A developer has a rectangular 5-acre site with a commercial zoning designation allowing mini-storage, office, retail, or apartments. The land is under contract for

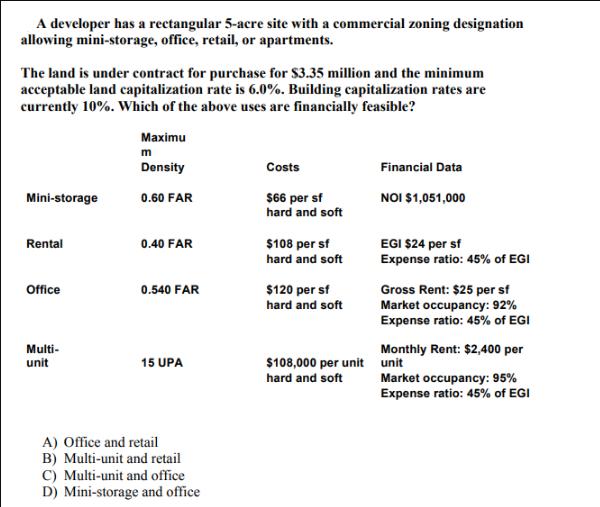

A developer has a rectangular 5-acre site with a commercial zoning designation allowing mini-storage, office, retail, or apartments. The land is under contract for purchase for $3.35 million and the minimum acceptable land capitalization rate is 6.0%. Building capitalization rates are currently 10%. Which of the above uses are financially feasible? Mini-storage Rental Office Multi- unit Maximu m Density 0.60 FAR 0.40 FAR 0.540 FAR 15 UPA A) Office and retail B) Multi-unit and retail C) Multi-unit and office D) Mini-storage and office Costs $66 per sf hard and soft $108 per sf hard and soft $120 per sf hard and soft $108,000 per unit hard and soft Financial Data NOI $1,051,000 EGI $24 per sf Expense ratio: 45% of EGI Gross Rent: $25 per sf Market occupancy: 92% Expense ratio: 45% of EGI Monthly Rent: $2,400 per unit Market occupancy: 95% Expense ratio: 45% of EGI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The image presents a real estate development scenario with three different use cases ministorage rental and office for a 5acre site For each use maximum density expressed as floor area ratio or FAR co...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started