Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A conservative investor would like to invest some money in a bond fund. The investor is concerned about the safety of her principal (the

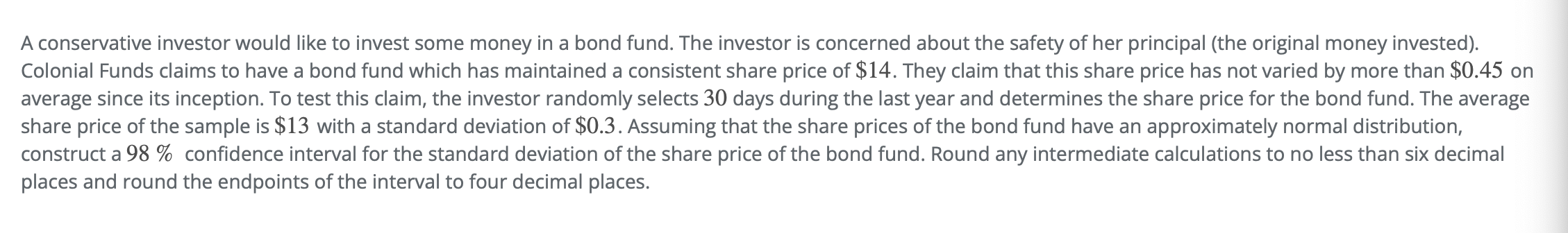

A conservative investor would like to invest some money in a bond fund. The investor is concerned about the safety of her principal (the original money invested). Colonial Funds claims to have a bond fund which has maintained a consistent share price of $14. They claim that this share price has not varied by more than $0.45 on average since its inception. To test this claim, the investor randomly selects 30 days during the last year and determines the share price for the bond fund. The average share price of the sample is $13 with a standard deviation of $0.3. Assuming that the share prices of the bond fund have an approximately normal distribution, construct a 98% confidence interval for the standard deviation of the share price of the bond fund. Round any intermediate calculations to no less than six decimal places and round the endpoints of the interval to four decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The formula for a 98 confidence interval for the standard deviation is CI s Z2 n s Z2 n where CI is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started