Question

A corporation buys a 10-year semi-annual coupon bond with 5% coupon rate. The price, duration, and convexity of the bond is $103.58, 8.03, and

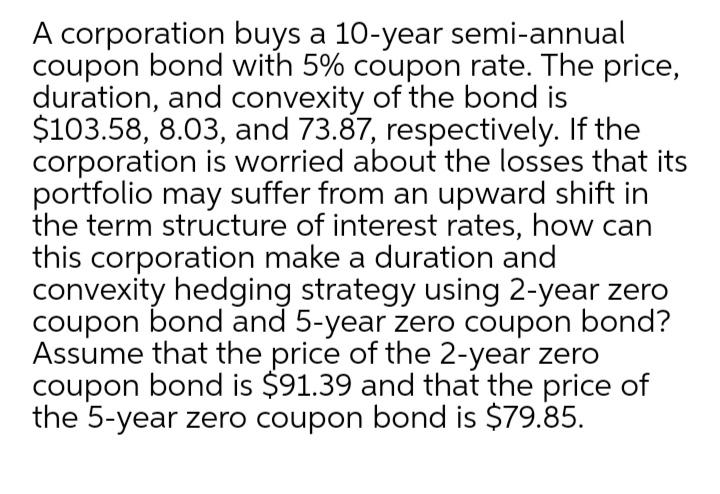

A corporation buys a 10-year semi-annual coupon bond with 5% coupon rate. The price, duration, and convexity of the bond is $103.58, 8.03, and 73.87, respectively. If the corporation is worried about the losses that its portfolio may suffer from an upward shift in the term structure of interest rates, how can this corporation make a duration and convexity hedging strategy using 2-year zero coupon bond and 5-year zero coupon bond? Assume that the price of the 2-year zero coupon bond is $91.39 and that the price of the 5-year zero coupon bond is $79.85.

Step by Step Solution

3.44 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Introduction Duration measures the sensitivity of bonds with respect to cha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Corporate Finance A Focused Approach

Authors: Michael C. Ehrhardt, Eugene F. Brigham

4th Edition

1439078084, 978-1439078082

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App