Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a) Dimi wants to start up his own business. Unfortunately, he doesn't have a lot of money. That's why his bank is offering him

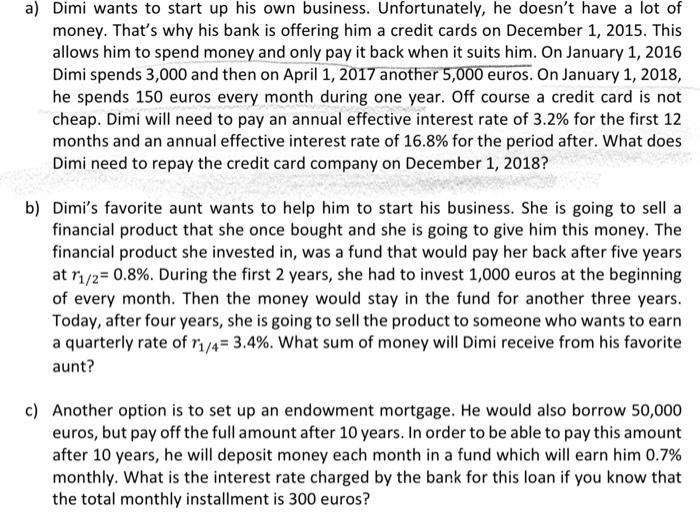

a) Dimi wants to start up his own business. Unfortunately, he doesn't have a lot of money. That's why his bank is offering him a credit cards on December 1, 2015. This allows him to spend money and only pay it back when it suits him. On January 1, 2016 Dimi spends 3,000 and then on April 1, 2017 another 5,000 euros. On January 1, 2018, he spends 150 euros every month during one year. Off course a credit card is not cheap. Dimi will need to pay an annual effective interest rate of 3.2% for the first 12 months and an annual effective interest rate of 16.8% for the period after. What does Dimi need to repay the credit card company on December 1, 2018? it card company on December 1, 2018? b) Dimi's favorite aunt wants to help him to start his business. She is going to sell a financial product that she once bought and she is going to give him this money. The financial product she invested in, was a fund that would pay her back after five years at 11/2= 0.8%. During the first 2 years, she had to invest 1,000 euros at the beginning of every month. Then the money would stay in the fund for another three years. Today, after four years, she is going to sell the product to someone who wants to earn a quarterly rate of 1/4= 3.4%. What sum of money will Dimi receive from his favorite aunt? c) Another option is to set up an endowment mortgage. He would also borrow 50,000 euros, but pay off the full amount after 10 years. In order to be able to pay this amount after 10 years, he will deposit money each month in a fund which will earn him 0.7% monthly. What is the interest rate charged by the bank for this loan if you know that the total monthly installment is 300 euros?

Step by Step Solution

★★★★★

3.52 Rating (172 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started