Answered step by step

Verified Expert Solution

Question

1 Approved Answer

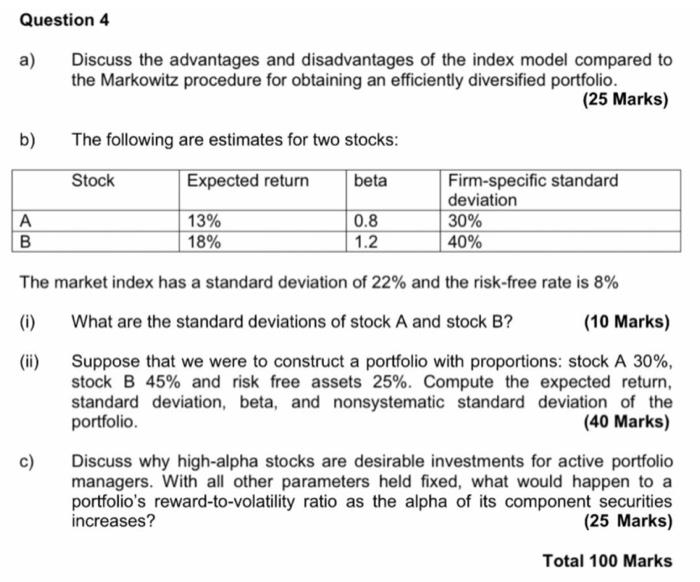

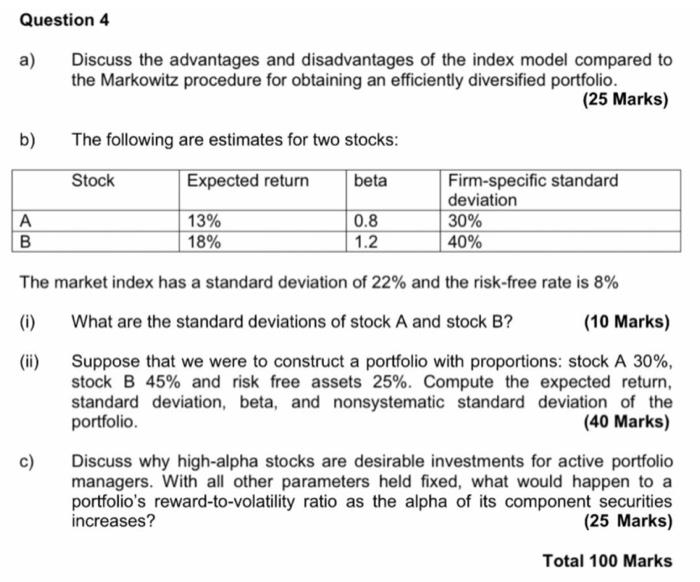

a) Discuss the advantages and disadvantages of the index model compared to the Markowitz procedure for obtaining an efficiently diversified portfolio. (25 Marks) b) The

a) Discuss the advantages and disadvantages of the index model compared to the Markowitz procedure for obtaining an efficiently diversified portfolio. (25 Marks) b) The following are estimates for two stocks: The market index has a standard deviation of 22% and the risk-free rate is 8% (i) What are the standard deviations of stock A and stock B ? (10 Marks) (ii) Suppose that we were to construct a portfolio with proportions: stock A 30%, stock B 45% and risk free assets 25%. Compute the expected return, standard deviation, beta, and nonsystematic standard deviation of the portfolio. (40 Marks) c) Discuss why high-alpha stocks are desirable investments for active portfolio managers. With all other parameters held fixed, what would happen to a portfolio's reward-to-volatility ratio as the alpha of its component securities increases? (25 Marks)

a) Discuss the advantages and disadvantages of the index model compared to the Markowitz procedure for obtaining an efficiently diversified portfolio. (25 Marks) b) The following are estimates for two stocks: The market index has a standard deviation of 22% and the risk-free rate is 8% (i) What are the standard deviations of stock A and stock B ? (10 Marks) (ii) Suppose that we were to construct a portfolio with proportions: stock A 30%, stock B 45% and risk free assets 25%. Compute the expected return, standard deviation, beta, and nonsystematic standard deviation of the portfolio. (40 Marks) c) Discuss why high-alpha stocks are desirable investments for active portfolio managers. With all other parameters held fixed, what would happen to a portfolio's reward-to-volatility ratio as the alpha of its component securities increases? (25 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started