Question

A. determine the standard markup percentage for each of the following cost basis around answers to two decimal places: 1. full costs including fixed and

A. determine the standard markup percentage for each of the following cost basis around answers to two decimal places:

1. full costs including fixed and variable manufacturing costs, and fixed and variable selling and administrative costs

2. manufacturing costs plus variable selling and administrative costs

3. manufacturing costs

4. variable costs

5. variable manufacturing costs

B. explain why the markup percentages become progressively larger from requirement (a), parts (1) through (5)

C. determine the initial price set of the TW Irons using the manufacturing cost markup and the variable manufacturing cost markup

D. do you believe the comptroller's approach to product pricing is reasonable? why or why not?

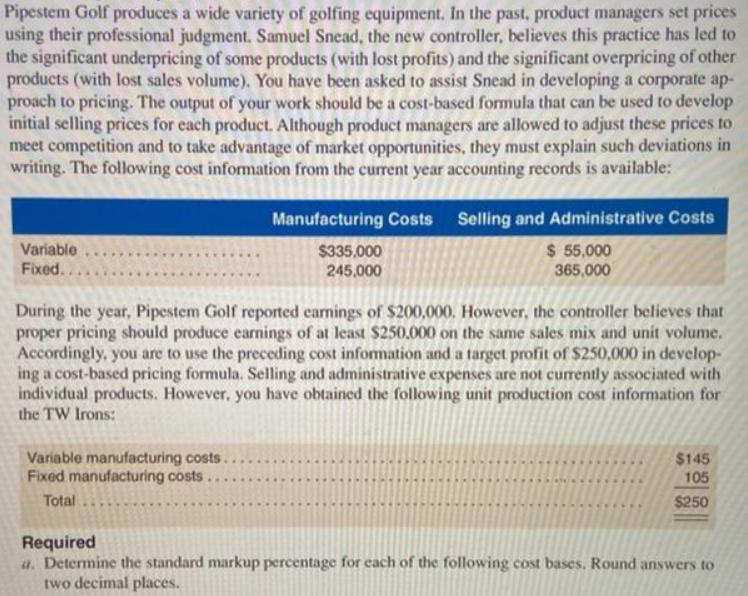

Pipestem Golf produces a wide variety of golfing equipment. In the past, product managers set prices using their professional judgment. Samuel Snead, the new controller, believes this practice has led to the significant underpricing of some products (with lost profits) and the significant overpricing of other products (with lost sales volume). You have been asked to assist Snead in developing a corporate ap- proach to pricing. The output of your work should be a cost-based formula that can be used to develop initial selling prices for each product. Although product managers are allowed to adjust these prices to meet competition and to take advantage of market opportunities, they must explain such deviations in writing. The following cost information from the current year accounting records is available: Manufacturing Costs Selling and Administrative Costs Variable Fixed.. $335,000 245,000 $ 55,000 365,000 During the year, Pipestem Golf reported earnings of $200,000. However, the controller believes that proper pricing should produce earnings of at least $250.000 on the same sales mix and unit volume. Accordingly, you are to use the preceding cost information and a target profit of $250,000 in develop- ing a cost-based pricing formula. Selling and administrative expenses are not currently associated with individual products. However, you have obtained the following unit production cost information for the TW Irons: Variable manufacturing costs.. Fixed manufacturing costs $145 105 Total $250 Required a. Determine the standard markup percentage for cach of the following cost bases. Round answers to two decimal places.

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

1 Total Manfacturing cost Selling and admin cost Variable 335000 55000 Fixed 245000 365000 Total 580000 420000 Reported earnings 200000 expected Earnings 250000 Step1 calculation total units of produc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started