Answered step by step

Verified Expert Solution

Question

1 Approved Answer

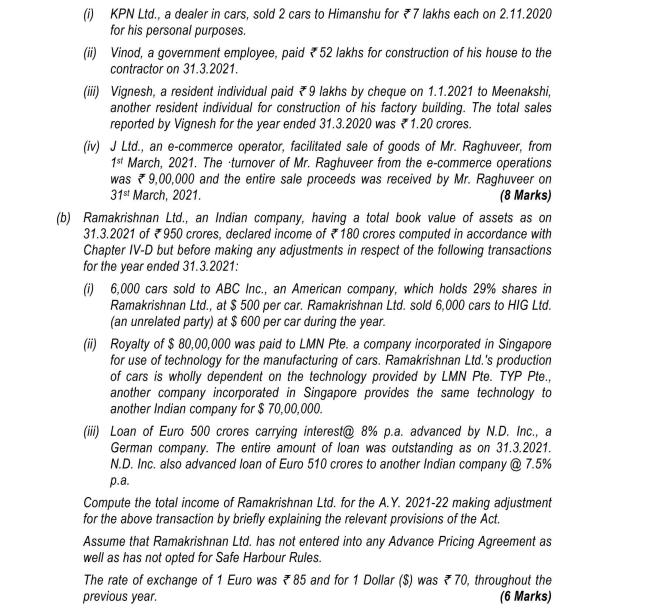

(a) Discuss the relevant provisions of the Income-tax Act, with respect to deduction/collection of tax in the following independent situations: (i) KPN Ltd., a

![]()

(a) Discuss the relevant provisions of the Income-tax Act, with respect to deduction/collection of tax in the following independent situations: (i) KPN Ltd., a dealer in cars, sold 2 cars to Himanshu for 7 lakhs each on 2.11.2020 for his personal purposes. (ii) Vinod, a government employee, paid 52 lakhs for construction of his house to the contractor on 31.3.2021. Vignesh, a resident individual paid 9 lakhs by cheque on 1.1.2021 to Meenakshi, another resident individual for construction of his factory building. The total sales reported by Vignesh for the year ended 31.3.2020 was 1.20 crores. (iv) J Ltd., an e-commerce operator, facilitated sale of goods of Mr. Raghuveer, from 1st March, 2021. The turnover of Mr. Raghuveer from the e-commerce operations was 9,00,000 and the entire sale proceeds was received by Mr. Raghuveer on 31st March, 2021. (8 Marks) (b) Ramakrishnan Ltd., an Indian company, having a total book value of assets as on 31.3.2021 of 950 crores, declared income of 180 crores computed in accordance with Chapter IV-D but before making any adjustments in respect of the following transactions for the year ended 31.3.2021: (i) 6,000 cars sold to ABC Inc., an American company, which holds 29% shares in Ramakrishnan Ltd., at $ 500 per car. Ramakrishnan Ltd. sold 6,000 cars to HIG Ltd. (an unrelated party) at $ 600 per car during the year. (ii) Royalty of $ 80,00,000 was paid to LMN Pte. a company incorporated in Singapore for use of technology for the manufacturing of cars. Ramakrishnan Ltd.'s production of cars is wholly dependent on the technology provided by LMN Pte. TYP Pte., another company incorporated in Singapore provides the same technology to another Indian company for $ 70,00,000. (iii) Loan of Euro 500 crores carrying interest@ 8% p.a. advanced by N.D. Inc., a German company. The entire amount of loan was outstanding as on 31.3.2021. N.D. Inc. also advanced loan of Euro 510 crores to another Indian company @ 7.5% p.a. Compute the total income of Ramakrishnan Ltd. for the A.Y. 2021-22 making adjustment for the above transaction by briefly explaining the relevant provisions of the Act. Assume that Ramakrishnan Ltd. has not entered into any Advance Pricing Agreement as well as has not opted for Safe Harbour Rules. The rate of exchange of 1 Euro was 85 and for 1 Dollar ($) was 70, throughout the previous year. (6 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started