Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a Derived from an option pricing model such as the Black - Scholes model b ( 6 0 0 , 0 0 0 $ 1

a Derived from an option pricing model such as the BlackScholes model

b $:$:

c $:$:

d Fair value intrinsic value ie equals the residual fair value derived from all sources except for intrinsic value eg time value

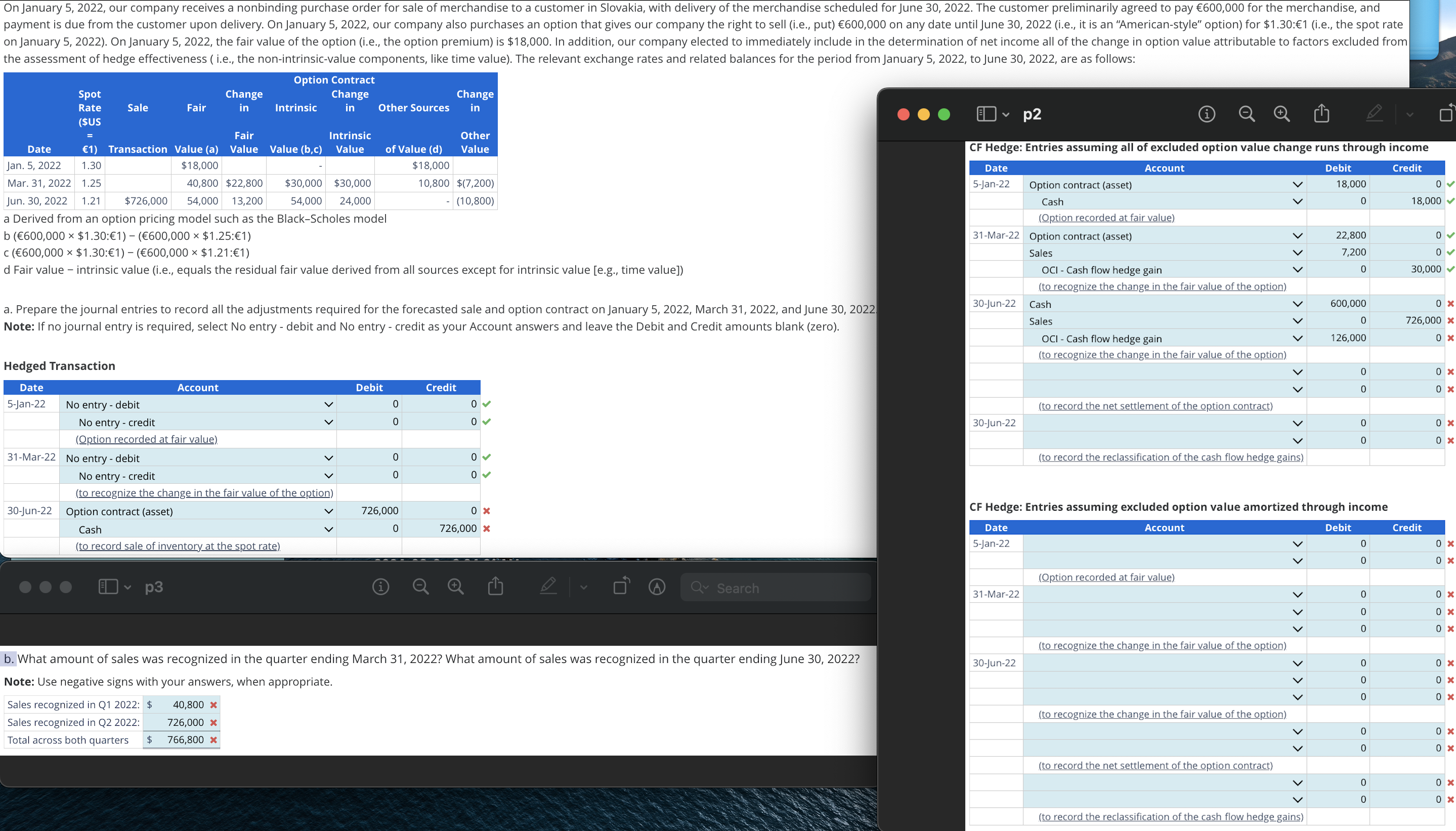

a Prepare the journal entries to record all the adjustments required for the forecasted sale and option contract on January March and June

Note: If no journal entry is required, select No entry debit and No entry credit as your Account answers and leave the Debit and Credit amounts blank zero

Hedged Transaction

b What amount of sales was recognized in the quarter ending March What amount of sales was recognized in the quarter ending June

Note: Use negative signs with your answers, when appropriate.

CF Hedge: Entries assuming excluded option value amortized through income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started