Answered step by step

Verified Expert Solution

Question

1 Approved Answer

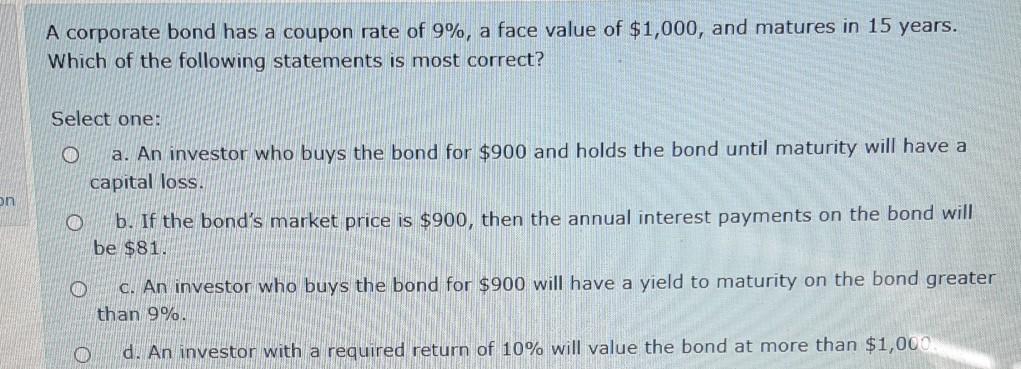

A corporate bond has a coupon rate of 9%, a face value of $1,000, and matures in 15 years. Which of the following statements is

