Question

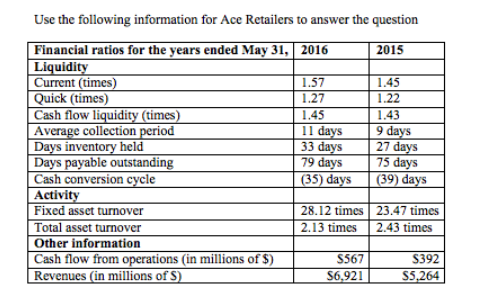

A concern that an analyst would have when analyzing the liquidity of Ace Retailers is that: A. the firm may be taking too long to

A concern that an analyst would have when analyzing the liquidity of Ace Retailers is that:

| A. | the firm may be taking too long to pay suppliers. | |

| B. | the quick ratio is less than the current ratio. | |

| C. | the company appears to sell inventory too quickly. | |

| D. | the company has negative cash flows from operations. |

Which of the following statements is true with regard to Ace Retailers?

| A. | The average collection period and the days inventory held ratios are too high for a retailer. | |

| B. | The company is able to collect cash faster than they are paying their suppliers, which is why their cash conversion cycle is negative. | |

| C. | The low average collection period implies that Ace takes too long to collect on accounts receivable. | |

| D. | The negative cash conversion cycle means that Ace Retailers is paying out cash sooner than they collect from their customers. |

All of the following statements are true with regard to Ace Retailers except:

| A. | Current assets are greater than current liabilities in both 2016 and 2015. | |

| B. | The firm has enough cash flow to cover current liabilities | |

| C. | Overall, Ace Retailers has good cash management and short term liquidity does not appear to be a concern for the firm. | |

| D. | The decline in the cash flow from operations amount from 2015 to 2016 explains the negative cash conversion cycle. |

Which of the following statements is true with regard to the asset turnover ratios of Ace Retailers?

| A. | Total asset turnover has decreased due to less efficient use of fixed assets. | |

| B. | Ace Retailers has increased sales relative to their investment in fixed assets or decreased their investments in fixed assets relative to sales. | |

| C. | Fixed asset turnover has gotten worse while total asset turnover is better in 2016 compared to 2015. | |

| D. | Total asset turnover has declined in 2016 due to the change in revenues. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started