Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The company purchased a warehouse

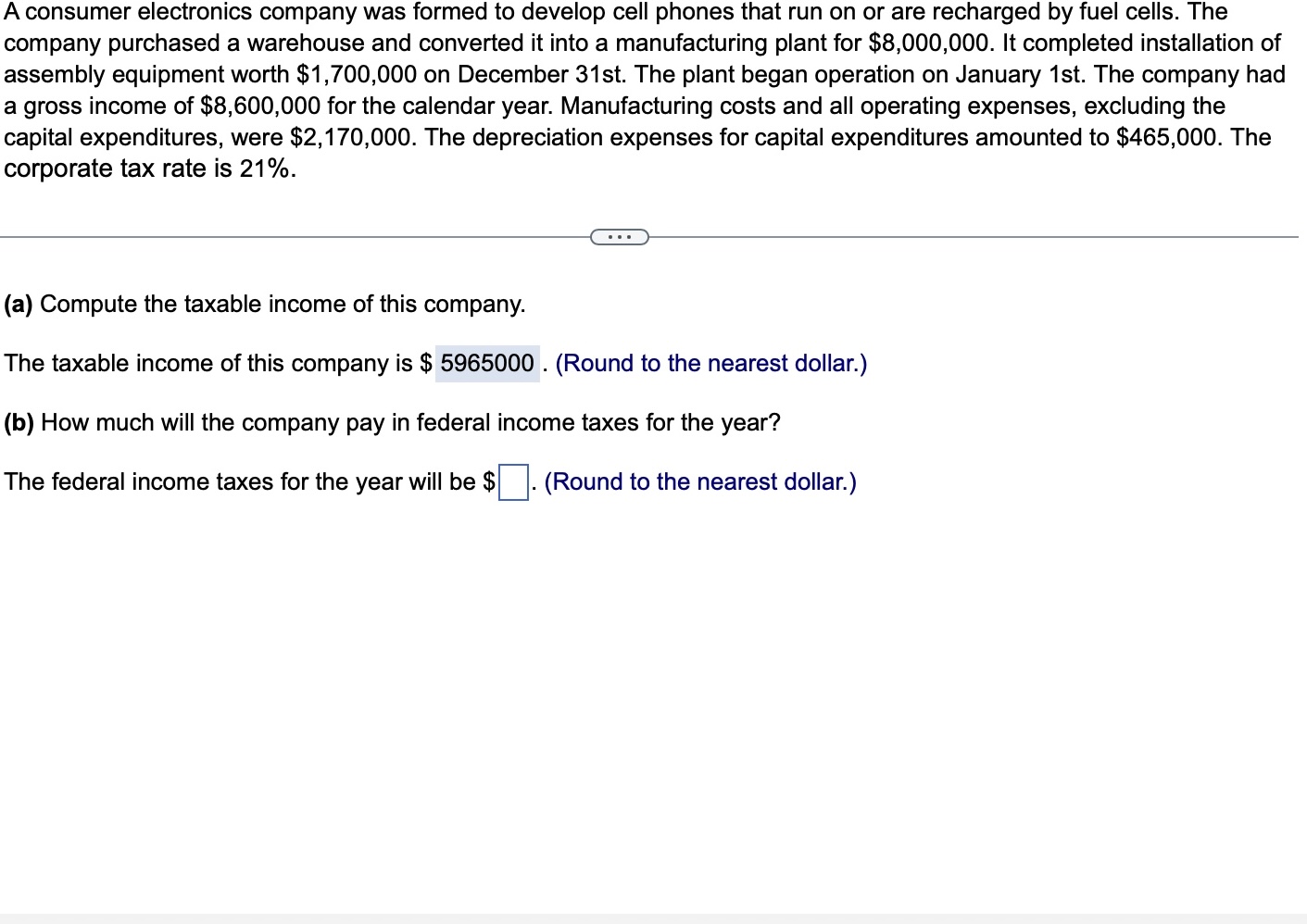

A consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The company purchased a warehouse and converted it into a manufacturing plant for $8,000,000. It completed installation of assembly equipment worth $1,700,000 on December 31st. The plant began operation on January 1st. The company had a gross income of $8,600,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the capital expenditures, were $2,170,000. The depreciation expenses for capital expenditures amounted to $465,000. The corporate tax rate is 21%. (a) Compute the taxable income of this company. The taxable income of this company is $ 5965000. (Round to the nearest dollar.) (b) How much will the company pay in federal income taxes for the year? The federal income taxes for the year will be $ . (Round to the nearest dollar.)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the federal income taxes for the year we can use the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started