Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A. Determine the price of a five year 10% coupon treasury bond, sold to yield 8%. B. You buy the bond above for the

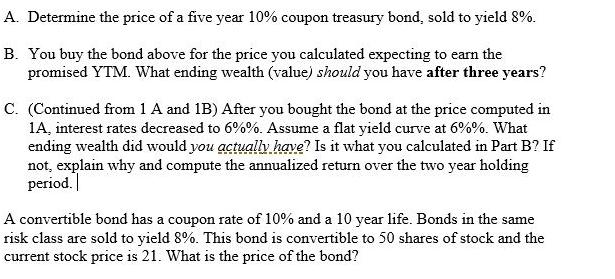

A. Determine the price of a five year 10% coupon treasury bond, sold to yield 8%. B. You buy the bond above for the price you calculated expecting to earn the promised YTM. What ending wealth (value) should you have after three years? C. (Continued from 1 A and 1B) After you bought the bond at the price computed in 1A, interest rates decreased to 6%%. Assume a flat yield curve at 6%%. What ending wealth did would you actually have? Is it what you calculated in Part B? If not, explain why and compute the annualized return over the two year holding period. A convertible bond has a coupon rate of 10% and a 10 year life. Bonds in the same risk class are sold to yield 8%. This bond is convertible to 50 shares of stock and the current stock price is 21. What is the price of the bond?

Step by Step Solution

★★★★★

3.54 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

A To determine the price of a fiveyear 10 coupon Treasury bond sold to yield 8 Given Coupon Rate 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started