Answered step by step

Verified Expert Solution

Question

1 Approved Answer

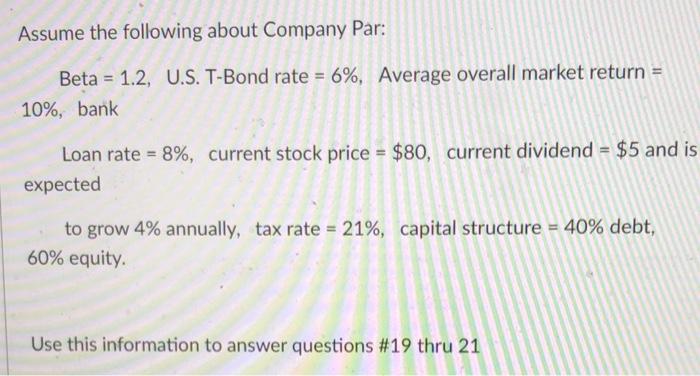

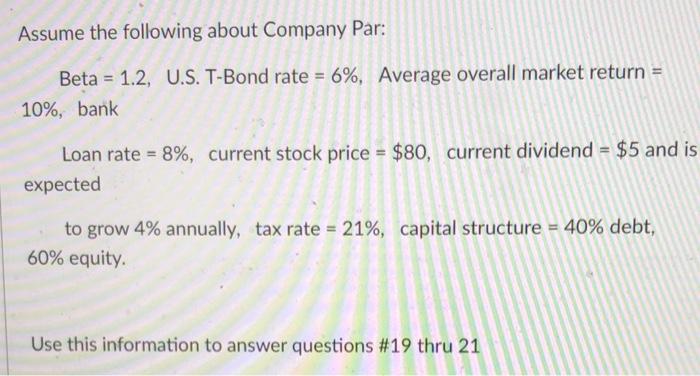

a detailed answer to each question will be greatly appreciated!! Assume the following about Company Par: Beta = 1.2, U.S. T-Bond rate = 6%, Average

a detailed answer to each question will be greatly appreciated!!

Assume the following about Company Par: Beta = 1.2, U.S. T-Bond rate = 6%, Average overall market return = 10%, bank Loan rate = 8%, current stock price = $80, current dividend = $5 and is expected to grow 4% annually, tax rate = 21%, capital structure = 40% debt, 60% equity. Use this information to answer questions #19 thru 21 What is the after tax cost of debt for Company Par?(round to 3 decimals - ex: .123) What is its cost of equity? (round to 3 decimals - ex: .123) What is Company Par's WACC? (round to 3 decimals - ex: .123)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started