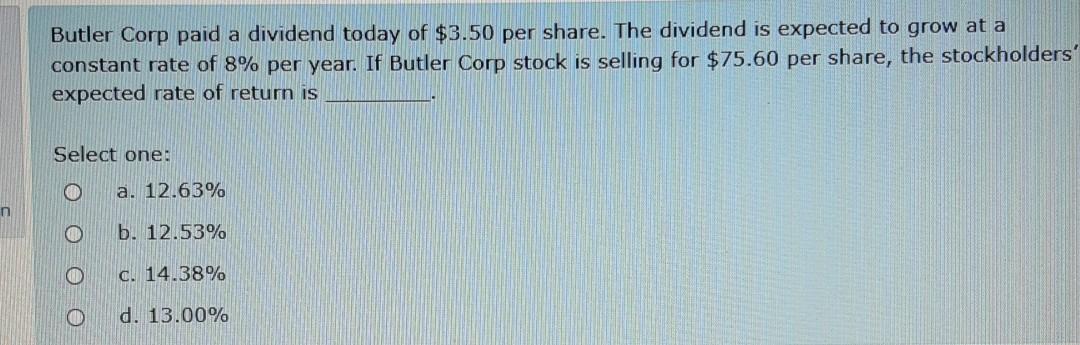

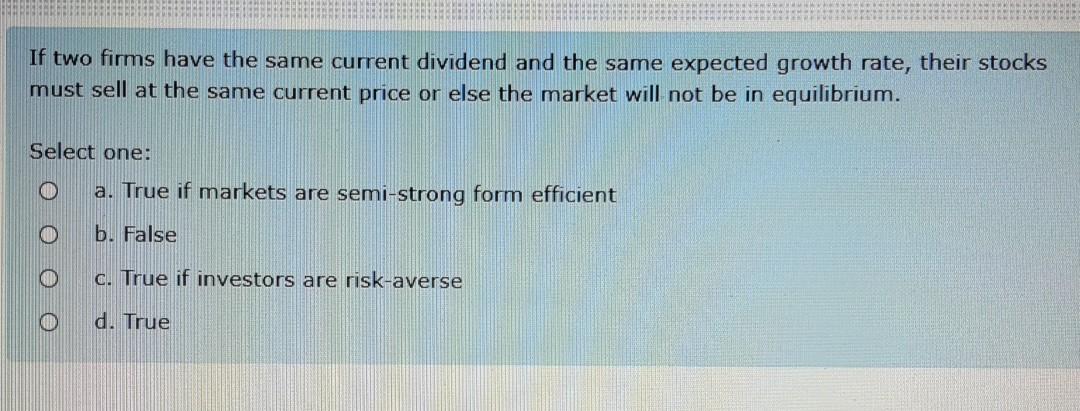

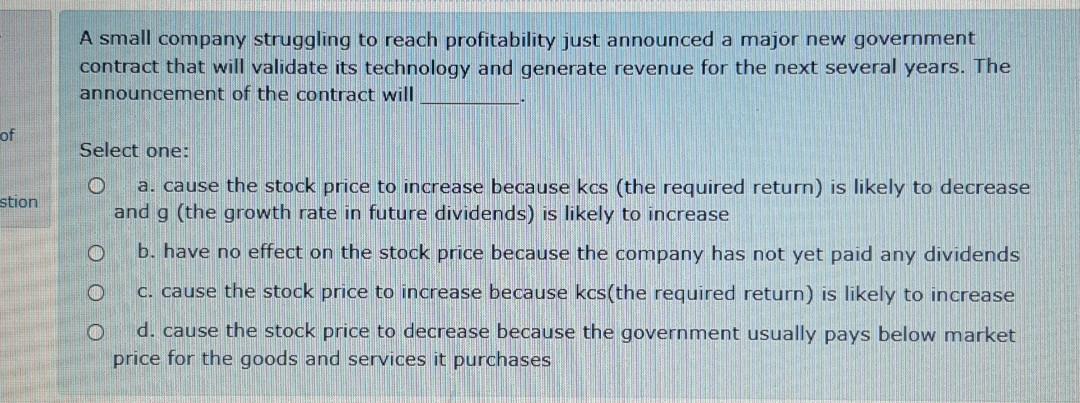

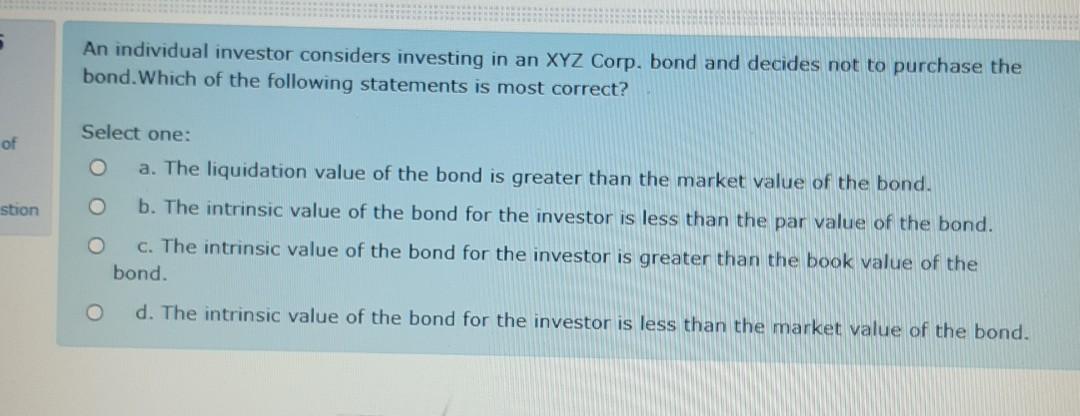

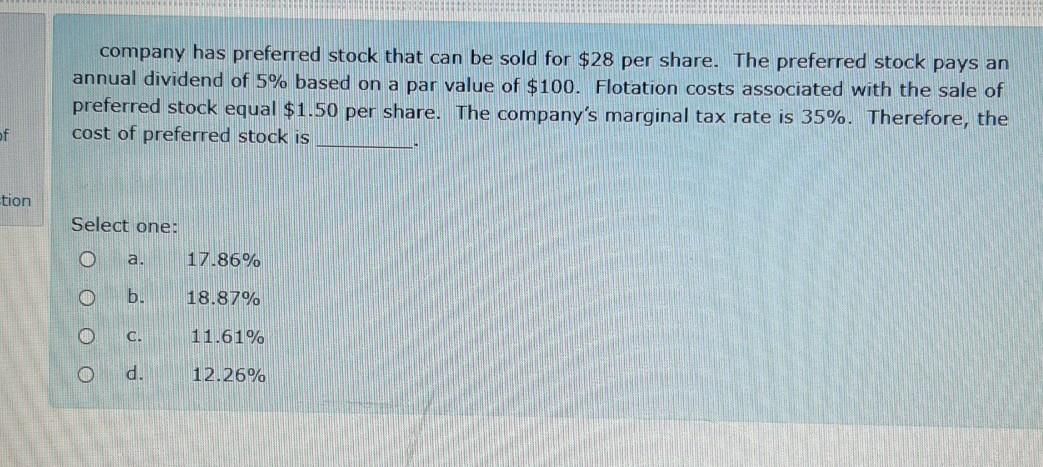

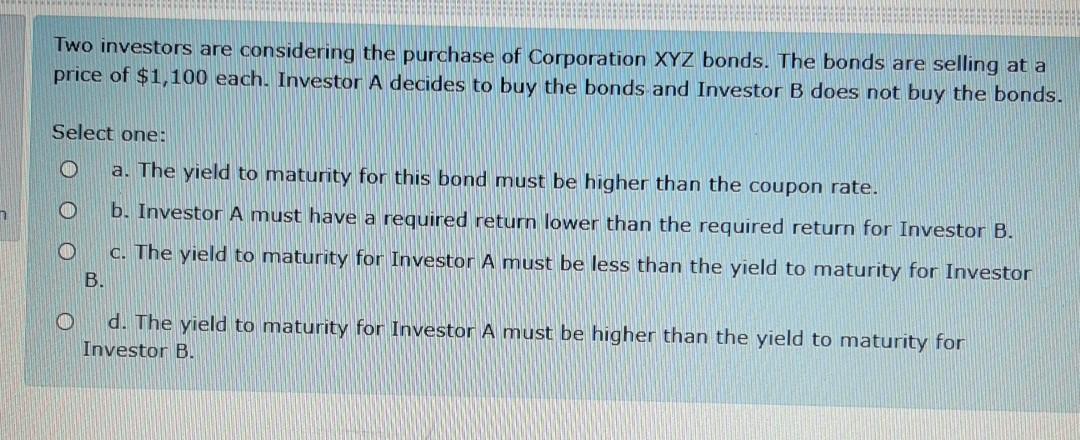

A corporate bond has a coupon rate of 9%, a face value of $1,000, and matures in 15 years. Which of the following statements is most correct? Select one: a. An investor who buys the bond for $900 and holds the bond until maturity will have a capital loss. an O b. If the bond's market price is $900, then the annual interest payments on the bond will be $81. o c. An investor who buys the bond for $900 will have a yield to maturity on the bond greater than 9%. d. An investor with a required return of 10% will value the bond at more than $1,000 Butler Corp paid a dividend today of $3.50 per share. The dividend is expected to grow at a constant rate of 8% per year. If Butler Corp stock is selling for $75.60 per share, the stockholders' expected rate of return is Select one: a. 12.63% n O b. 12.53% c. 14.38% 0 d. 13.00% If two firms have the same current dividend and the same expected growth rate, their stocks must sell at the same current price or else the market will not be in equilibrium. Select one: O a. True if markets are semi-strong form efficient O b. False O c. True if investors are risk-averse d. True A small company struggling to reach profitability just announced a major new government contract that will validate its technology and generate revenue for the next several years. The announcement of the contract will of stion Select one: a. cause the stock price to increase because kcs (the required retum) is likely to decrease and g (the growth rate in future dividends) is likely to increase b. have no effect on the stock price because