Answered step by step

Verified Expert Solution

Question

1 Approved Answer

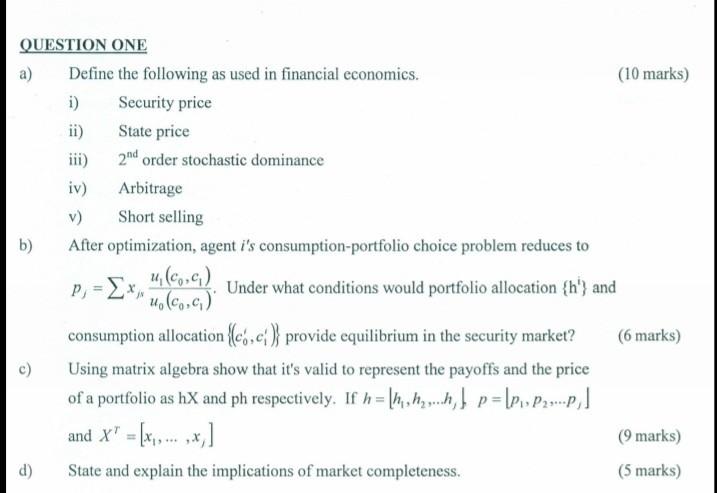

a) Define the following as used in financial economics. (10 marks) i) Security price ii) State price iii) 2nd order stochastic dominance iv) Arbitrage v)

a) Define the following as used in financial economics. (10 marks) i) Security price ii) State price iii) 2nd order stochastic dominance iv) Arbitrage v) Short selling b) After optimization, agent i 's consumption-portfolio choice problem reduces to pj=xjsu0(c0,c1)u1(c0,c1). Under what conditions would portfolio allocation {hi} and consumption allocation {(c0,c1)} provide equilibrium in the security market? (6 marks) c) Using matrix algebra show that it's valid to represent the payoffs and the price of a portfolio as hX and ph respectively. If h=h1,h2,hjp=p1,p2,pj and XT=[x1,,xj] (9 marks) d) State and explain the implications of market completeness

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started