Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A _ Consider two bonds issued by the federal government. Both bonds pay $10,000 a year from - now. One of them, however, pays

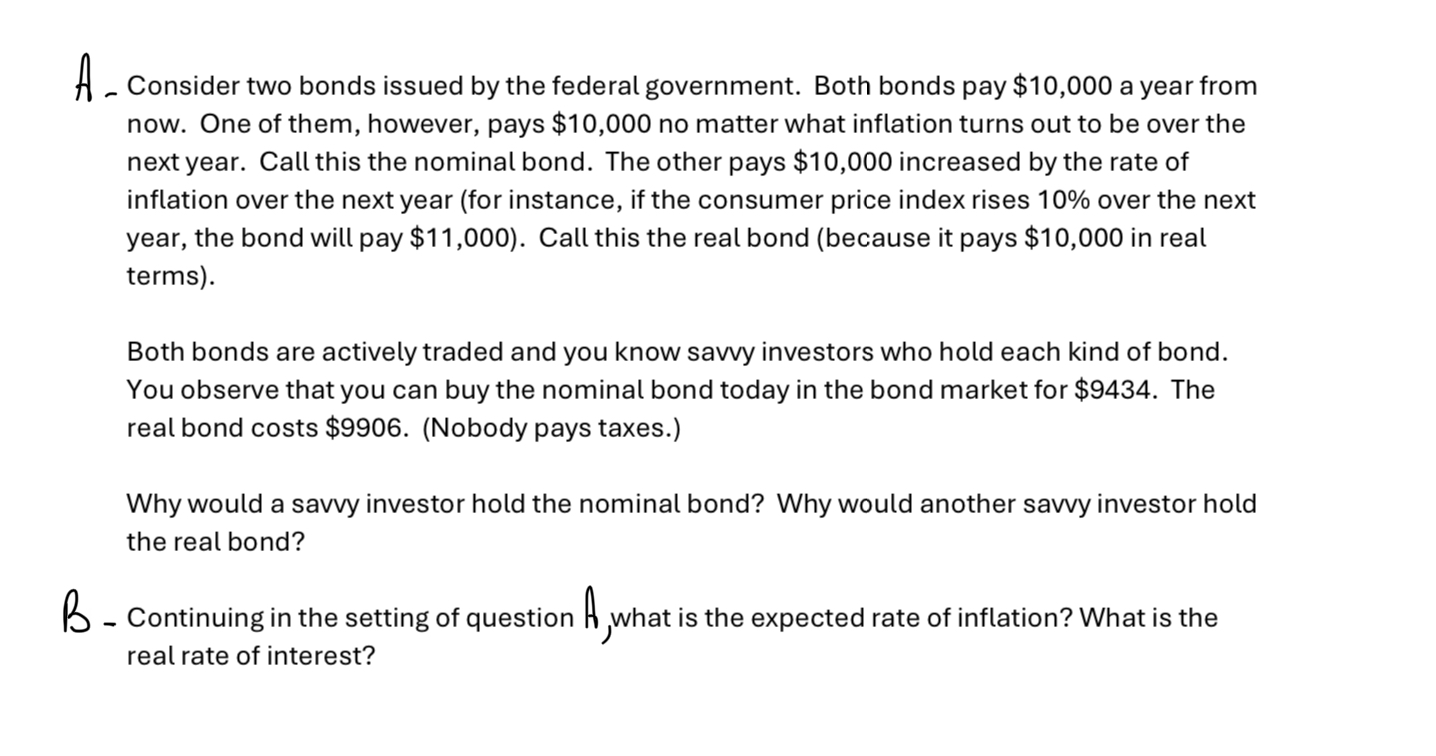

A _ Consider two bonds issued by the federal government. Both bonds pay $10,000 a year from - now. One of them, however, pays $10,000 no matter what inflation turns out to be over the next year. Call this the nominal bond. The other pays $10,000 increased by the rate of inflation over the next year (for instance, if the consumer price index rises 10% over the next year, the bond will pay $11,000). Call this the real bond (because it pays $10,000 in real terms). Both bonds are actively traded and you know savvy investors who hold each kind of bond. You observe that you can buy the nominal bond today in the bond market for $9434. The real bond costs $9906. (Nobody pays taxes.) Why would a savvy investor hold the nominal bond? Why would another savvy investor hold the real bond? B - Continuing in the setting of question A, what is the expected rate of inflation? What is the real rate of interest?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started