Answered step by step

Verified Expert Solution

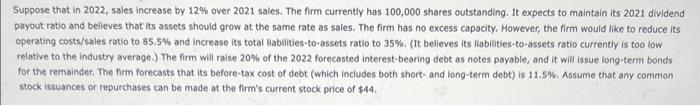

Question

1 Approved Answer

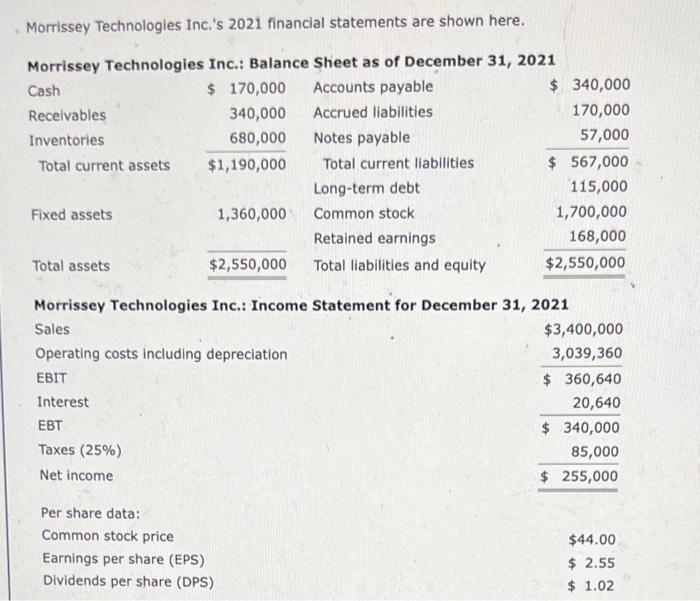

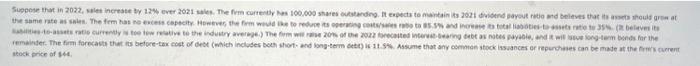

a. conduct the forcasted financial statments that these changes are made. What are the firms forcasted notes payable and long-term debt balances? What is the

a. conduct the forcasted financial statments that these changes are made. What are the firms forcasted notes payable and long-term debt balances? What is the forcasted addition to retained earnings? Round your answers to the nearest cent.

a. conduct the forcasted financial statments that these changes are made. What are the firms forcasted notes payable and long-term debt balances? What is the forcasted addition to retained earnings? Round your answers to the nearest cent.b. If the profit margin remains at 7.50% and the divident payout ratio remains at 40%, at what growth rate in sales will tge additional financing requirements be exactly zero? In other words, what is the firm's sustainable growth rate? (hint: set AFN equal to zero and solve for g) Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started