Question

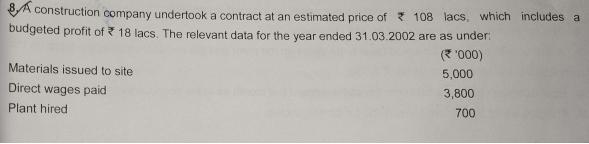

A construction company undertook a contract at an estimated price of 108 lacs, which includes a budgeted profit of 18 lacs. The relevant data

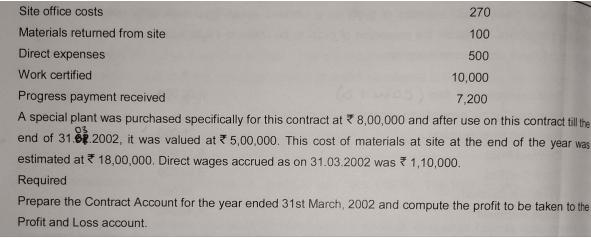

A construction company undertook a contract at an estimated price of 108 lacs, which includes a budgeted profit of 18 lacs. The relevant data for the year ended 31.03.2002 are as under: ('000) 5,000 3,800 700 Materials issued to site Direct wages paid Plant hired 270 100 500 10,000 Progress payment received 7,200 A special plant was purchased specifically for this contract at 8,00,000 and after use on this contract till the 03 end of 31.08.2002, it was valued at 5,00,000. This cost of materials at site at the end of the year was estimated at 18,00,000. Direct wages accrued as on 31.03.2002 was 1,10,000. Required Prepare the Contract Account for the year ended 31st March, 2002 and compute the profit to be taken to the Profit and Loss account. Site office costs Materials returned from site Direct expenses Work certified

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Cost Benefit Analysis Concepts and Practice

Authors: Anthony Boardman, David Greenberg, Aidan Vining, David Weimer

4th edition

137002696, 978-1108448284, 1108448283, 978-0137002696

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App