Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a. Did Apple have a positive or negative cash flow generated from Operating Activities for the year 2021? What is the dollar amount? Is

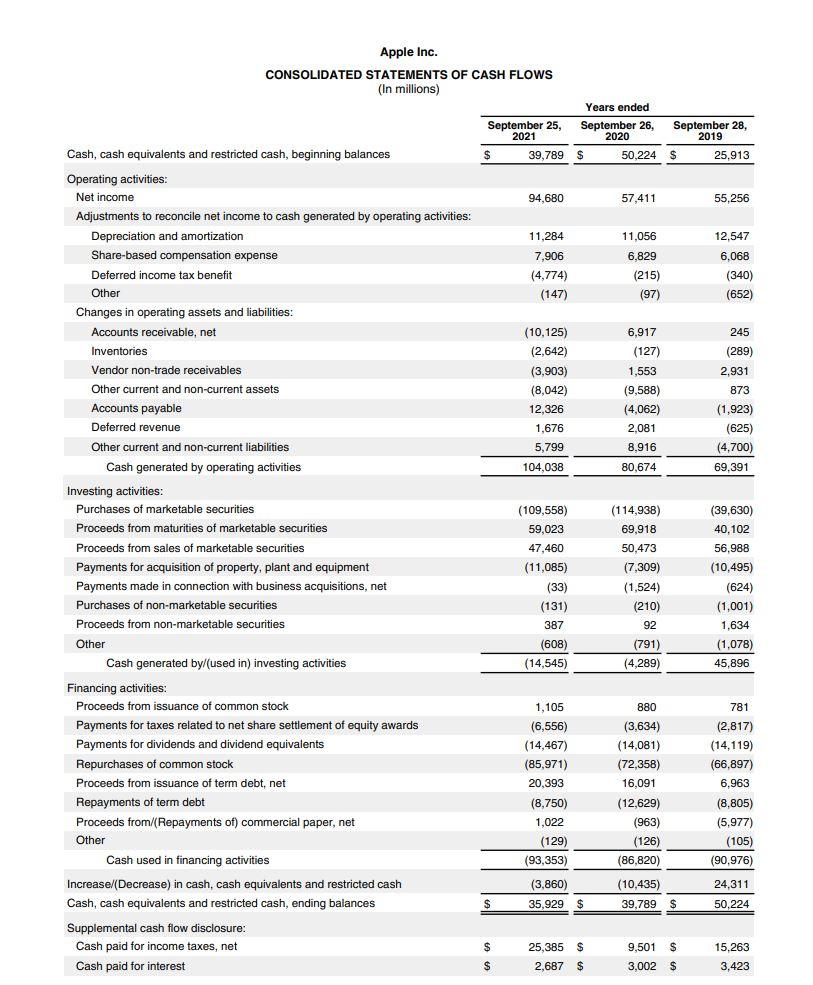

a. Did Apple have a positive or negative cash flow generated from Operating Activities for the year 2021? What is the dollar amount? Is this a good thing or bad thing? Explain, perhaps comparing it to the previous years. (3pts) b. How much did Apple pay in dividends in 2021? (notice this is in millions) (2pts) c. What were the names and dollar amounts of Apple's TWO largest cash outflows for the year 2021? Both of these were discussed in previous chapters but with slightly different wording. Explain what they were called in previous chapters. (2pts) Cash, cash equivalents and restricted cash, beginning balances Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax benefit Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Apple Inc. CONSOLIDATED STATEMENTS OF CASH FLOWS (In millions) Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Purchases of non-marketable securities Proceeds from non-marketable securities Other Cash generated by/(used in) investing activities Financing activities: Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt. Proceeds from/(Repayments of) commercial paper, net Other Cash used in financing activities Increase/(Decrease) in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, ending balances Supplemental cash flow disclosure: Cash paid for income taxes, net Cash paid for interest September 25, 2021 $ $ $ $ 39,789 $ 94,680 11,284 7,906 (4,774) (147) (10,125) (2,642) (3,903) (8,042) 12,326 1,676 5,799 104,038 (109,558) 59,023 47,460 (11,085) (33) (131) 387 (608) (14,545) Years ended September 26, 2020 1,105 (6,556) (14,467) (85,971) 20,393 (8,750) 1,022 (129) (93,353) (3,860) 35,929 $ 25,385 $ 2,687 $ 50,224 $ 57,411 11,056 6,829 (215) (97) 6,917 (127) 1,553 (9,588) (4,062) 2,081 8,916 80,674 (114,938) 69,918 50,473 (7,309) (1,524) (210) 92 (791) (4,289) September 28, 2019 880 (3,634) (14,081) (72,358) 16,091 (12,629) (963) (126) (86,820) (10,435) 39,789 $ 9,501 $ 3,002 $ 25,913 55,256 12,547 6,068 (340) (652) 245 (289) 2,931 873 (1,923) (625) (4,700) 69,391 (39,630) 40,102 56,988 (10,495) (624) (1,001) 1,634 (1,078) 45,896 781 (2,817) (14,119) (66,897) 6,963 (8,805) (5,977) (105) (90,976) 24,311 50,224 15,263 3,423

Step by Step Solution

★★★★★

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Based on the second image provided which appears to be the Consolidated Statements of Cash Flows for Apple Inc we can answer the following questions a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started