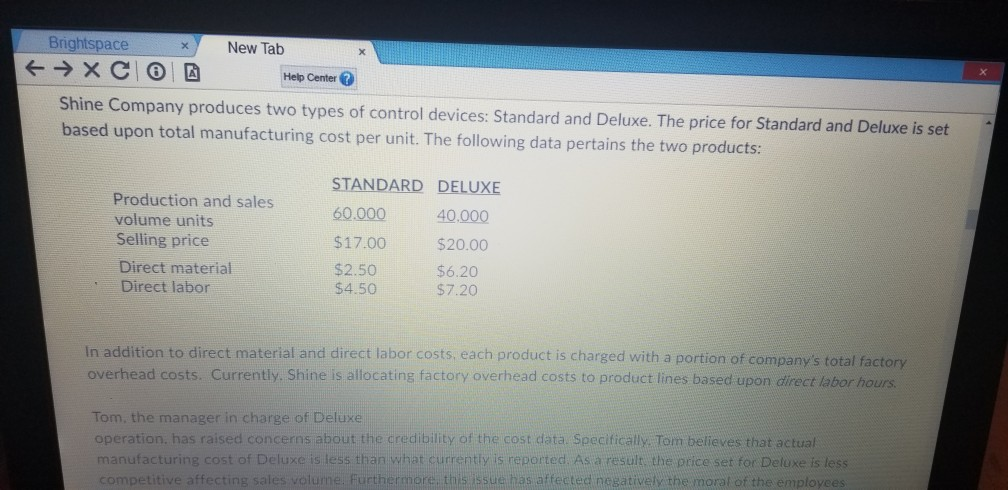

a- compute Total manufacturing cost Per unit of Deluxe under current plant-wide overhead allocation method based on Direct labor hours. b- compute total

a- compute Total manufacturing cost Per unit of Deluxe " under current plant-wide overhead allocation method "" based on Direct labor hours. b- compute total manufacturing cost per unit of Deluxe using activity based costing for the allocation of factory overhead cost. Carry your overhead rate calculations up to THREE decimal point. --------------'xxxxxxx

