Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A CPA firm performs the annual audit of Wilson Group, a private company. Wilson asks the firm to determine whether the company would qualify for

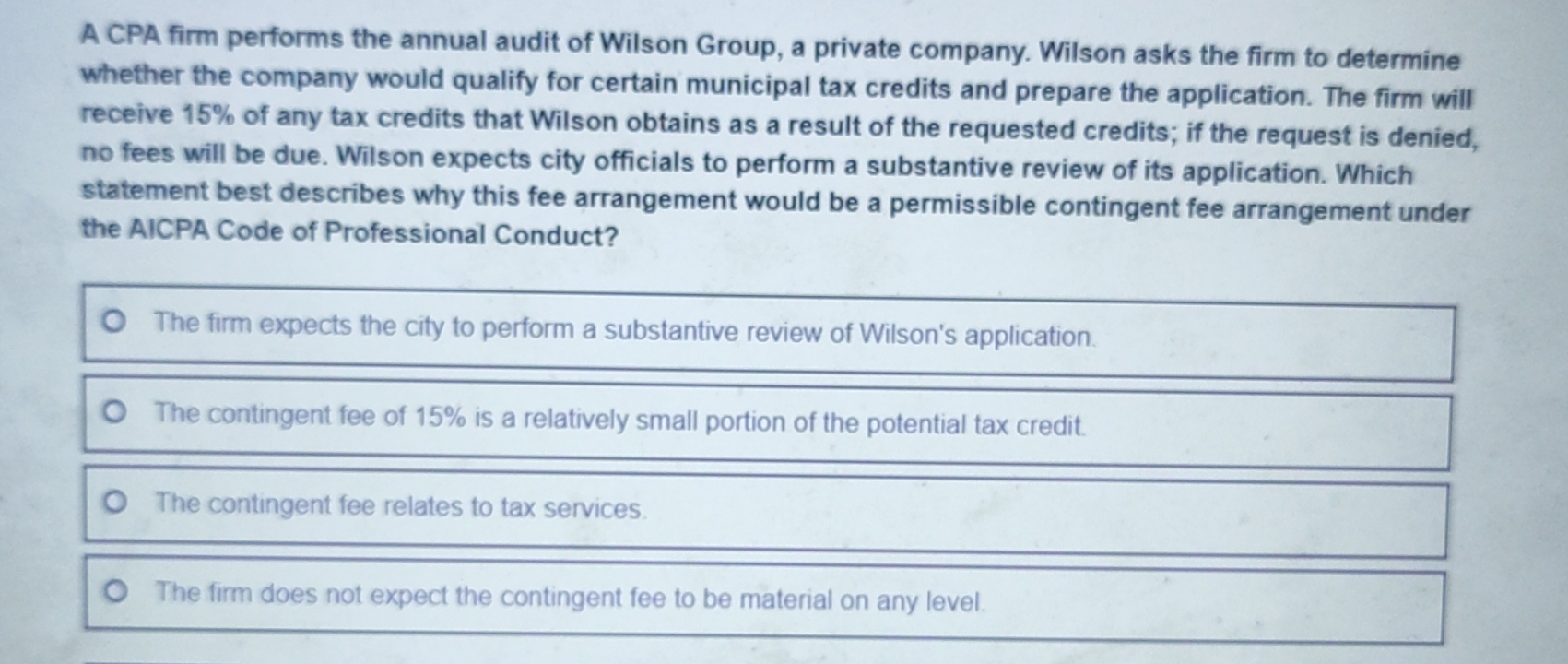

A CPA firm performs the annual audit of Wilson Group, a private company. Wilson asks the firm to determine

whether the company would qualify for certain municipal tax credits and prepare the application. The firm will

receive of any tax credits that Wilson obtains as a result of the requested credits; if the request is denied,

no fees will be due. Wilson expects city officials to perform a substantive review of its application. Which

statement best describes why this fee arrangement would be a permissible contingent fee arrangement under

the AICPA Code of Professional Conduct?

The firm expects the city to perform a substantive review of Wilson's application.

The contingent fee of is a relatively small portion of the potential tax credit.

The firm does not expect the contingent fee to be material on any level.

The contingent fee relates to tax services.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started