Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Congratulations! You have just won World Chess Championship! However, the organizer has just informed you that you can take your winnings in one of

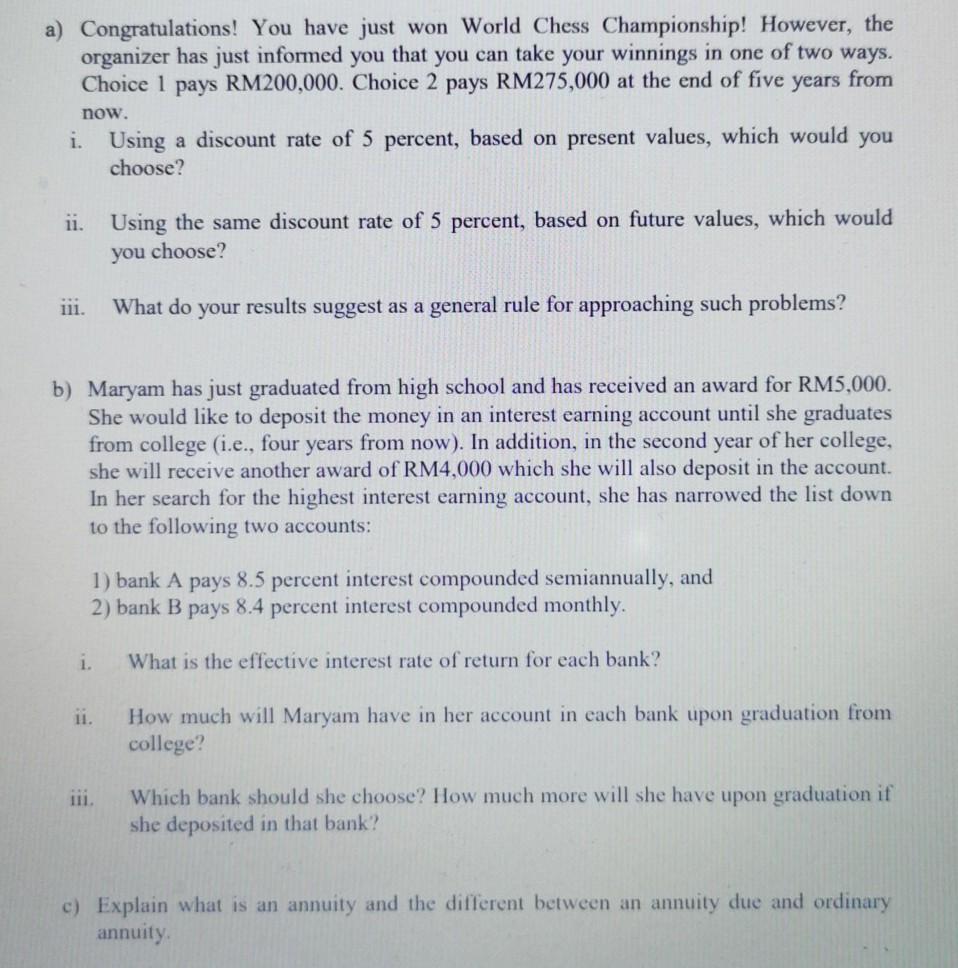

a) Congratulations! You have just won World Chess Championship! However, the organizer has just informed you that you can take your winnings in one of two ways. Choice 1 pays RM200,000. Choice 2 pays RM275,000 at the end of five years from now. i. Using a discount rate of 5 percent, based on present values, which would you choose? ii. Using the same discount rate of 5 percent, based on future values, which would you choose? 111. What do your results suggest as a general rule for approaching such problems? b) Maryam has just graduated from high school and has received an award for RM5,000. She would like to deposit the money in an interest earning account until she graduates from college (i.e., four years from now). In addition, in the second year of her college, she will receive another award of RM4,000 which she will also deposit in the account. In her search for the highest interest earning account, she has narrowed the list down to the following two accounts: 1) bank A pays 8.5 percent interest compounded semiannually, and 2) bank B pays 8.4 percent interest compounded monthly i. What is the effective interest rate of return for each bank? ii. How much will Maryam have in her account in each bank upon graduation from college? Which bank should she choose? How much more will she have upon graduation if she deposited in that bank? c) Explain what is an annuity and the different between an annuity due and ordinary annuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started