Question

A corporation uses the indirect method for preparing the statement of cash flows. A fixed asset has been sold for $21,488 representing a gain of

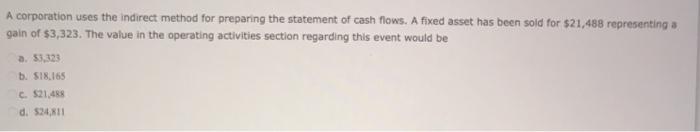

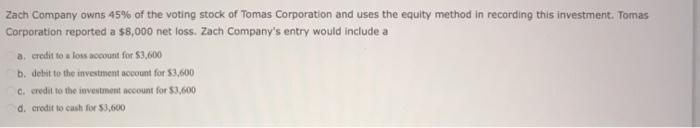

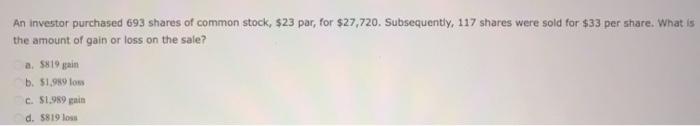

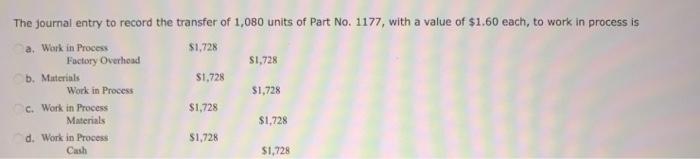

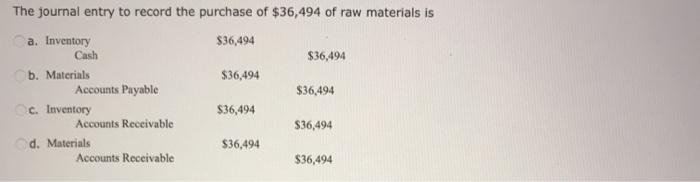

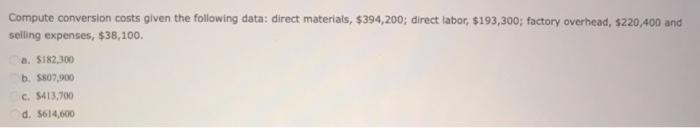

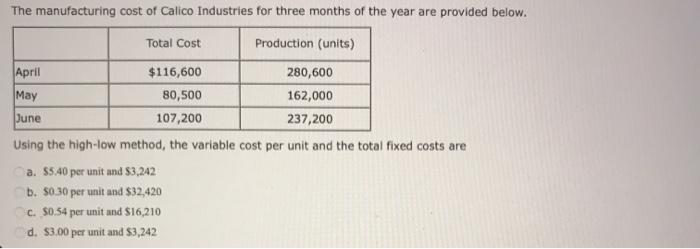

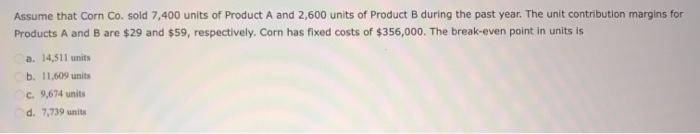

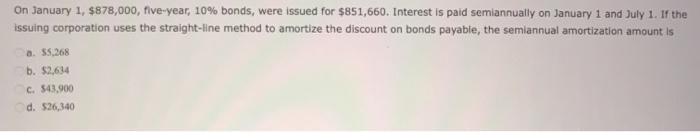

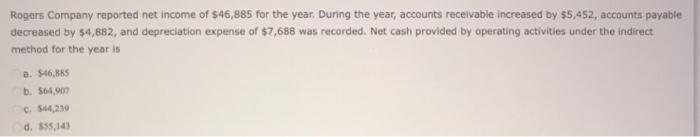

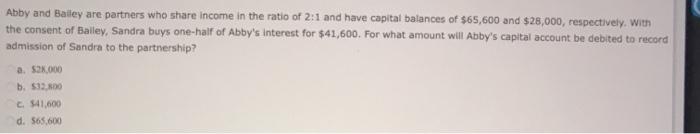

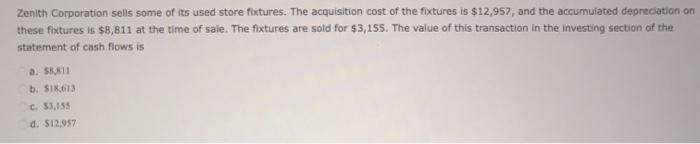

A corporation uses the indirect method for preparing the statement of cash flows. A fixed asset has been sold for $21,488 representing a gain of $3,323. The value in the operating activities section regarding this event would be a. $3,323 b. $18,165 c. $21,488 d. $24,811 Zach Company owns 45% of the voting stock of Tomas Corporation and uses the equity method in recording this investment. Tomas Corporation reported a $8,000 net loss. Zach Company's entry would include a a. credit to a loss account for $3,600 b. debit to the investment account for $3,600 c. credit to the investment account for $3,600 d. credit to cash for $3,600 An investor purchased 693 shares of common stock, $23 par, for $27,720. Subsequently, 117 shares were sold for $33 per share. What is the amount of gain or loss on the sale? a. $819 gain b. $1,989 loss c. $1.989 gain d. $819 loss The journal entry to record the transfer of 1,080 units of Part No. 1177, with a value of $1.60 each, to work in process is a. Work in Process Factory Overhead $1,728 $1,728 b. Materials $1,728 Work in Process $1,728 c. Work in Process $1,728 Materials $1,728 d. Work in Process $1,728 Cash $1,728 The journal entry to record the purchase of $36,494 of raw materials is a. Inventory $36,494 Cash $36,494 b. Materials $36,494 Accounts Payable $36,494. OC. Inventory $36,494 Accounts Receivable $36,494 d. Materials $36,494 Accounts Receivable $36,494 Compute conversion costs given the following data: direct materials, $394,200; direct labor, $193,300; factory overhead, $220,400 and selling expenses, $38,100. a. $182,300 b. $807,900 c. $413,700 d. $614,600 The manufacturing cost of Calico Industries for three months of the year are provided below. April May June Total Cost $116,600 80,500 107,200 Production (units) 280,600 162,000 237,200 Using the high-low method, the variable cost per unit and the total fixed costs are a. $5.40 per unit and $3,242 b. $0.30 per unit and $32,420 c. $0.54 per unit and $16,210 d. $3.00 per unit and $3,242 Assume that Corn Co. sold 7,400 units of Product A and 2,600 units of Product B during the past year. The unit contribution margins for Products A and B are $29 and $59, respectively. Corn has fixed costs of $356,000. The break-even point in units is a. 14,511 units b. 11,609 units c. 9,674 units i d. 7,739 units On January 1, $878,000, five-year, 10% bonds, were issued for $851,660. Interest is paid semiannually on January 1 and July 1. If the issuing corporation uses the straight-line method to amortize the discount on bonds payable, the semiannual amortization amount is a. $5,268 b. $2,634 c. $43,900 d. $26,340 Rogers Company reported net income of $46,885 for the year. During the year, accounts receivable increased by $5,452, accounts payable decreased by $4,882, and depreciation expense of $7,688 was recorded. Net cash provided by operating activities under the indirect method for the year is a. $46,885 b. $64,907 c. $44,239 d. $55,143 Abby and Bailey are partners who share income in the ratio of 2:1 and have capital balances of $65,600 and $28,000, respectively. With the consent of Bailey, Sandra buys one-half of Abby's interest for $41,600. For what amount will Abby's capital account be debited to record admission of Sandra to the partnership? a. $28,000 b. $32,800 c. $41,600 d. $65,600 Zenith Corporation sells some of its used store fixtures. The acquisition cost of the fixtures is $12,957, and the accumulated depreciation on these fixtures is $8,811 at the time of sale. The fixtures are sold for $3,155. The value of this transaction in the investing section of the statement of cash flows is a. $8,811 b. $18,613 c. $3,155 d. $12,957

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started