Answered step by step

Verified Expert Solution

Question

1 Approved Answer

At the beginning of 20X1, Global Ltd acquired 20% of the shares of Chen Pty Ltd for $100,000. Chen Pty Ltd's financial statements for

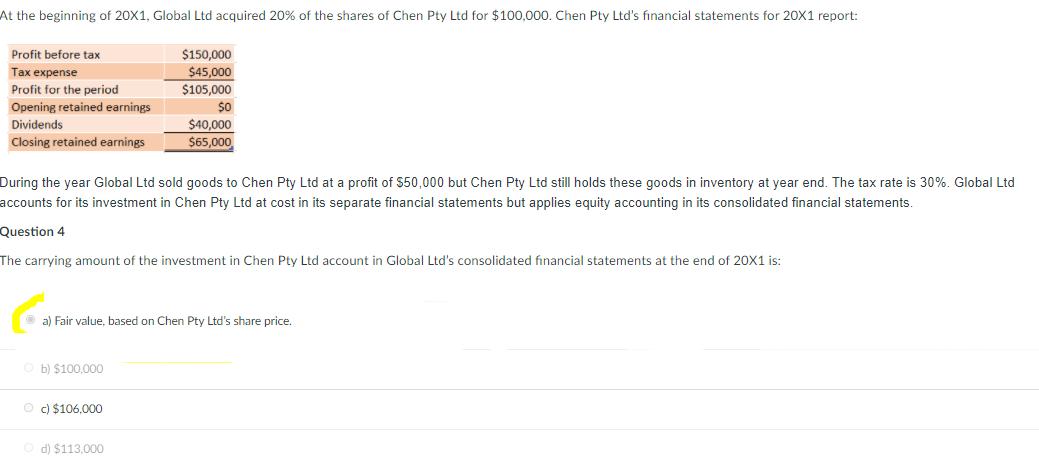

At the beginning of 20X1, Global Ltd acquired 20% of the shares of Chen Pty Ltd for $100,000. Chen Pty Ltd's financial statements for 20X1 report: Profit before tax Tax expense Profit for the period Opening retained earnings Dividends Closing retained earnings $150,000 $45,000 $105,000 $0 $40,000 $65,000, During the year Global Ltd sold goods to Chen Pty Ltd at a profit of $50,000 but Chen Pty Ltd still holds these goods in inventory at year end. The tax rate is 30%. Global Ltd accounts for its investment in Chen Pty Ltd at cost in its separate financial statements but applies equity accounting in its consolidated financial statements. Question 5 In preparing the consolidated financial statements for the year ended 20X2 the adjusting entry for unrealised profit in opening inventory should include a: a) debit to Opening retained earnings Ob) credit to Opening retained earnings c) debit to Investment in Associate d) credit to Cost of sales-opening inventory At the beginning of 20X1, Global Ltd acquired 20% of the shares of Chen Pty Ltd for $100,000. Chen Pty Ltd's financial statements for 20X1 report: Profit before tax Tax expense Profit for the period Opening retained earnings Dividends Closing retained earnings During the year Global Ltd sold goods to Chen Pty Ltd at a profit of $50,000 but Chen Pty Ltd still holds these goods in inventory at year end. The tax rate is 30%. Global Ltd accounts for its investment in Chen Pty Ltd at cost in its separate financial statements but applies equity accounting in its consolidated financial statements. Question 4 The carrying amount of the investment in Chen Pty Ltd account in Global Ltd's consolidated financial statements at the end of 20X1 is: a) Fair value, based on Chen Pty Ltd's share price. b) $100,000 $150,000 $45,000 $105,000 $0 $40,000 $65,000 c) $106.000 d) $113,000

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started