Answered step by step

Verified Expert Solution

Question

1 Approved Answer

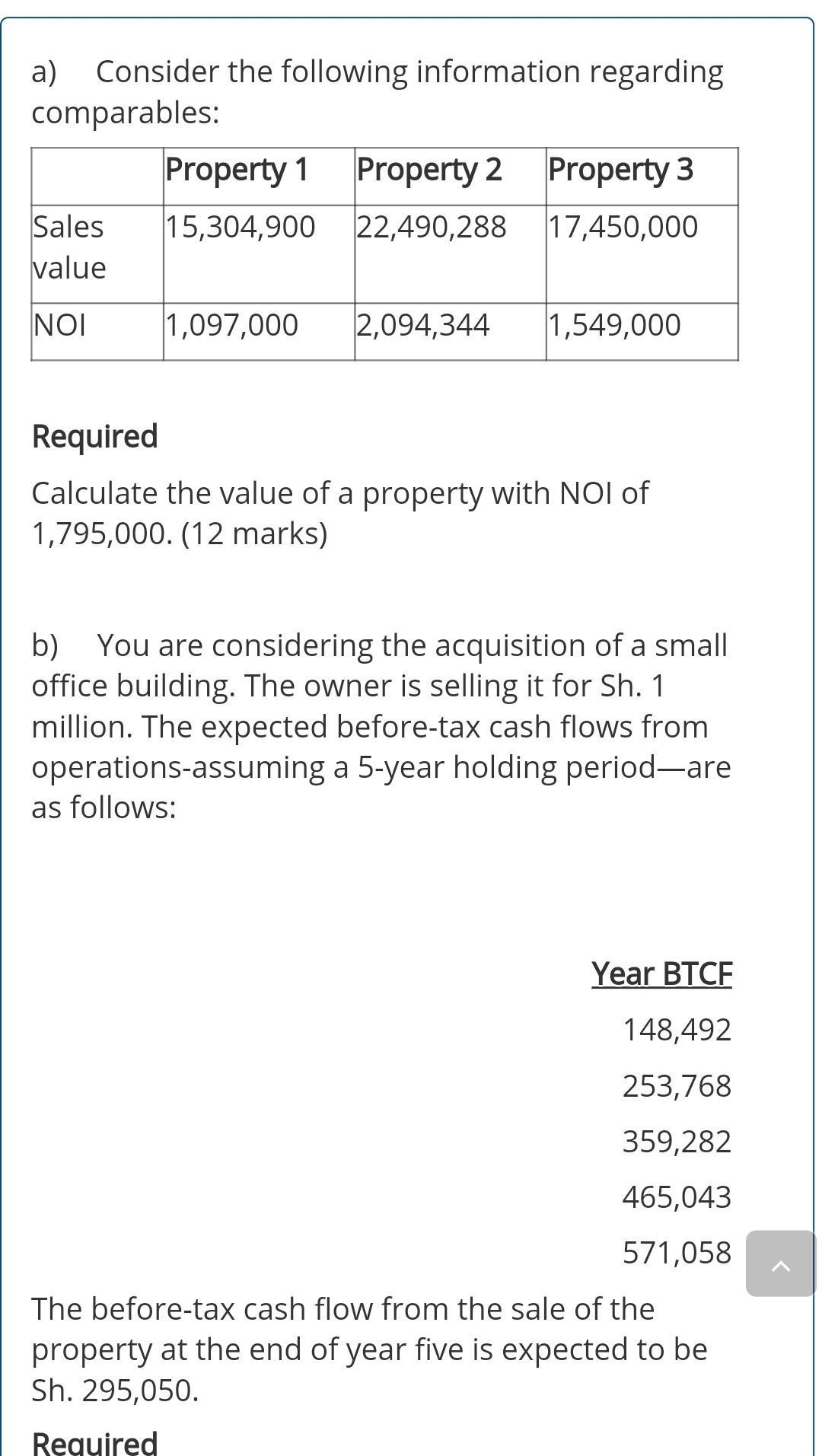

a) Consider the following information regarding comparables: Property 1 Property 2 Property 3 Sales 15,304,900 22,490,288 17,450,000 value 1,097,000 2,094,344 1,549,000 Required Calculate the

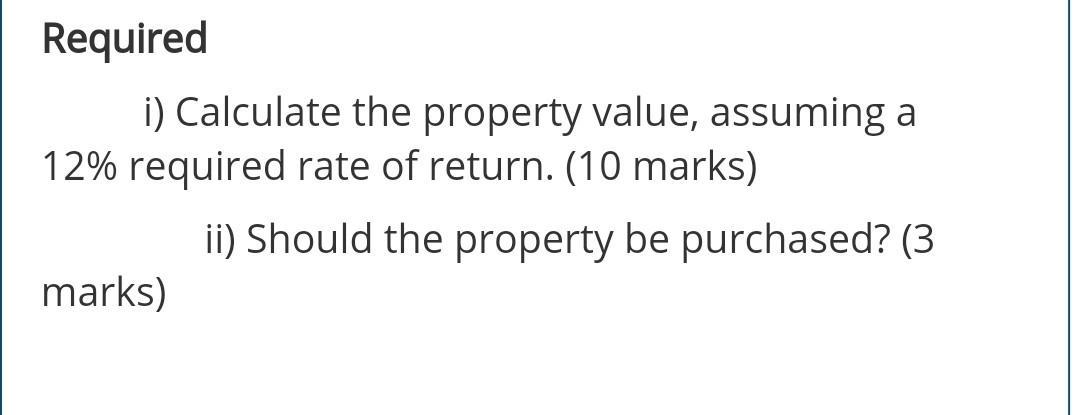

a) Consider the following information regarding comparables: Property 1 Property 2 Property 3 Sales 15,304,900 22,490,288 17,450,000 value 1,097,000 2,094,344 1,549,000 Required Calculate the value of a property with NOI of 1,795,000. (12 marks) b) You are considering the acquisition of a small office building. The owner is selling it for Sh. 1 million. The expected before-tax cash flows from operations-assuming a 5-year holding periodare as follows: Year BTCF 148,492 253,768 359,282 465,043 571,058 The before-tax cash flow from the sale of the property at the end of year five is expected to be Sh. 295,050. Required Required i) Calculate the property value, assuming a 12% required rate of return. (10 marks) marks) ii) Should the property be purchased? (3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Calculating Property Value using Capitalization Rate We can estimate the value of the property with NOI of 1795000 using the income approach and a c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started