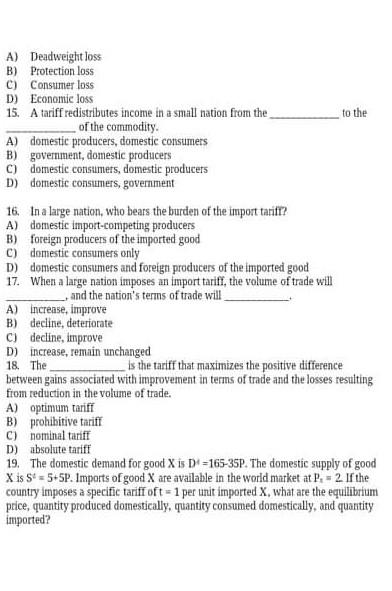

Question: A) Deadweight loss B) Protection loss c) Consumer loss D) Economic loss 15. A tariff redistributes income in a small nation from the to the

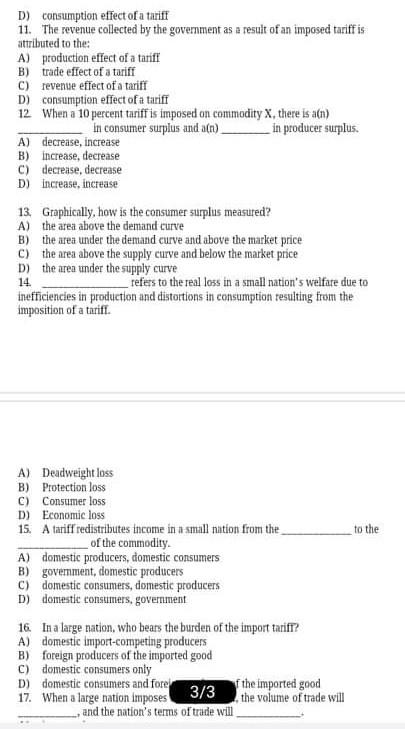

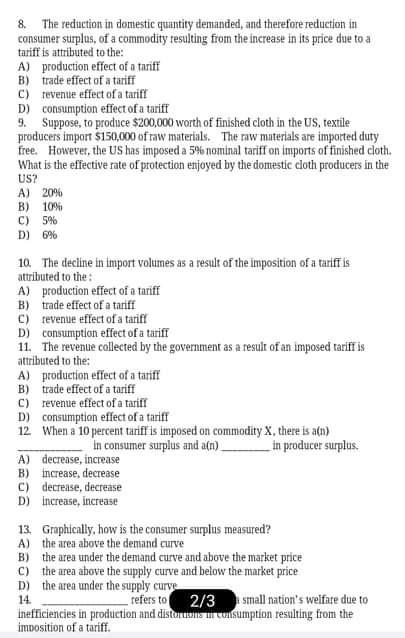

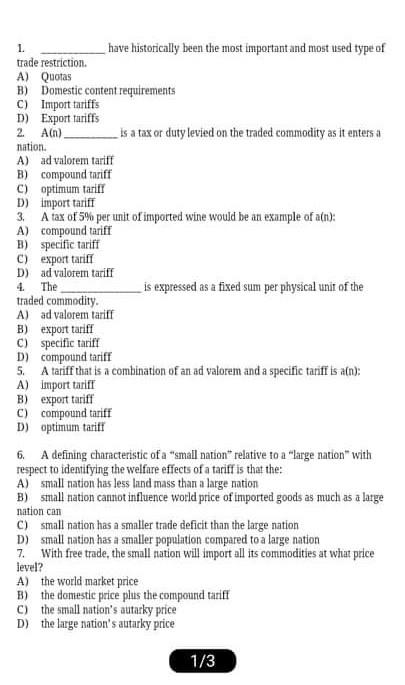

A) Deadweight loss B) Protection loss c) Consumer loss D) Economic loss 15. A tariff redistributes income in a small nation from the to the of the commodity. A) domestic producers, domestic consumers B) government, domestic producers c) domestic consumers, domestic producers D) domestic consumers, government 16. In a large nation, who bears the burden of the import taritt? A) domestic import-competing producers B) foreign producers of the imported good c) domestic consumers only D) domestic consumers and foreign producers of the imported good 17. When a large nation imposes an import tariff, the volume of trade will _, and the nation's terms of trade will A) increase, improve B) decline, deteriorate c) decline, improve D) increase, remain unchanged 18. The Is the tariff that maximizes the positive difference between gains associated with improvement in terms of trade and the losses resulting from reduction in the volume of trade. A) optimum tarifi B) prohibitive tarifi C) nominal tarifi D) absolute tariff 19. The domestic demand for good X is D) =165-35P. The domestic supply of good X is S* = 5+5P. Imparts of good X are available in the world market at P = 2 If the country imposes a specific tariff oft = 1 per unit imported X, what are the equilibrium price, quantity produced domestically, quantity consumed domestically, and quantity imported? D) consumption effect of a tariff 11. The revenue collected by the government as a result of an imposed tariff is attributed to the A) production effect of a tariff B) trade effect of a tarifi C) revenue effect of a tarify D) consumption effect of a tariff 12 When a 10 percent tariff is imposed on commodity X, there is acn) in consumer surplus and a(n) in producer surplus. A) decrease, increase B) increase, decrease C) decrease, decrease D) Increase, increase 13. Graphically, how is the consumer surplus measured? A) the area above the demand curve B) the area under the demand curve and above the market price C) the area above the supply curve and below the market price D) the area under the supply curve 14 refers to the real loss in a small nation's welfare due to inefficiencies in production and distortions in consumption resulting from the imposition of a tarifi. to the A) Deadweight loss B) Protection loss C) Consumer loss D) Economic loss 15. A tariff redistributes income in a small nation from the of the commodity. A) domestic producers, domestic consumers B) government domestic producers C) domestic consumers, domestic producers D) domestie consumers, government 16 In a large nation. who bears the burden of the import tarifT? A) domestic import-competing producers B) foreign producers of the imported good C) domestic consumers only D) domestic consumers and fore 3/3 17. When a large nation imposes the imported good the volume of trade will and the nation's terms of trade will 