Answered step by step

Verified Expert Solution

Question

1 Approved Answer

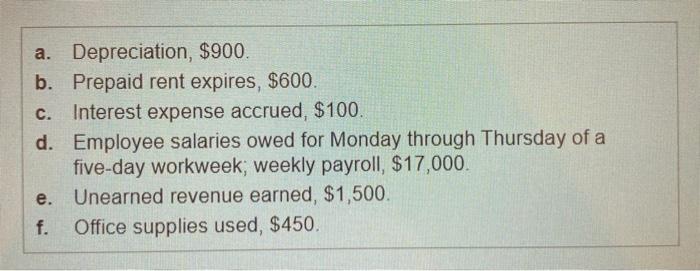

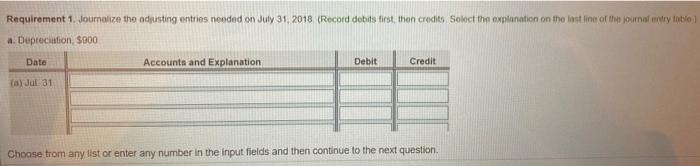

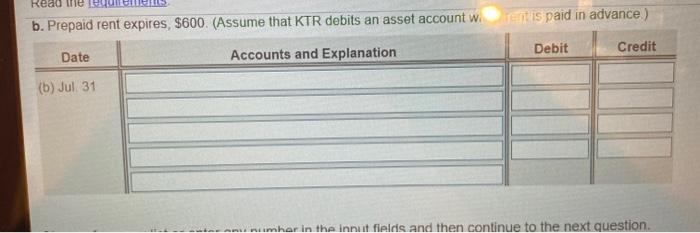

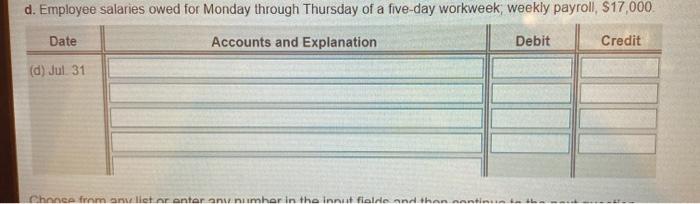

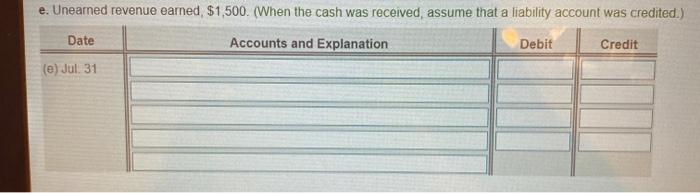

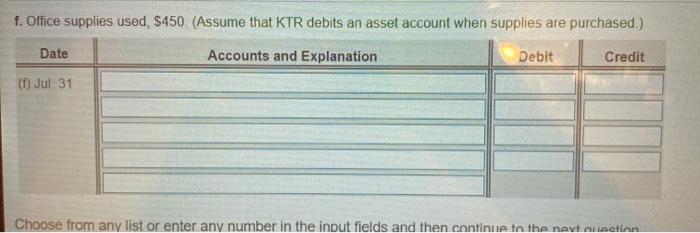

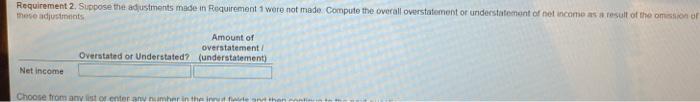

a. Depreciation, $900. b. Prepaid rent expires, $600. c. Interest expense accrued, $100. d. Employee salaries owed for Monday through Thursday of a five-day workweek,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

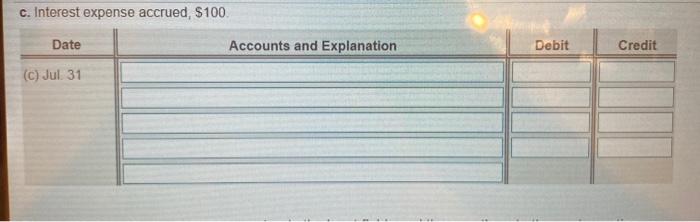

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started