A B 1 Problem 11.25 2 3 4 5 6 7 8 9 10 11 12 C D E F G H I J

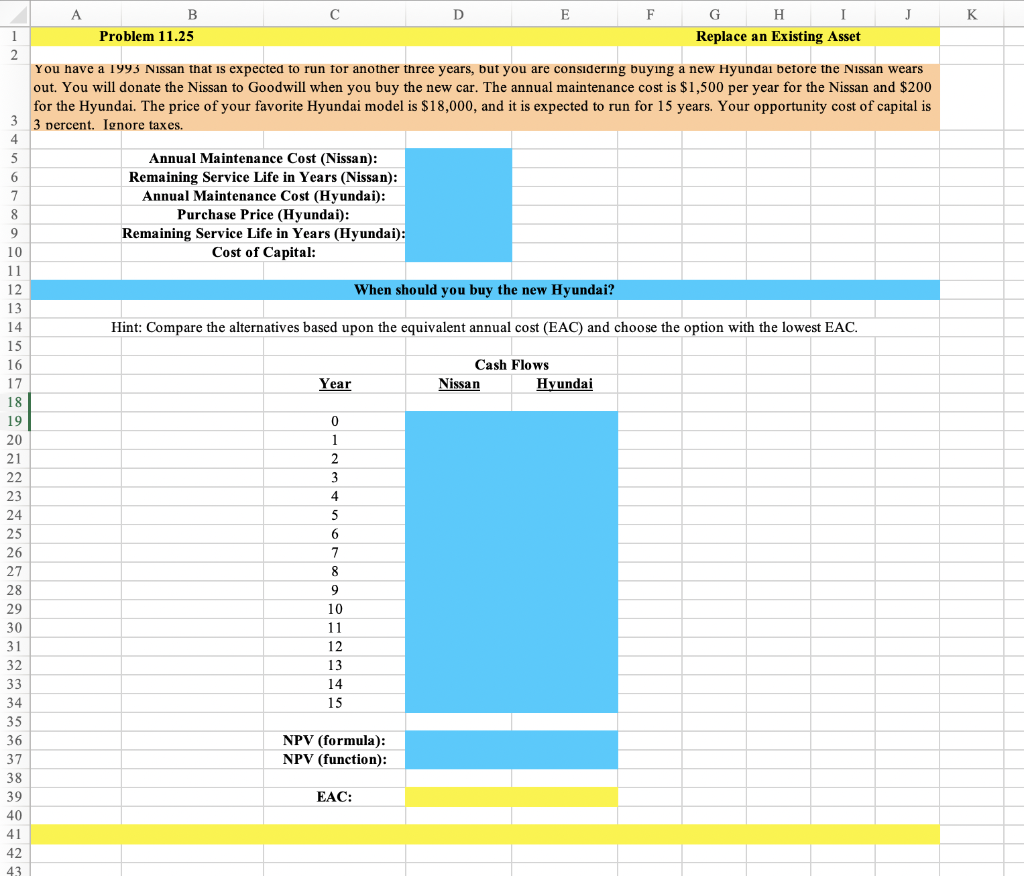

A B 1 Problem 11.25 2 3 4 5 6 7 8 9 10 11 12 C D E F G H I J K Replace an Existing Asset You have a 1993 Nissan that is expected to run for another three years, but you are considering buying a new Hyundai before the Nissan wears out. You will donate the Nissan to Goodwill when you buy the new car. The annual maintenance cost is $1,500 per year for the Nissan and $200 for the Hyundai. The price of your favorite Hyundai model is $18,000, and it is expected to run for 15 years. Your opportunity cost of capital is 3 percent. Ignore taxes. Annual Maintenance Cost (Nissan): Remaining Service Life in Years (Nissan): Annual Maintenance Cost (Hyundai): Purchase Price (Hyundai): Remaining Service Life in Years (Hyundai): Cost of Capital: When should you buy the new Hyundai? 13 14 Hint: Compare the alternatives based upon the equivalent annual cost (EAC) and choose the option with the lowest EAC. 15 16 17 Year Cash Flows Nissan Hyundai 18 19 0 20 1 21 2 22 3 23 4 24 5 25 6 26 7 27 8 28 9 29 10 30 11 31 12 32 13 33 14 34 15 35 36 37 38 39 NPV (formula): NPV (function): EAC: 40 41 42 43

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine when to replace the Nissan with the Hyundai we need to compare their Equivalent Annual ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started