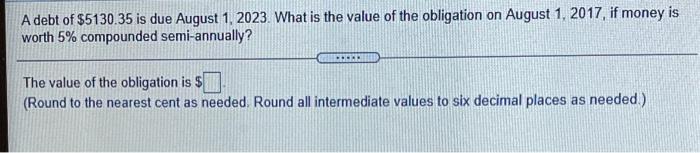

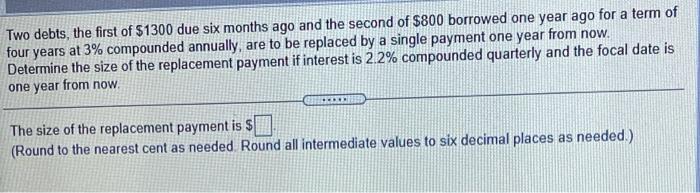

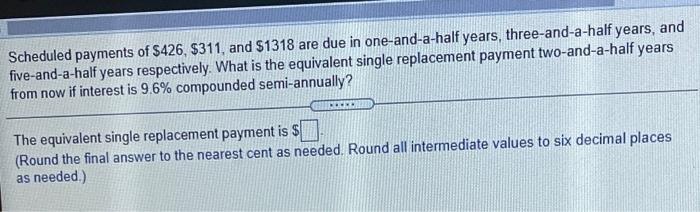

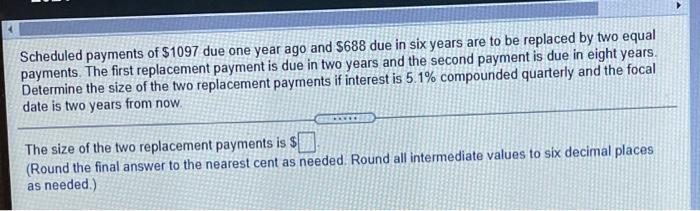

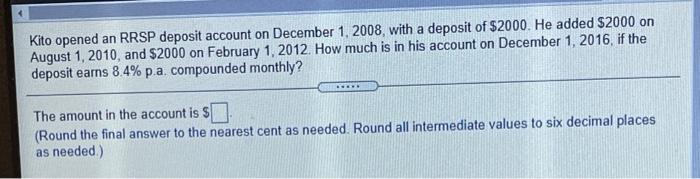

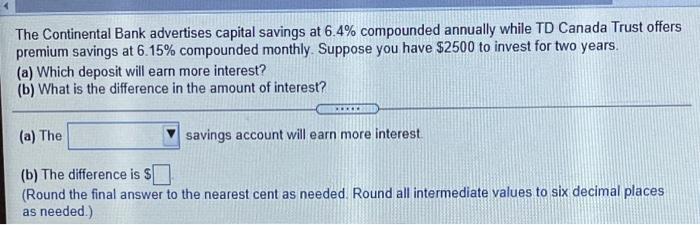

A debt of $5130.35 is due August 1, 2023. What is the value of the obligation on August 1, 2017, if money is worth 5% compounded semi-annually? - The value of the obligation is $ (Round to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Two debts, the first of $1300 due six months ago and the second of $800 borrowed one year ago for a term of four years at 3% compounded annually, are to be replaced by a single payment one year from now. Determine the size of the replacement payment if interest is 2.2% compounded quarterly and the focal date is one year from now The size of the replacement payment is $ (Round to the nearest cent as needed Round all intermediate values to six decimal places as needed.) Scheduled payments of $426, $311, and $1318 are due in one-and-a-half years, three-and-a-half years, and five-and-a-half years respectively. What is the equivalent single replacement payment two-and-a-half years from now if interest is 9.6% compounded semi-annually? . The equivalent single replacement payment is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.) Scheduled payments of $1097 due one year ago and $688 due in six years are to be replaced by two equal payments. The first replacement payment is due in two years and the second payment is due in eight years. Determine the size of the two replacement payments if interest is 5.1% compounded quarterly and the focal date is two years from now. The size of the two replacement payments is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) Kito opened an RRSP deposit account on December 1, 2008, with a deposit of $2000. He added $2000 on August 1, 2010, and $2000 on February 1, 2012. How much is in his account on December 1, 2016. if the deposit earns 8.4% p.a. compounded monthly? The amount in the account is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed) The Continental Bank advertises capital savings at 6.4% compounded annually while TD Canada Trust offers premium savings at 6.15% compounded monthly. Suppose you have $2500 to invest for two years. (a) Which deposit will earn more interest? (b) What is the difference in the amount of interest? B. (a) The savings account will earn more interest (b) The difference is $ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)