Answered step by step

Verified Expert Solution

Question

1 Approved Answer

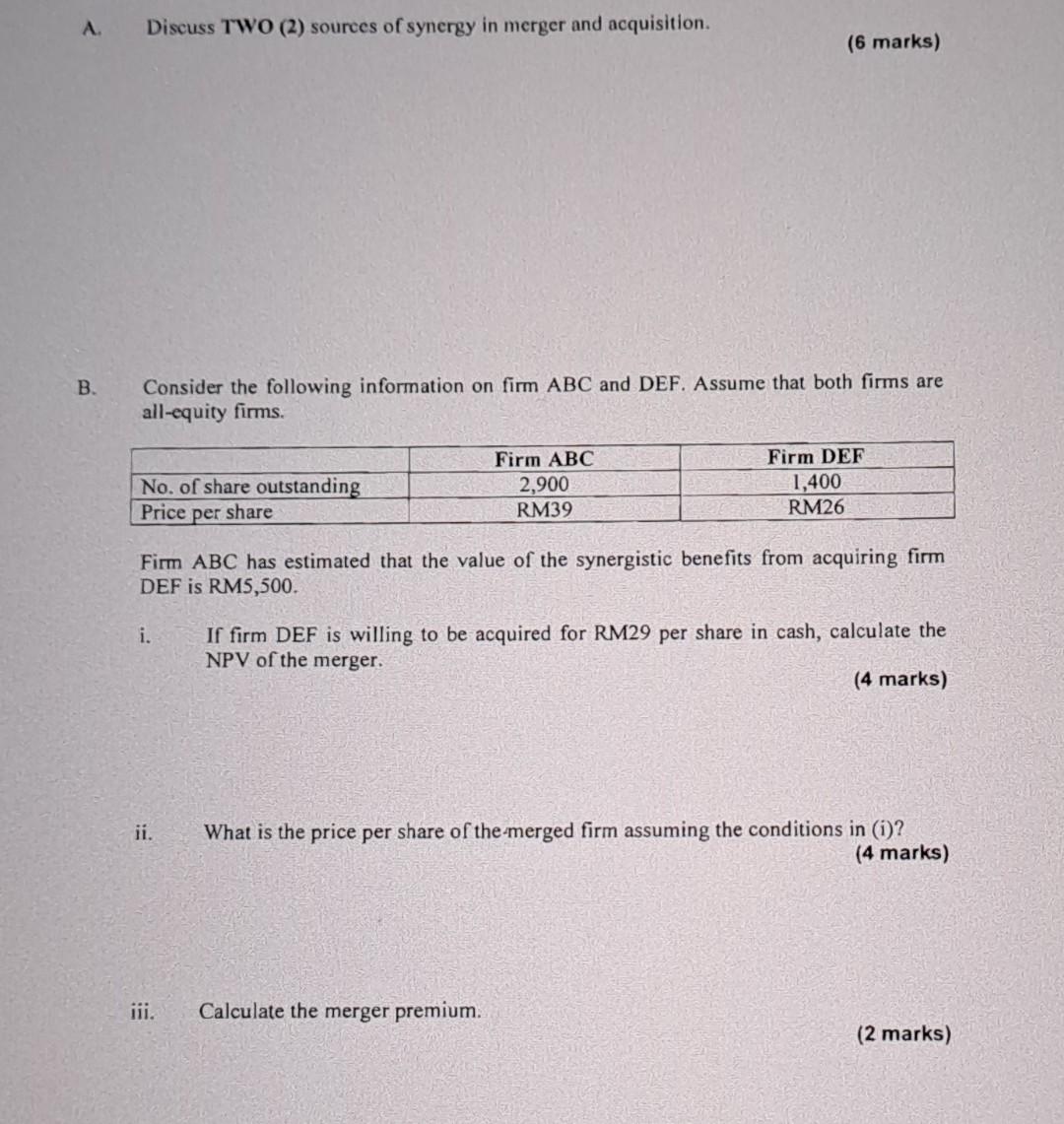

A. Discuss TWO (2) sourees of synergy in merger and acquisition. (6 marks) B. Consider the following information on firm ABC and DEF. Assume that

