Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A credit card has a balance of $3,400. The APR is 27% and the minimum payment is 3% of the balance. You will pay

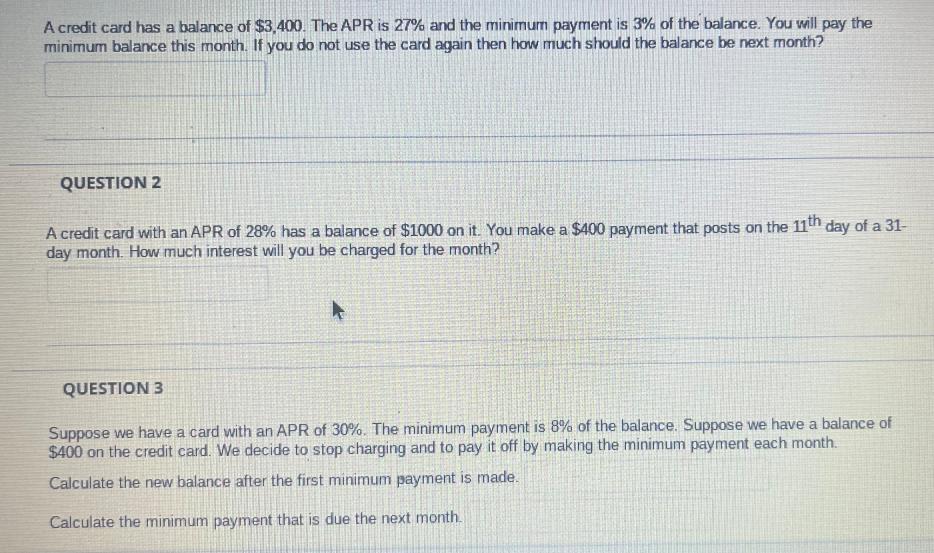

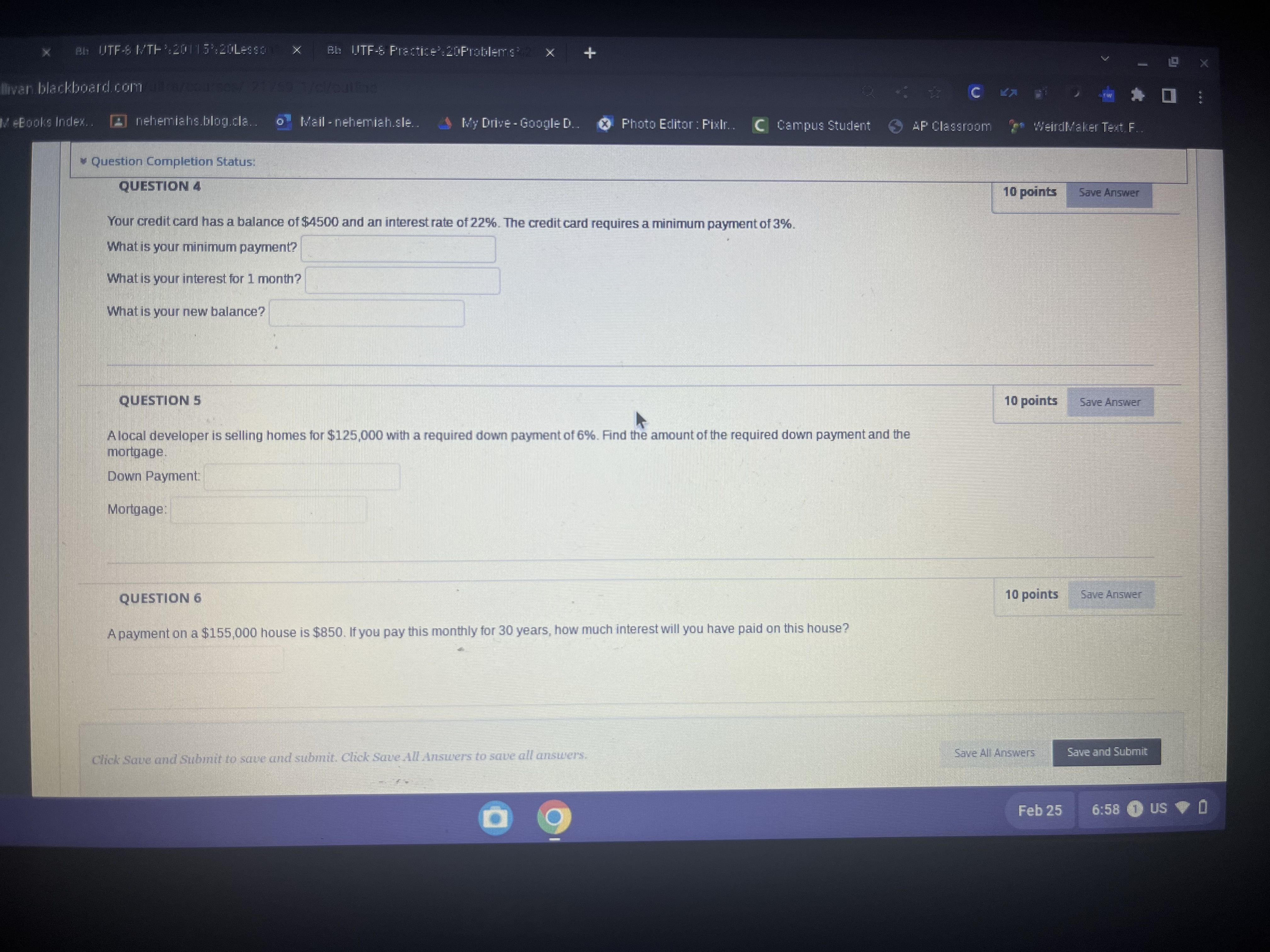

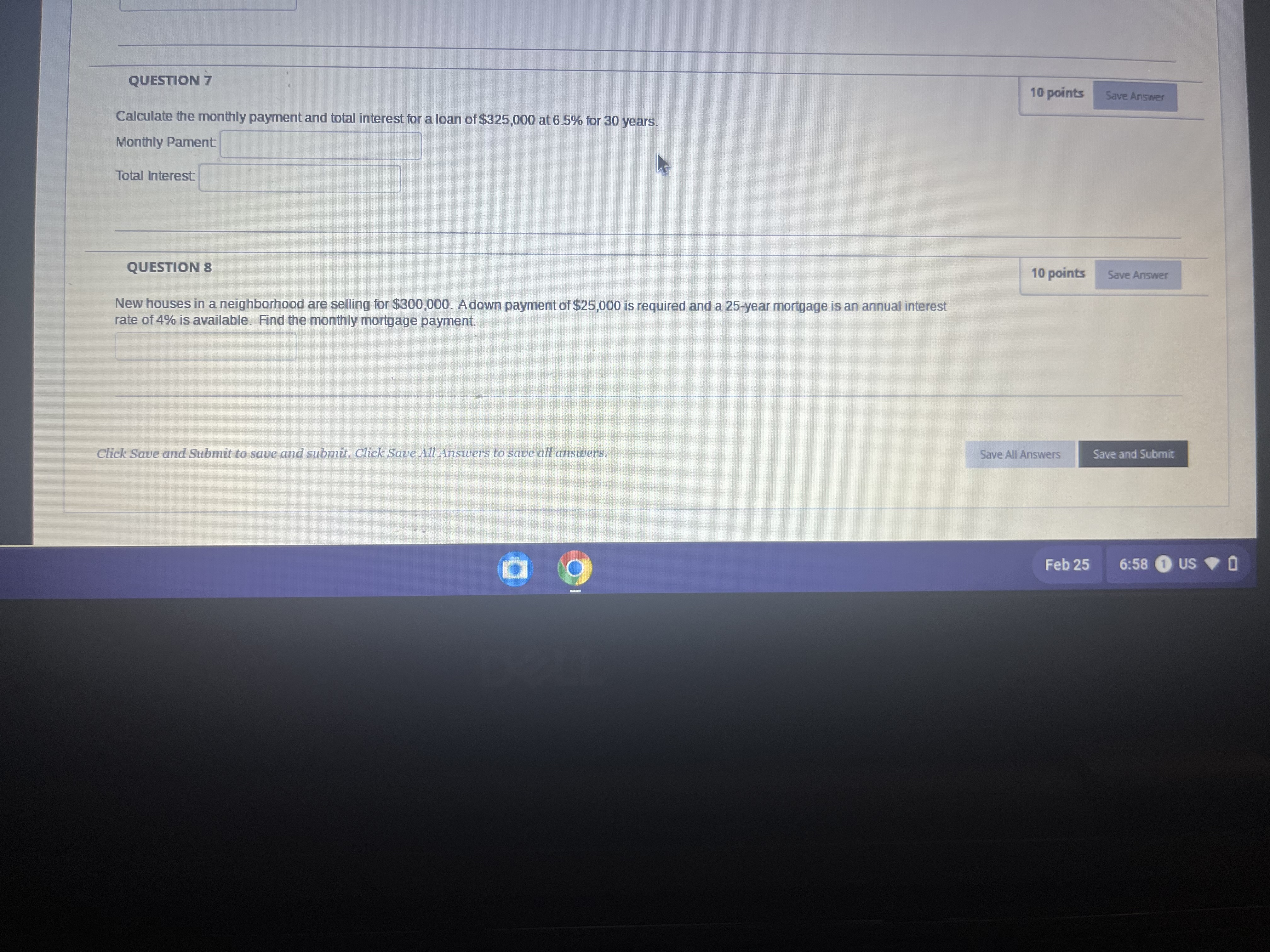

A credit card has a balance of $3,400. The APR is 27% and the minimum payment is 3% of the balance. You will pay the minimum balance this month. If you do not use the card again then how much should the balance be next month? QUESTION 2 A credit card with an APR of 28% has a balance of $1000 on it. You make a $400 payment that posts on the 11th day of a 31- day month. How much interest will you be charged for the month? QUESTION 3 Suppose we have a card with an APR of 30%. The minimum payment is 8% of the balance. Suppose we have a balance of $400 on the credit card. We decide to stop