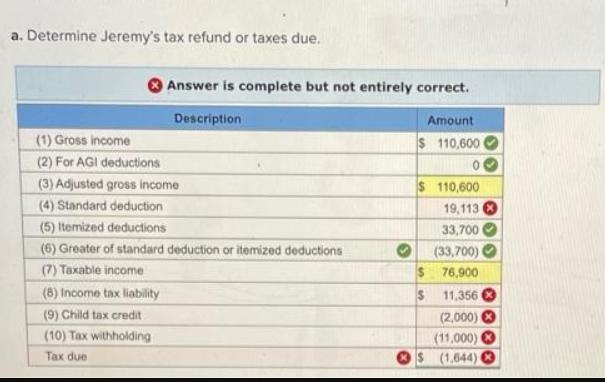

a. Determine Jeremy's tax refund or taxes due. (1) Gross income (2) For AGI deductions Answer is complete but not entirely correct. Amount $

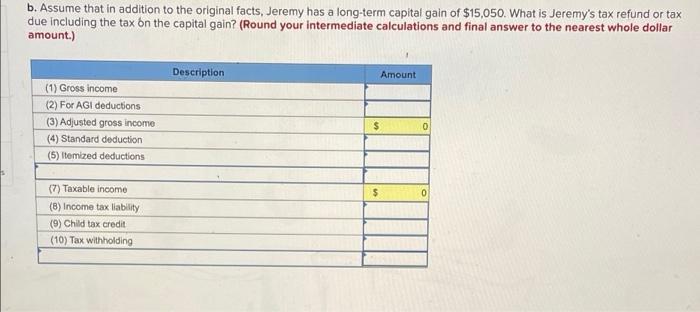

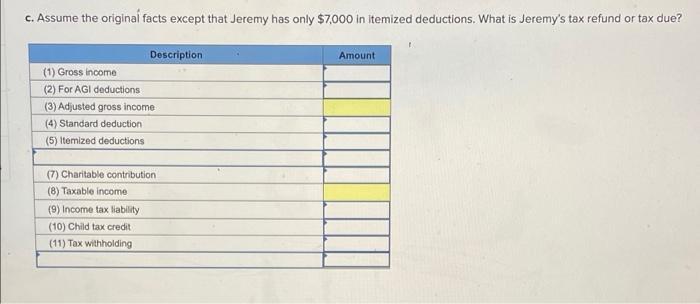

a. Determine Jeremy's tax refund or taxes due. (1) Gross income (2) For AGI deductions Answer is complete but not entirely correct. Amount $ 110,600 Description (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (6) Greater of standard deduction or itemized deductions (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding Tax due $ 110,600 19,113 33,700 (33,700) 76,900 11,356 (2,000) (11,000) $ (1,644) $ $ b. Assume that in addition to the original facts, Jeremy has a long-term capital gain of $15,050. What is Jeremy's tax refund or tax due including the tax on the capital gain? (Round your intermediate calculations and final answer to the nearest whole dollar amount.) (1) Gross income (2) For AGI deductions (3) Adjusted gross income (4) Standard deduction (5) Itemized deductions (7) Taxable income (8) Income tax liability (9) Child tax credit (10) Tax withholding Description Amount $ $ 0 0 c. Assume the original facts except that Jeremy has only $7,000 in itemized deductions. What is Jeremy's tax refund or tax due? (1) Gross income (2) For AGI deductions (3) Adjusted gross income. (4) Standard deduction (5) Itemized deductions Description. (7) Charitable contribution (8) Taxable income (9) Income tax liability (10) Child tax credit (11) Tax withholding Amount

Step by Step Solution

3.50 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Feb8322 Solution Less Less Less a 1 2 3 4 st 5 6 7 8 9 10 As per Tax y...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started