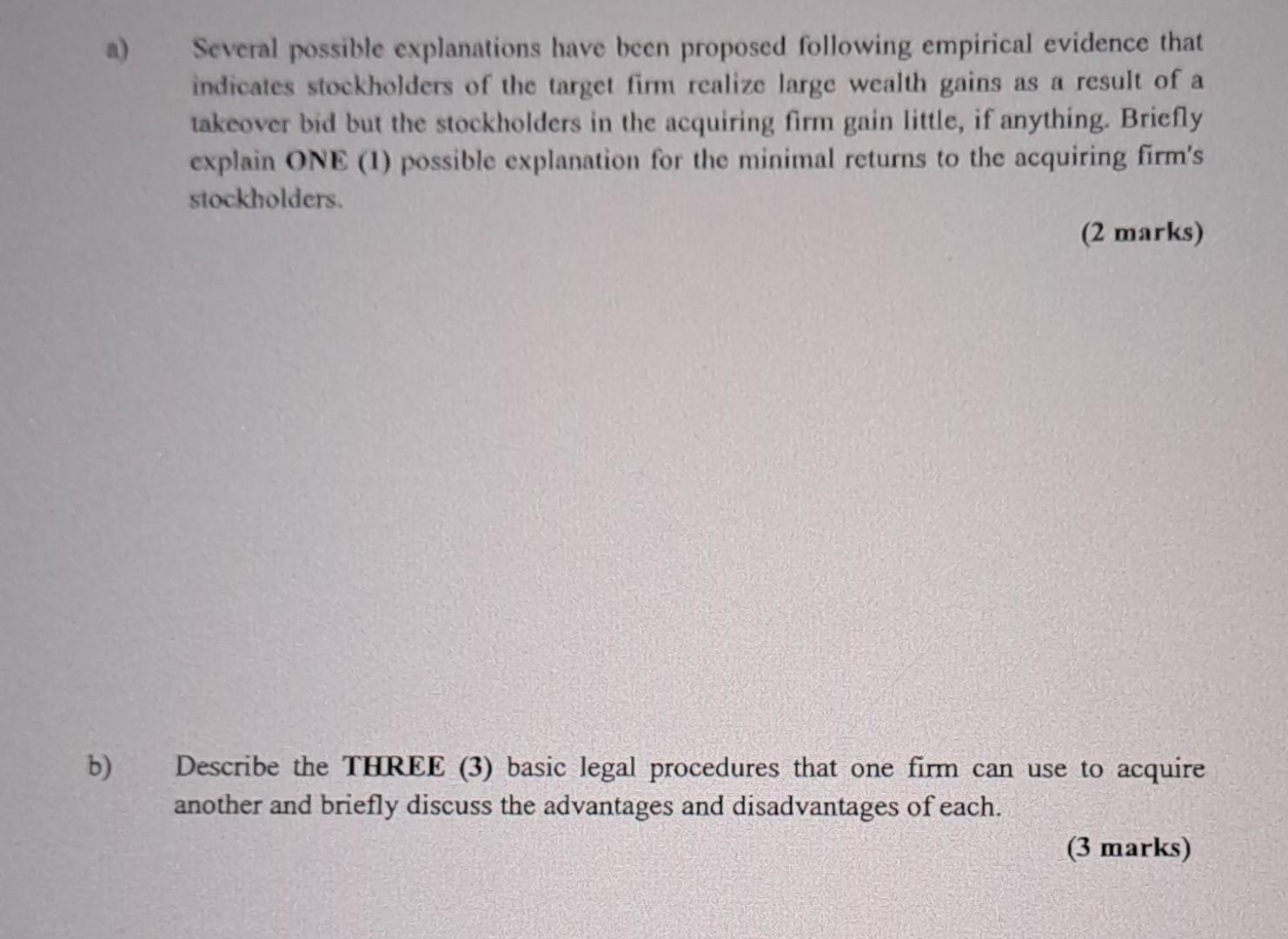

