Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A: determine the annual capital cost(ownership cost) for the equipment. B: determine the equivalent annual savings(revenues) C: determine the annual equivalent worth. You are considering

A: determine the annual capital cost(ownership cost) for the equipment.

B: determine the equivalent annual savings(revenues)

C: determine the annual equivalent worth.

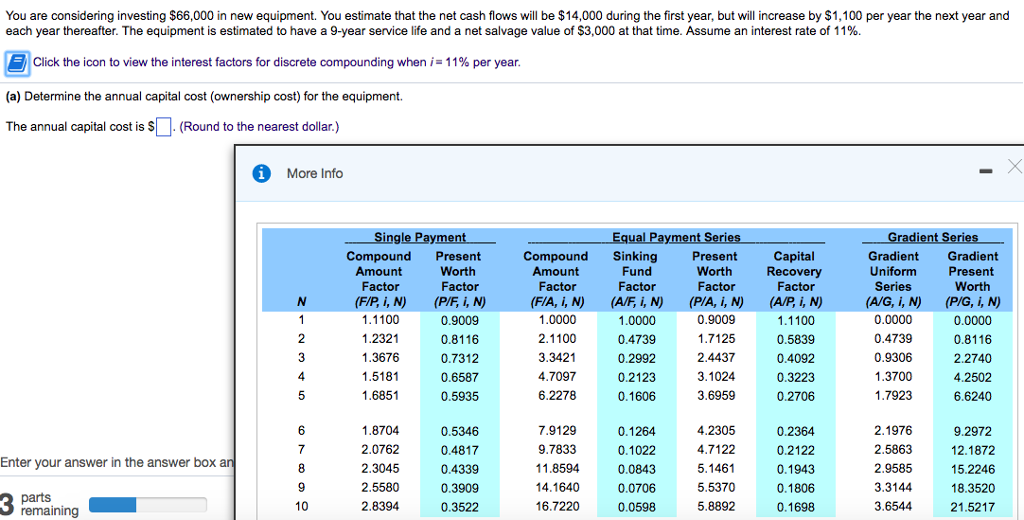

You are considering investing $66,000 in new equipment. You estimate that the net cash flows will be $14,000 during the first year, but will increase by $1,100 per year the next year and each year thereafter. The equipment is estimated to have a 9-year service life and a net salvage value of $3,000 at that time. Assume an interest rate of 11%. Click the icon to view the interest factors for discrete compounding when i-11% per year (a) Determine the annual capital cost (ownership cost) for the equipment. The annual capital cost is S(Round to the nearest dollar.) More Info gle Payment Compound Present Worth Compound Sinking Present Worth Factor (P/A, i, N) 0.9009 1.7125 2.4437 3.1024 3.6959 Capital Recovery Gradient Gradient Uniform Series (A/G, N) 0.0000 0.4739 0.9306 1.3700 1.7923 Amount Factor Amount Factor (FIA, N) Factor (AF, i, N) 1.0000 0.4739 0.2992 0.2123 0.1606 Present Worth (P/G, i, N) 0.0000 0.8116 2.2740 4.2502 6.6240 (AP, i, N) 0.9009 1.2321 1.3676 1.5181 1.6851 0.7312 0.6587 0.5935 3.3421 4.7097 6.2278 0.5839 0.4092 0.3223 0.2706 1.8704 2.0762 2.3045 2.5580 2.8394 0.5346 0.4817 0.4339 0.3909 0.3522 7.9129 9.7833 11.8594 14.1640 16.7220 0.1264 0.1022 0.0843 0.0706 0.0598 4.2305 4.7122 5.1461 5.5370 5.8892 0.2364 0.2122 0.1943 0.1806 0.1698 2.1976 2.5863 2.9585 3.3144 3.6544 9.2972 12.1872 15.2246 18.3520 21.5217 Enter your answer in the answer box 9 remainingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started