the company has not yet paid any dividends o c. cause the stock price to increase because kcs(the required return) is likely to increase O d. cause the stock price to decrease because the government usually pays below market price for the goods and services it purchases 5 An individual investor considers investing in an XYZ Corp. bond and decides not to purchase the bond. Which of the following statements is most correct? of stion Select one: a. The liquidation value of the bond is greater than the market value of the bond. b. The intrinsic value of the bond for the investor is less than the par value of the bond. c. The intrinsic value of the bond for the investor is greater than the book value of the bond. d. The intrinsic value of the bond for the investor is less than the market value of the bond. company has preferred stock that can be sold for $28 per share. The preferred stock pays an annual dividend of 5% based on a par value of $100. Flotation costs associated with the sale of preferred stock equal $1.50 per share. The company's marginal tax rate is 35%. Therefore, the cost of preferred stock is of tion Select one: O a. 17.86% O b. 18.87% O C. 11.61% d. 12.26% Two investors are considering the purchase of Corporation XYZ bonds. The bonds are selling at a price of $1,100 each. Investor A decides to buy the bonds and Investor B does not buy the bonds. Select one: a. The yield to maturity for this bond must be higher than the coupon rate. b. Investor A must have a required return lower than the required return for Investor B. c. The yield to maturity for Investor A must be less than the yield to maturity for Investor B. d. The yield to maturity for Investor A must be higher than the yield to maturity for Investor B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started