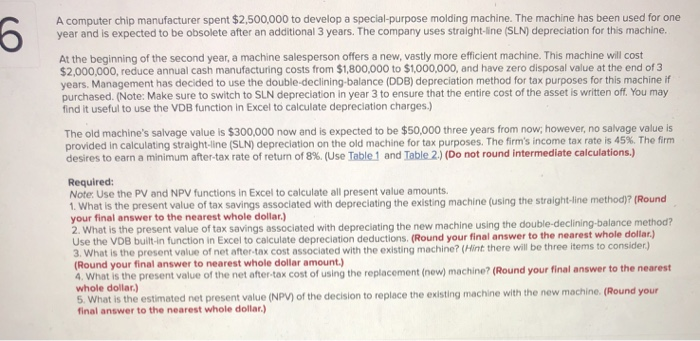

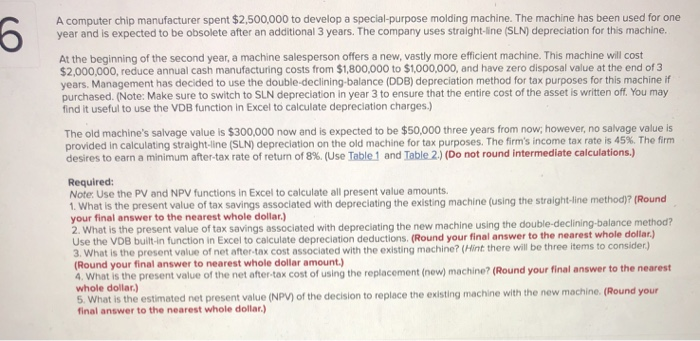

A computer chip manufacturer spent $2,500,000 to develop a special-purpose molding machine. The machine has been used for one year and is expected to be obsolete after an additional 3 years. The company uses straight-line (SLN) depreciation for this machine. At the beginning of the second year, a machine salesperson offers a new, vastly more efficient machine. This machine will cost $2,000,000, reduce annual cash manufacturing costs from $1,800,000 to $1,000,000, and have zero disposal value at the end of 3 years. Management has decided to use the double-declining-balance (DDB) depreciation method for tax purposes for this machine if purchased. (Note: Make sure to switch to SLN depreciation in year 3 to ensure that the entire cost of the asset is written off. You may find it useful to use the VDB function in Excel to calculate depreciation charges.) The old machine's salvage value is $300,000 now and is expected to be $50,000 three years from now; however, no salvage value is provided in calculating straight-line SL depreciation on the old machine for tax purposes. The firm's income tax rate is 45% The firm desires to earn a minimum after-tax rate of return of 8%. (Use Table1 and Table2) (Do not round intermediate calculations.) Required: Note: Use the PV and NPV functions in Excel to calculate all present value amounts 1. What is the present value of tax savings associated with depreciating the existing machine (using the straight -line method)? (Round your final answer to the nearest whole dollar.) 2. What is the present value of tax savings associated with depreciating the new machine using the double-declining-balance method? Use the VDB built-in function in Excel to calculate depreciation deductions. (Round your final answer to the nearest whole dollar.) 3. What is the present value of net after-tax cost associated with the existing machine? (Hint there will be three items to consider) (Round your final answer to nearest whole dollar amount.) 4. What is the present value of the net after-tax cost of using the replacement (new) machine? (Round your final answer to the nearest whole dollar.) 5. What is the estimated net present value (NpV) of the decision to replace the existing machine with the new machine. (Round y final answer to the nearest whole dollar) A computer chip manufacturer spent $2,500,000 to develop a special-purpose molding machine. The machine has been used for one year and is expected to be obsolete after an additional 3 years. The company uses straight-line (SLN) depreciation for this machine. At the beginning of the second year, a machine salesperson offers a new, vastly more efficient machine. This machine will cost $2,000,000, reduce annual cash manufacturing costs from $1,800,000 to $1,000,000, and have zero disposal value at the end of 3 years. Management has decided to use the double-declining-balance (DDB) depreciation method for tax purposes for this machine if purchased. (Note: Make sure to switch to SLN depreciation in year 3 to ensure that the entire cost of the asset is written off. You may find it useful to use the VDB function in Excel to calculate depreciation charges.) The old machine's salvage value is $300,000 now and is expected to be $50,000 three years from now; however, no salvage value is provided in calculating straight-line SL depreciation on the old machine for tax purposes. The firm's income tax rate is 45% The firm desires to earn a minimum after-tax rate of return of 8%. (Use Table1 and Table2) (Do not round intermediate calculations.) Required: Note: Use the PV and NPV functions in Excel to calculate all present value amounts 1. What is the present value of tax savings associated with depreciating the existing machine (using the straight -line method)? (Round your final answer to the nearest whole dollar.) 2. What is the present value of tax savings associated with depreciating the new machine using the double-declining-balance method? Use the VDB built-in function in Excel to calculate depreciation deductions. (Round your final answer to the nearest whole dollar.) 3. What is the present value of net after-tax cost associated with the existing machine? (Hint there will be three items to consider) (Round your final answer to nearest whole dollar amount.) 4. What is the present value of the net after-tax cost of using the replacement (new) machine? (Round your final answer to the nearest whole dollar.) 5. What is the estimated net present value (NpV) of the decision to replace the existing machine with the new machine. (Round y final answer to the nearest whole dollar)