Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Determine Sharpe's sustainable growth given its current financial condition and assuming its profit margin and asset turnover equal industry average. b. Determine owners required

a. Determine Sharpe's sustainable growth given its current financial condition and assuming its profit margin and asset turnover equal industry average.

b. Determine owners required rate of return given Sharpe's current risk and assuming its risk equals the industry average.

c. What is Gordon's estimate of the value of Sharpe's common stock if she believes it will maintain its current condition for three years and begin to resemble the industry average as described in parts (a) and (b).

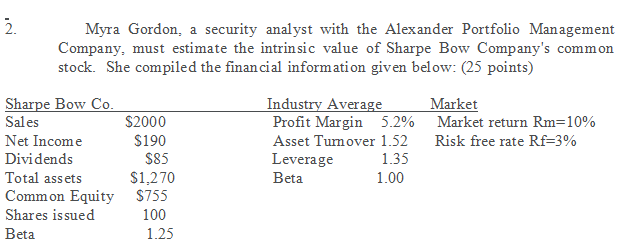

2. Myra Gordon, a security analyst with the Alexander Portfolio Management Company, must estimate the intrinsic value of Sharpe Bow Company's common stock. She compiled the financial information given below: (25 points) Sharpe Bow Co. Industry Average Market Sales $2000 Profit Margin 5.2% Market return Rm=10% Net Income $190 Asset Turnover 1.52 Risk free rate Rf=3% Dividends $85 Leverage 1.35 Total assets $1,270 Beta 1.00 Common Equity $755 Shares issued 100 Beta 1.25 2. Myra Gordon, a security analyst with the Alexander Portfolio Management Company, must estimate the intrinsic value of Sharpe Bow Company's common stock. She compiled the financial information given below: (25 points) Sharpe Bow Co. Industry Average Market Sales $2000 Profit Margin 5.2% Market return Rm=10% Net Income $190 Asset Turnover 1.52 Risk free rate Rf=3% Dividends $85 Leverage 1.35 Total assets $1,270 Beta 1.00 Common Equity $755 Shares issued 100 Beta 1.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started