Question

A corporate bond is available in the market. It will pay $80 in interest one year from today and two years from today, and $1,000

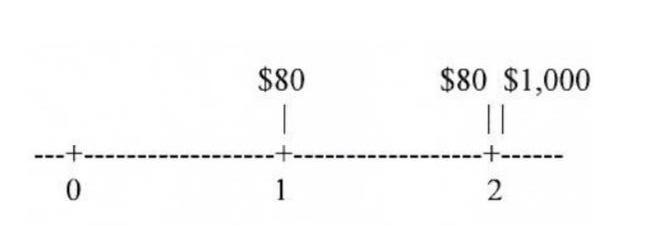

A corporate bond is available in the market. It will pay $80 in interest one year from today and two years from today, and $1,000 at maturity two years from today. The time line below shows these cash flows — $80 in one year, and $80 and $1,000 in two years.

a. If investors require an 8 percent return on these bonds, what is the bond's current price?

b. Assume the bond is currently selling for $1,000. At what price must you be able to sell the bond for one year from today, after receiving the interest payment, to earn 8 percent on your investment?

c. At what price would the bond sell for today if the investor required rate of return was 7%?

d. Assume the price of the bond today is $1,018.08. At what price must you be able to sell the bond for in one year, after receiving interest, to earn 7% on your investment? Assume you sell the bond immediately after receiving the first $80 payment.

e. Suppose you purchased the bond today at a price of $1,000 to yield 8 percent per year. One year later, the market required rate of return has changed to 7 percent. At what price will the bond sell for at that time (one year from today, after the first $80 interest payment has been made). Hint: imagine you are standing on the time line at "time 1" what cash flows remain on the bond? Recall that the price is the present value of the remaining payments.

---+-- 0 $80 1 $80 $1,000 || -+------ 2

Step by Step Solution

3.48 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a To calculate the bonds current price we need to discount each of the cash flows back to the present using the required rate of return of 8 percent P...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started