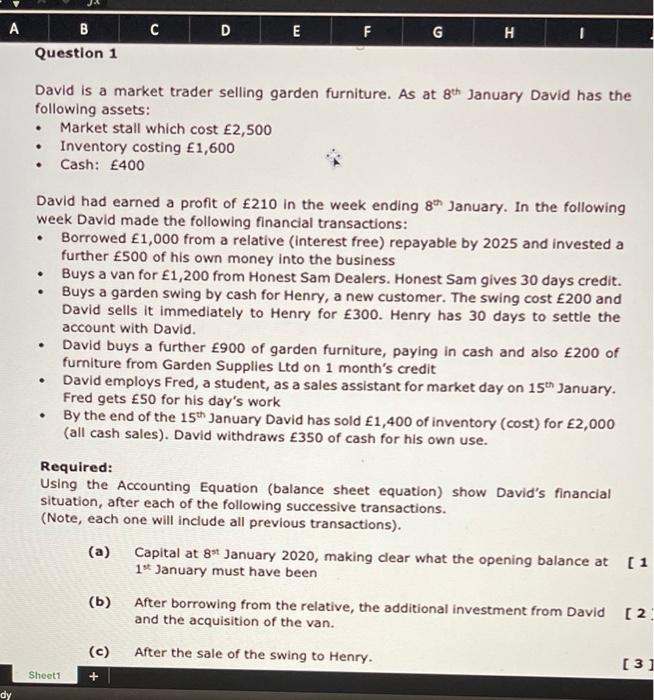

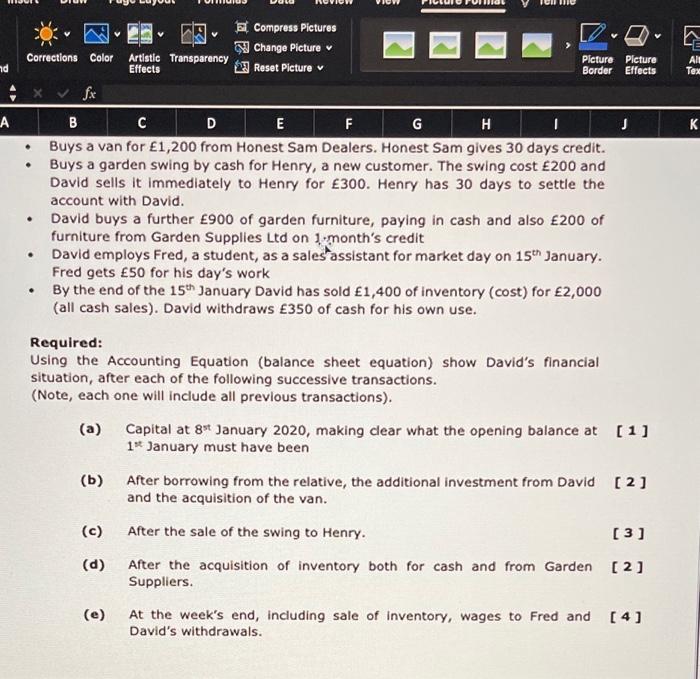

A D E E F G H 1 B Question 1 David is a market trader selling garden furniture. As at 8th January David has the following assets: Market stall which cost 2,500 Inventory costing 1,600 Cash: 400 . . . . . David had earned a profit of 210 in the week ending 8th January. In the following week David made the following financial transactions: Borrowed 1,000 from a relative Interest free) repayable by 2025 and invested a further 500 of his own money into the business Buys a van for 1,200 from Honest Sam Dealers. Honest Sam gives 30 days credit. Buys a garden swing by cash for Henry, a new customer. The swing cost 200 and David sells it immediately to Henry for 300. Henry has 30 days to settle the account with David. David buys a further 900 of garden furniture, paying in cash and also 200 of furniture from Garden Supplies Ltd on 1 month's credit David employs Fred, a student, as a sales assistant for market day on 15th January. Fred gets 50 for his day's work By the end of the 15th January David has sold 1,400 of inventory (cost) for 2,000 (all cash sales). David withdraws 350 of cash for his own use. Required: Using the Accounting Equation (balance sheet equation) show David's financial situation, after each of the following successive transactions. (Note, each one will include all previous transactions). (a) Capital at 8 January 2020, making clear what the opening balance at [1 19 January must have been (b) After borrowing from the relative, the additional investment from David (2 and the acquisition of the van. (c) After the sale of the swing to Henry. [3] Sheet1 + dy v o Compress Pictures Y Change Picture Reset Picture Corrections Color Artistic Transparency Effects nd Picture Picture Border Effects Tex A . B C D E F G H J Buys a van for 1,200 from Honest Sam Dealers. Honest Sam gives 30 days credit. Buys a garden swing by cash for Henry, a new customer. The swing cost 200 and David sells it immediately to Henry for 300. Henry has 30 days to settle the account with David. David buys a further 900 of garden furniture, paying in cash and also 200 of furniture from Garden Supplies Ltd on 1 month's credit David employs Fred, a student, as a sales assistant for market day on 15th January. Fred gets 50 for his day's work By the end of the 15th January David has sold 1,400 of inventory (cost) for 2,000 (all cash sales). David withdraws 350 of cash for his own use. Required: Using the Accounting Equation (balance sheet equation) show David's financial situation, after each of the following successive transactions. (Note, each one will include all previous transactions). (a) Capital at 8 January 2020, making clear what the opening balance at [1] 1* January must have been (b) After borrowing from the relative, the additional investment from David [2] and the acquisition of the van. (c) After the sale of the swing to Henry. [3] (d) After the acquisition of inventory both for cash and from Garden [2] Suppliers. (e) At the week's end, including sale of Inventory, wages to Fred and [4] David's withdrawals