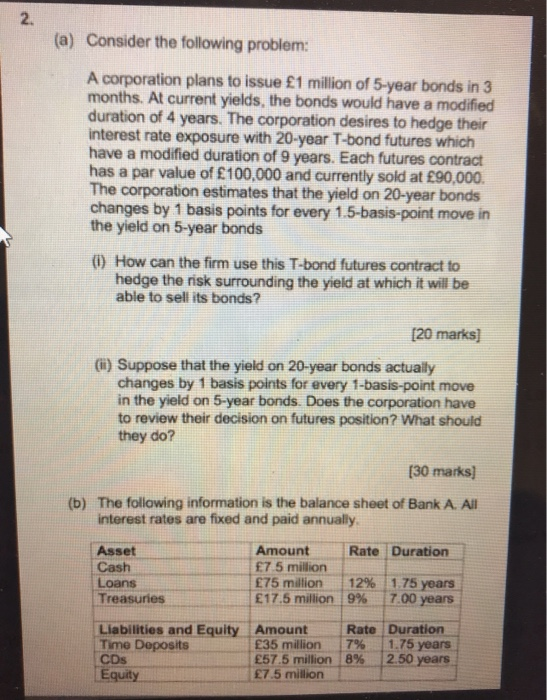

(a) Consider the following problem: A corporation plans to issue 1 million of 5-year bonds in 3 months. At current yields, the bonds would have a modified duration of 4 years. The corporation desires to hedge their interest rate exposure with 20-year T-bond futures which have a modified duration of 9 years. Each futures contract has a par value of 100,000 and currently sold at 90,000. The corporation estimates that the yield on 20-year bonds changes by 1 basis points for every 1.5-basis-point move in the yield on 5-year bonds (0) How can the firm use this T-bond futures contract to hedge the risk surrounding the yield at which it will be able to sell its bonds? [20 marks) (1) Suppose that the yield on 20-year bonds actually changes by 1 basis points for every 1-basis-point move in the yield on 5-year bonds. Does the corporation have to review their decision on futures position? What should they do? (30 marks) (b) The following information is the balance sheet of Bank A. All interest rates are fixed and paid annually Rate Duration Cash Loans Treasures Amount 75 million 75 million 17.5 million 12% 9% 1.75 years 7.00 years Liabilities and Equity Amount Time Deposits 35 million CDs 57.5 million Equity 7.5 million Rate Duration 7% 1.75 years 8% 2.50 years (a) Consider the following problem: A corporation plans to issue 1 million of 5-year bonds in 3 months. At current yields, the bonds would have a modified duration of 4 years. The corporation desires to hedge their interest rate exposure with 20-year T-bond futures which have a modified duration of 9 years. Each futures contract has a par value of 100,000 and currently sold at 90,000. The corporation estimates that the yield on 20-year bonds changes by 1 basis points for every 1.5-basis-point move in the yield on 5-year bonds (0) How can the firm use this T-bond futures contract to hedge the risk surrounding the yield at which it will be able to sell its bonds? [20 marks) (1) Suppose that the yield on 20-year bonds actually changes by 1 basis points for every 1-basis-point move in the yield on 5-year bonds. Does the corporation have to review their decision on futures position? What should they do? (30 marks) (b) The following information is the balance sheet of Bank A. All interest rates are fixed and paid annually Rate Duration Cash Loans Treasures Amount 75 million 75 million 17.5 million 12% 9% 1.75 years 7.00 years Liabilities and Equity Amount Time Deposits 35 million CDs 57.5 million Equity 7.5 million Rate Duration 7% 1.75 years 8% 2.50 years