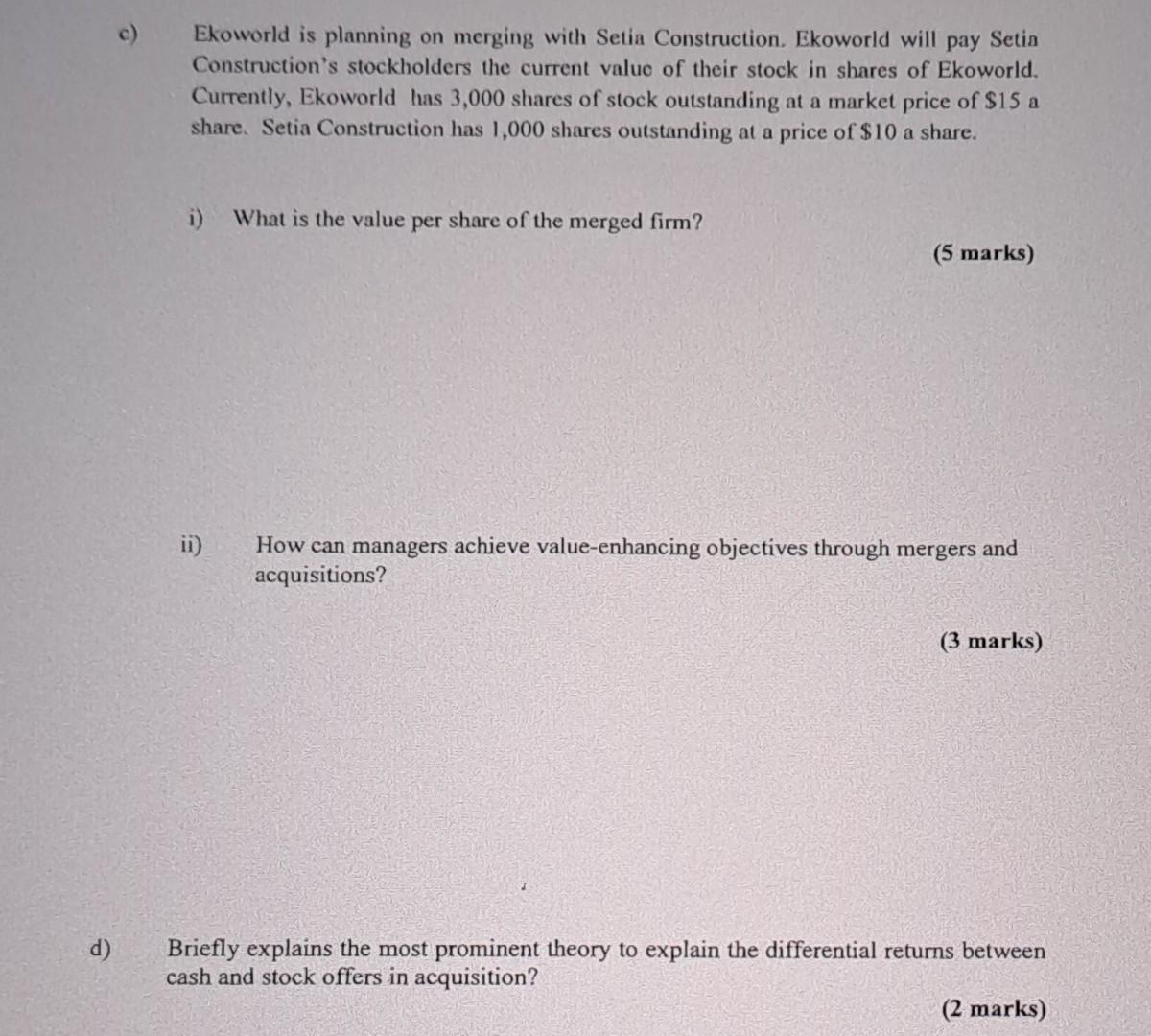

