Answered step by step

Verified Expert Solution

Question

1 Approved Answer

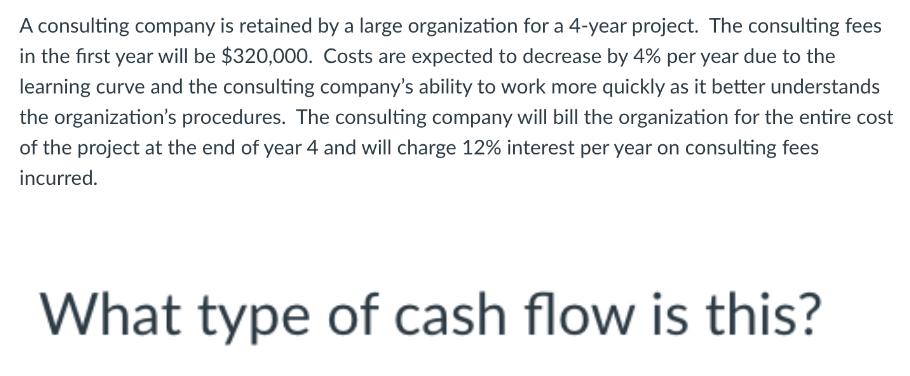

A consulting company is retained by a large organization for a 4-year project. The consulting fees in the first year will be $320,000. Costs

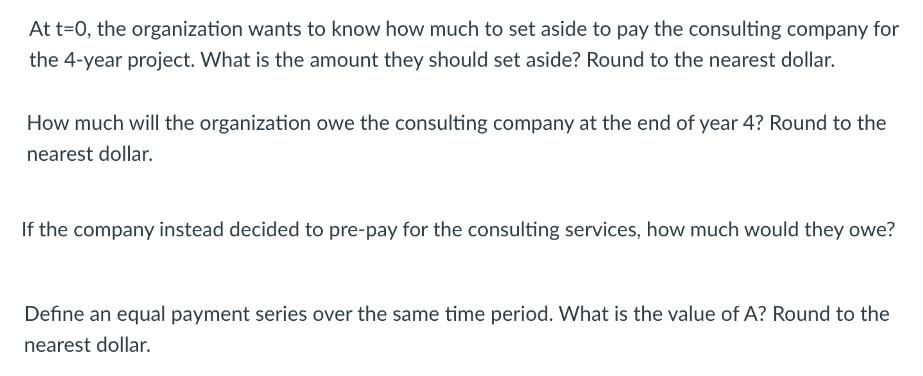

A consulting company is retained by a large organization for a 4-year project. The consulting fees in the first year will be $320,000. Costs are expected to decrease by 4% per year due to the learning curve and the consulting company's ability to work more quickly as it better understands the organization's procedures. The consulting company will bill the organization for the entire cost of the project at the end of year 4 and will charge 12% interest per year on consulting fees incurred. What type of cash flow is this? What are the values of i and g, respectively? At t=0, the organization wants to know how much to set aside to pay the consulting company for the 4-year project. What is the amount they should set aside? Round to the nearest dollar. How much will the organization owe the consulting company at the end of year 4? Round to the nearest dollar. If the company instead decided to pre-pay for the consulting services, how much would they owe? Define an equal payment series over the same time period. What is the value of A? Round to the nearest dollar.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Gradient series amount or any percentage in each given ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started