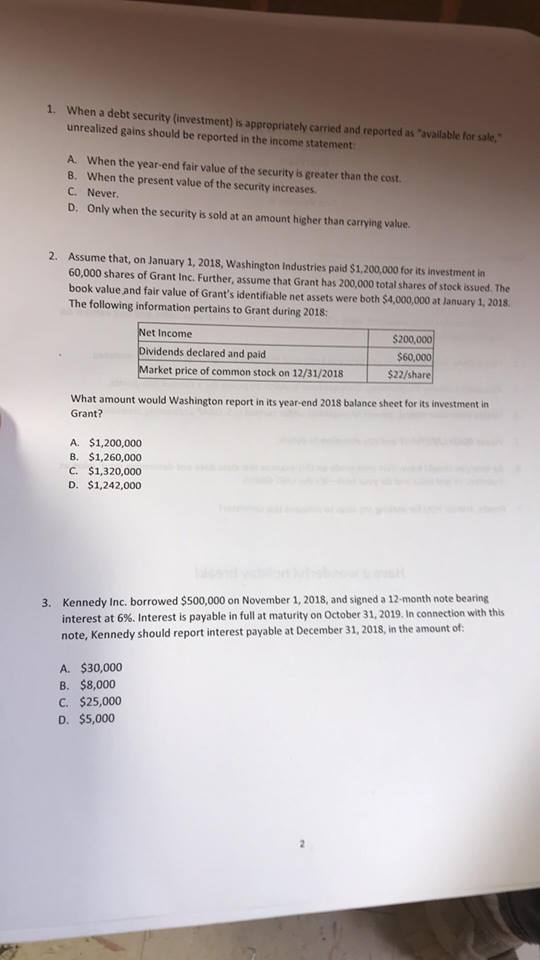

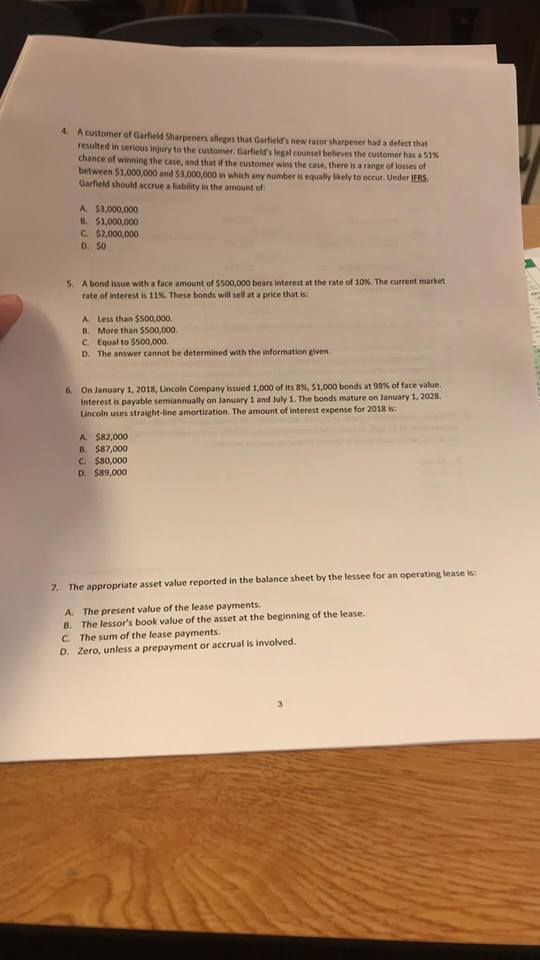

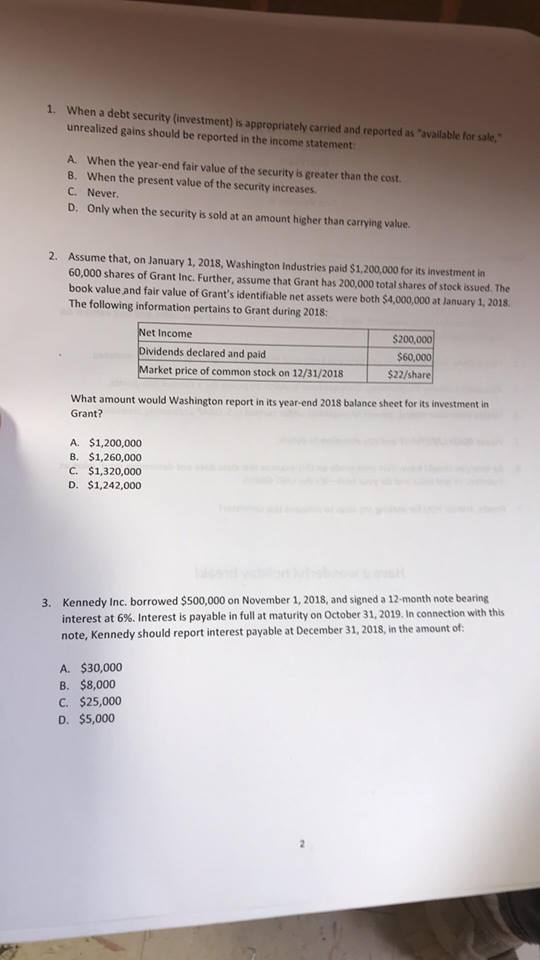

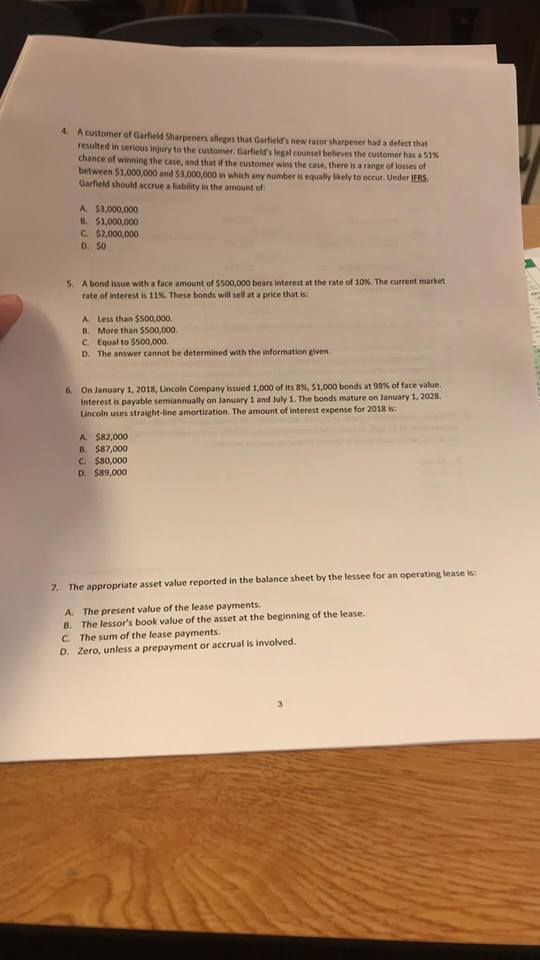

a debt security (investment) is appropriately carried and reported as "available for sale. unrealized gains should be reported in the income statement A. When the year-end fair value of the security is greater than the cost. B. When the present value of the security increases C. Never D. Only when the security is sold at an amount higher than carrying value. 2. Assume that, on January 1, 2018, Washington Industries paid $1,200,000 for its investment in 60,000 shares of Grant Inc. Further, assume that Grant has 200,000 total shares of stock issued. The book value and fair value of Grant's identifiable net assets were both $4,000,000 at January 1, 2018 The following information pertains to Grant during 2018 et Income Dividends declared and paid Market price of common stock on 12/31/2018 $200,000 $60, $22/share What amount would Washington report in its year-end 2018 balance sheet for its investment in Grant? A $1,200,000 B. $1,260,000 C. $1,320,000 D. $1,242,000 Kennedy Inc. borrowed $500,000 on November 1, 2018, and signed a 12-month note bearing interest at 6%. Interest is payable in full at maturity on October 31, 2019. In connection with this note, Kennedy should report interest payable at December 31, 2018, in the amount of: 3. A. $30,000 