8. The reduction in domestic quantity demanded, and therefore reduction in consumer surplus of a commodity resulting from the increase in its price due to a tariff is attributed to the A) production effect of a tariff B) trade effect of a tariff C) revenue effect of a tariff D) consumption effect of a tariff 9. Suppose, to produce $200,000 worth of finished cloth in the US, textile producers import $150,000 of raw materials. The raw materials are imported duty free. However, the US has imposed a 5% nominal tariffon imports of finished cloth. What is the effective rate of protection enjoyed by the domestic cloth producets in the US? A) 20% B) 10% C) 5% D) 6% 10. The decline in Import volumes as a result of the imposition of a tariff is attributed to the: A) production effect of a tariff B) trade effect of a tariff C) revenue effect of a tariff D) consumption effect of a tariff 11. The revenue collected by the government as a result of an imposed tarifi is attributed to the A) production effect of a tariff B) trade effect of a tariff C) revenue effect of a tarifi D) consumption effect of a tariff 12 When a 10 percent tariff is imposed on commodity X, there is alm) In consumer surplus and a(n) in producer surplus A) decrease increase B) increase, decrease C) decrease, decrease D) increase, Increase 13. Graphically, how is the consumer surplus measured? A) the area above the demand curve B) the area under the demand curve and above the market price C) the area above the supply curve and below the market price D) the area under the supply curve 14. refers to 2/3 small nation's welfare due to inefficiencies in production and distus sumption resulting from the imposition of a tariff. 1. have historically been the most important and most used type of trade restriction. A) Quotas B) Domestic content requirements C) Import tariffs D) Export tariffs 2. A) is a tax or duty levied on the traded commodity as it enters a nation A) ad valorem tarifi B) compound tariff C) optimum tarifi D) Import tarifi 3. A tax of 5% per unit of imported wine would be an example of an): A) compound tarifi B) specific tarifi C) export tarifi D) ad valotem tariff 4. The is expressed as a fixed sum per physical unit of the traded commodity. A) ad valorem tariff B) export tarifi C) specific tarif D) compound tariff 5. A tariff that is a combination of an ad valorem and a specific tariff is afn): A) Import tarifi B) export tariff C) compound tariff D) optimum tarit 6. A defining characteristic of a small nation relative to a large nation" with respect to identifying the welfare effects of a tariff is that the A) small nation has less land mass than a large nation B) small nation cannot influence world price of imported goods as much as a large nation can C) small nation has a smaller trade deficit than the large nation D) small nation has a smaller population compared to a large nation 7. With free trade, the small nation will import all its commodities at what price level? A) the world market price B) the domestic price plus the compound tarifi C) the small nation's autarky price D) the large nation's atitarky price 1/3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts