A coupon bond has a face value of $1,000 and matures in 6 years. The bond pays 6% coupons annually (not semiannually). The expected

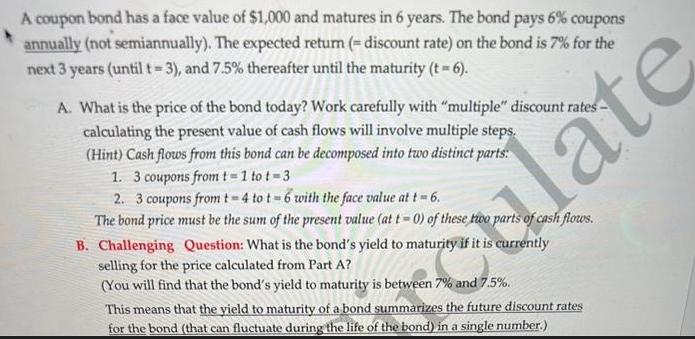

A coupon bond has a face value of $1,000 and matures in 6 years. The bond pays 6% coupons annually (not semiannually). The expected return (= discount rate) on the bond is 7% for the next 3 years (until t-3), and 7.5% thereafter until the maturity (t = 6). A. What is the price of the bond today? Work carefully with "multiple" discount rates- calculating the present value of cash flows will involve multiple steps. (Hint) Cash flows from this bond can be decomposed into two distinct parts: 1. 3 coupons from t=1 tot-3 2. 3 coupons from t-4 to t-6 with the face value at t = 6. The bond price must be the sum of the present value (at t=0) of these two parts of cash flows. Question: What is the bond's yield to maturity if it is currently B. Challenging selling for the price calculated from Part A? (You will find that the bond's yield to maturity is between 7% and 7.5%. culate This means that the yield to maturity of a bond summarizes the future discount rates for the bond (that can fluctuate during the life of the bond) in a single number.)

Step by Step Solution

3.60 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

A To calculate the price of the bond today we need to calculate the present value of each of the bon...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started