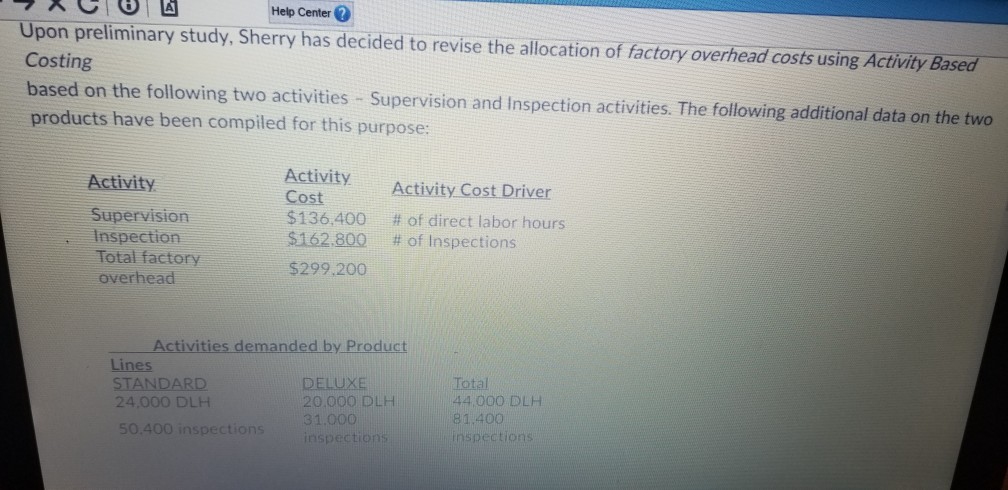

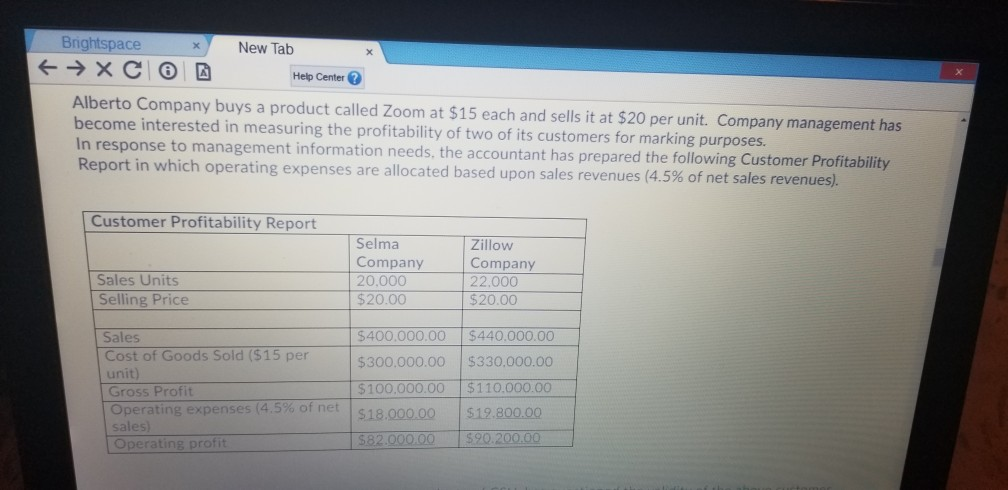

a- using activity based costing for the allocation of operating expenses of Alberto company, compute operating profit or loss made from customer Zillow company. b- using activity based costing for the allocation of operating expenses of Alberto company, compute operating profit or loss made from customer Selma company. Thanks

X New Tab Brightspace + XCO Help Center ? Shine Company produces two types of control devices: Standard and Deluxe. The price for Standard and Deluxe is set based upon total manufacturing cost per unit. The following data pertains the two products: STANDARD DELUXE 60.000 40.000 Production and sales volume units Selling price Direct material Direct labor $17.00 $20.00 $2.50 $4.50 $6.20 $7.20 In addition to direct material and direct labor costs, each product is charged with a portion of company's total factory overhead costs. Currently. Shine is allocating factory overhead costs to product lines based upon direct labor hours. Tom the manager in charge of Deluxe operation has raised concerns about the credibility of the cost data. Specifically, Tom believes that actual manufacturing cost of Deluxe is less than what currently is reported. As a result, the price set for Deluxe is less competitive affecting sales volume. Furthermore, this issue has affected negatively the moral of the employees Help Center Upon preliminary study, Sherry has decided to revise the allocation of factory overhead costs using Activity Based Costing based on the following two activities - Supervision and Inspection activities. The following additional data on the two products have been compiled for this purpose: Activity Cost Driver Activity Supervision Inspection Total factory overhead Activity Cost $136,400 $162.800 # of direct labor hours # of Inspections $299,200 Activities demanded by Product Lines STANDARD DELUXE 24.000 DLH 20.000 DLH 31.000 50.400 inspections inspections Total 44 000 DLH 81.400 inspections X X Brightspace New Tab 4 XC 62 Help Center? Alberto Company buys a product called Zoom at $15 each and sells it at $20 per unit. Company management has become interested in measuring the profitability of two of its customers for marking purposes. In response to management information needs, the accountant has prepared the following Customer Profitability Report in which operating expenses are allocated based upon sales revenues (4.5% of net sales revenues). Customer Profitability Report Selma Company 20.000 $20.00 Zillow Company 22.000 $20.00 Sales Units Selling Price $400.000.00 $440.000.00 $300,000.00 $330.000.00 Sales Cost of Goods Sold ($15 per unit) Gross Profit Operating expenses (4.5% of net sales) Operating profit $110.000.00 $100,000.00 $18.000.00 $82.000.00 $19.800.00 $90.200.00 X New Tab Brightspace 4 XC Help Center Activity Sales calls cost (paid to salespeople) Order processing cost Delivery cost Cost Driver and Rate $800 per visit $300 per order plus $0.40 per unit in each order $250 per order plus $0.50 per mile Lisa has gathered the following data pertaining to operating activities performed for Selma and Zillow customers: Zillow Company 11 Number of sales calls Number of Orders Number of units per orden Miles per delivery Selma Company 4 4 5.000 100 miles 2.000 280 miles Using Activity Based Costing for the allocation of operating expenses of Alberto Company, compute operating profit or loss made from customer Selma CompanyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started