charging and to pay it off by making the minimum payment each month. Calculate the new balance after the first minimum payment is made. Calculate the minimum payment that is due the next month. X Bb UTF-8 IV/TH%20115%20Lesson X Bb UTF-8 Practice: 20Problems* 2 X + llivan blackboard.com [8/060/80/ 21759 1/cl/culine C MeBooks Index.. Anehemiahs.blog.cla.. Mail - nehemiah.sle.. My Drive - Google D... Photo Editor: Pixlr.. C Campus Student AP Classroom Question Completion Status: QUESTION 4 Your credit card has a balance of $4500 and an interest rate of 22%. The credit card requires a minimum payment of 3%. What is your minimum payment? What is your interest for 1 month? What is your new balance? QUESTION 5 A local developer is selling homes for $125,000 with a required down payment of 6%. Find the amount of the required down payment and the mortgage. Down Payment: Mortgage: WeirdMaker Text. F.. 10 points Save Answer 10 points Save Answer QUESTION 6 10 points Save Answer A payment on a $155,000 house is $850. If you pay this monthly for 30 years, how much interest will you have paid on this house? Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Save and Submit O Feb 25 6:58 1 US O QUESTION 7 10 points Save Answer Calculate the monthly payment and total interest for a loan of $325,000 at 6.5% for 30 years. Monthly Pament Total Interest QUESTION 8 New houses in a neighborhood are selling for $300,000. A down payment of $25,000 is required and a 25-year mortgage is an annual interest rate of 4% is available. Find the monthly mortgage payment. Click Save and Submit to save and submit. Click Save All Answers to save all answers. 10 points Save Answer Save All Answers Save and Submit Feb 25 6:58 US

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started