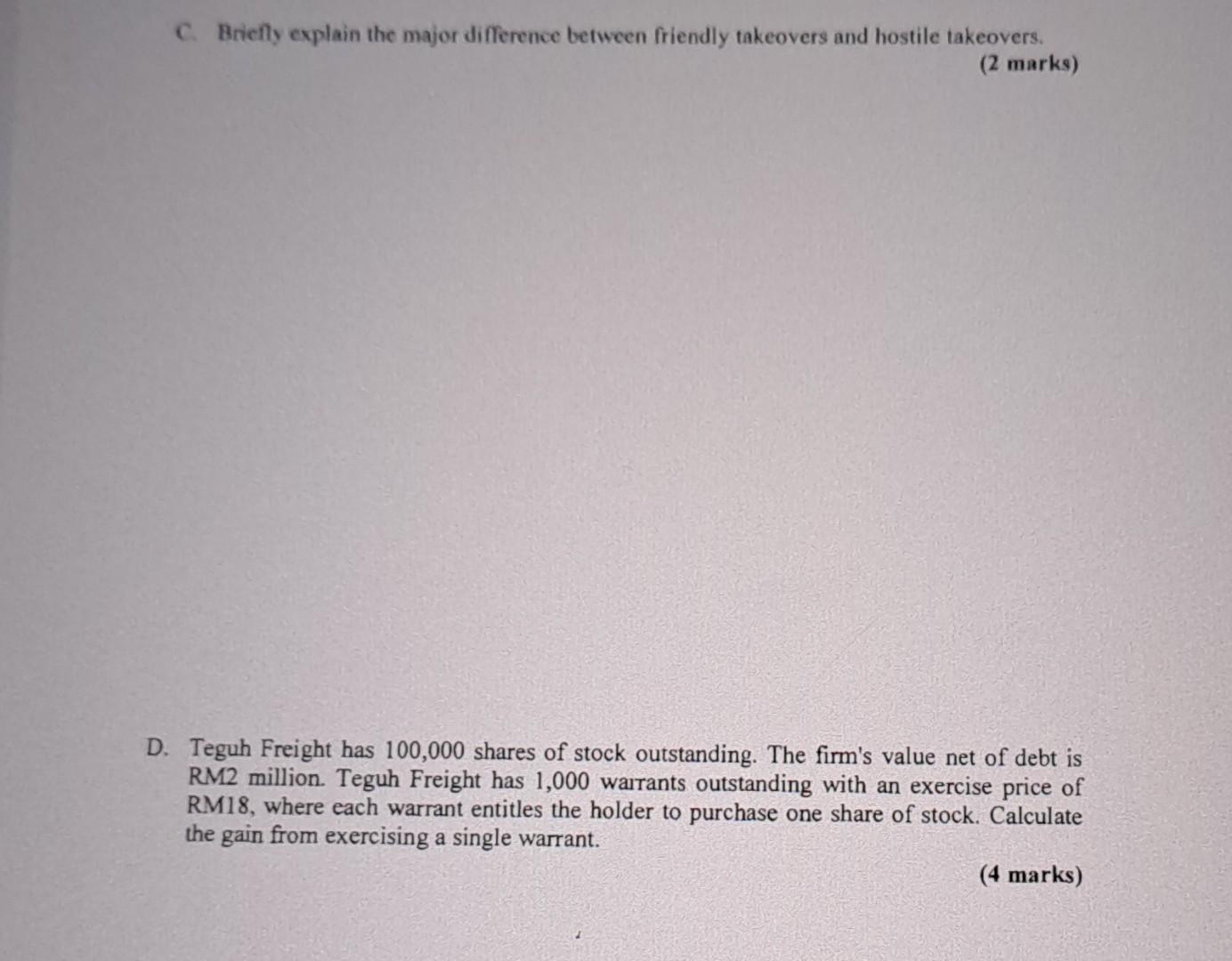

