Answered step by step

Verified Expert Solution

Question

1 Approved Answer

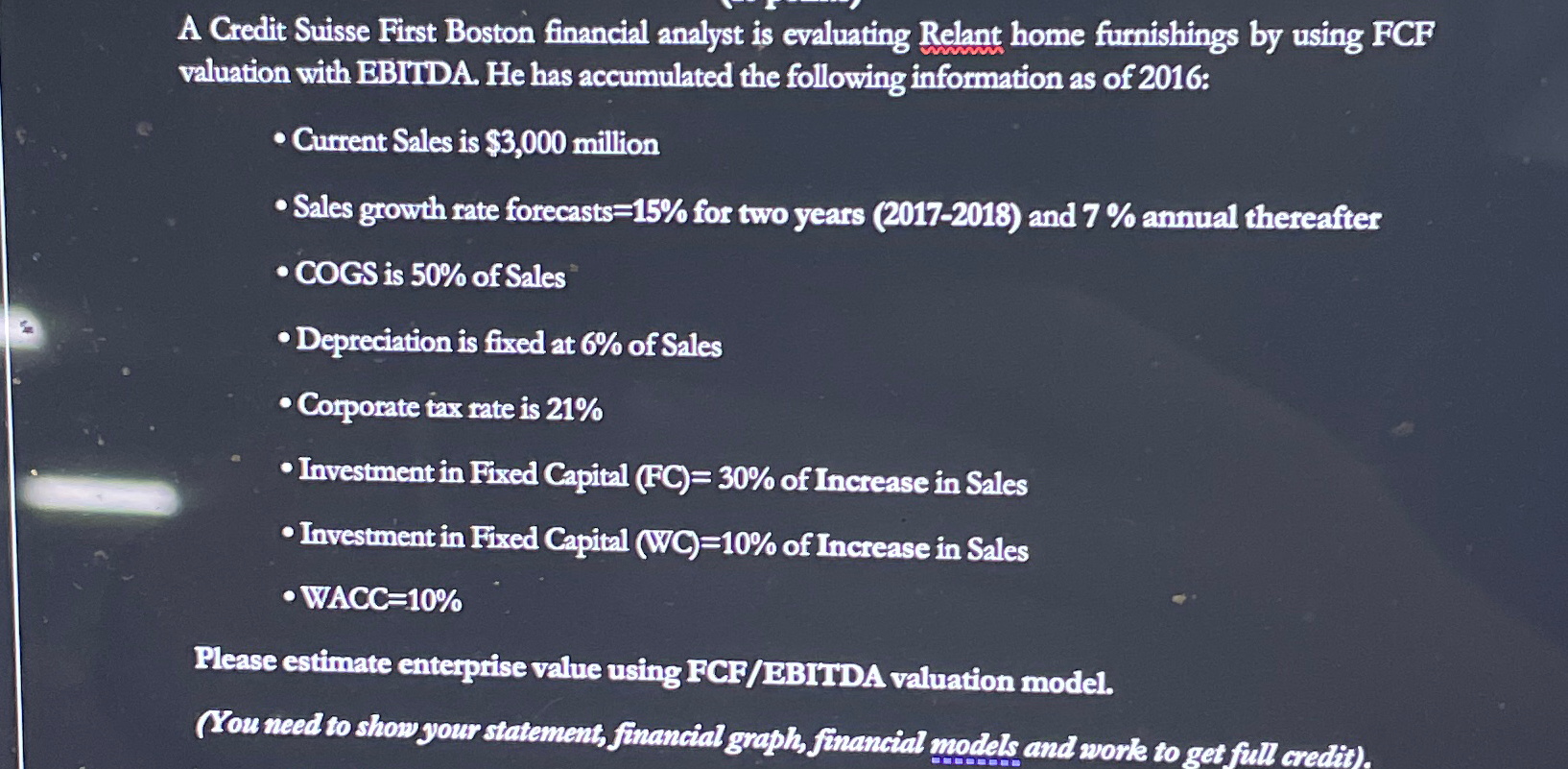

A Credit Suisse First Boston financial analyst is evaluating Relant home furnishings by using FCF valuation with EBITDA. He has accumulated the following information as

A Credit Suisse First Boston financial analyst is evaluating Relant home furnishings by using FCF valuation with EBITDA. He has accumulated the following information as of :

Current Sales is $ million

Sales growth rate forecasts for two years and annual thereafter

COGS is of Sales

Depreciation is fixed at of Sales

Corporate tax rate is

Investment in Fixed Capital FC of Increase in Sales

Investment in Fixed Capital WC of Increase in Sales

WACC

Please estimate enterprise value using FCFBBITDA valuation model.

Pu need to show your statement, financial graph, financial models and work to get foll credtit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started