B. $8,000 C. $25,000 D. $5,000 4. A customer of Garfield Sharpeners alleges that Garfield's new raxor sharpener had a defect that resulted in serious injury to the customer. Garfield's legal counsel beteves the customer has a 51% chance of winning the case, and that if the customer wins the case, there is a range of between $1,000,000 and $3,000,000 in which any number is equally Wely to accur. Under IERS Garfield should accrue a iability in the amount of losses of A. $3,000,000 B. $1,000,000 C. $2,000,000 .so A bond issue with a face amount of $500,000 bears interest at the rate of 10%. The current market rate of interest is 11%. These bonds will selatapriethats: 5. A Less than $500,000 B. More than $500,000 C. Equal to 5500,000. D. The answer cannot be determined with the information given. On January 1, 2018, Lincoln Company issued1,000 of its 8%. St,000 bonds at 9S% of tacente. Interest is payable semiannually on January 1 and July 1. The honds mature on January 1, 2028. Lincoln uses straight line amortization. The amount of interest expense for 2018 is A. $82,000 B. $87,000 c sso,000 D, $89,000 7. The appropriate asset value reported in the balance sheet by the lessee for an operating lease is: A. The present value of the lease payments 8. The lessor's book value of the asset at the beginning of the lease. C. The sum of the lease payments. D. Zero, unless a prepayment or accrual is involved