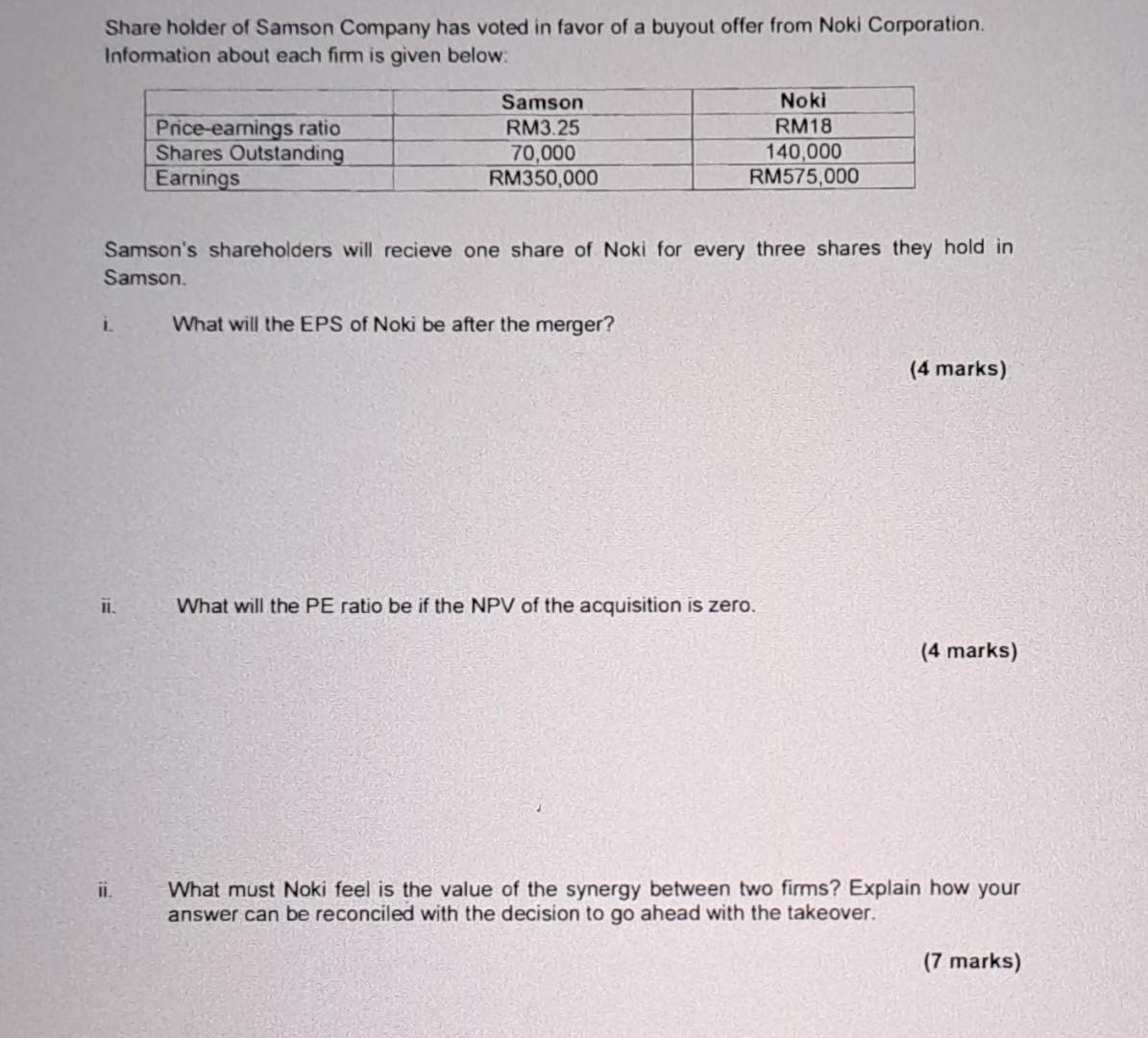

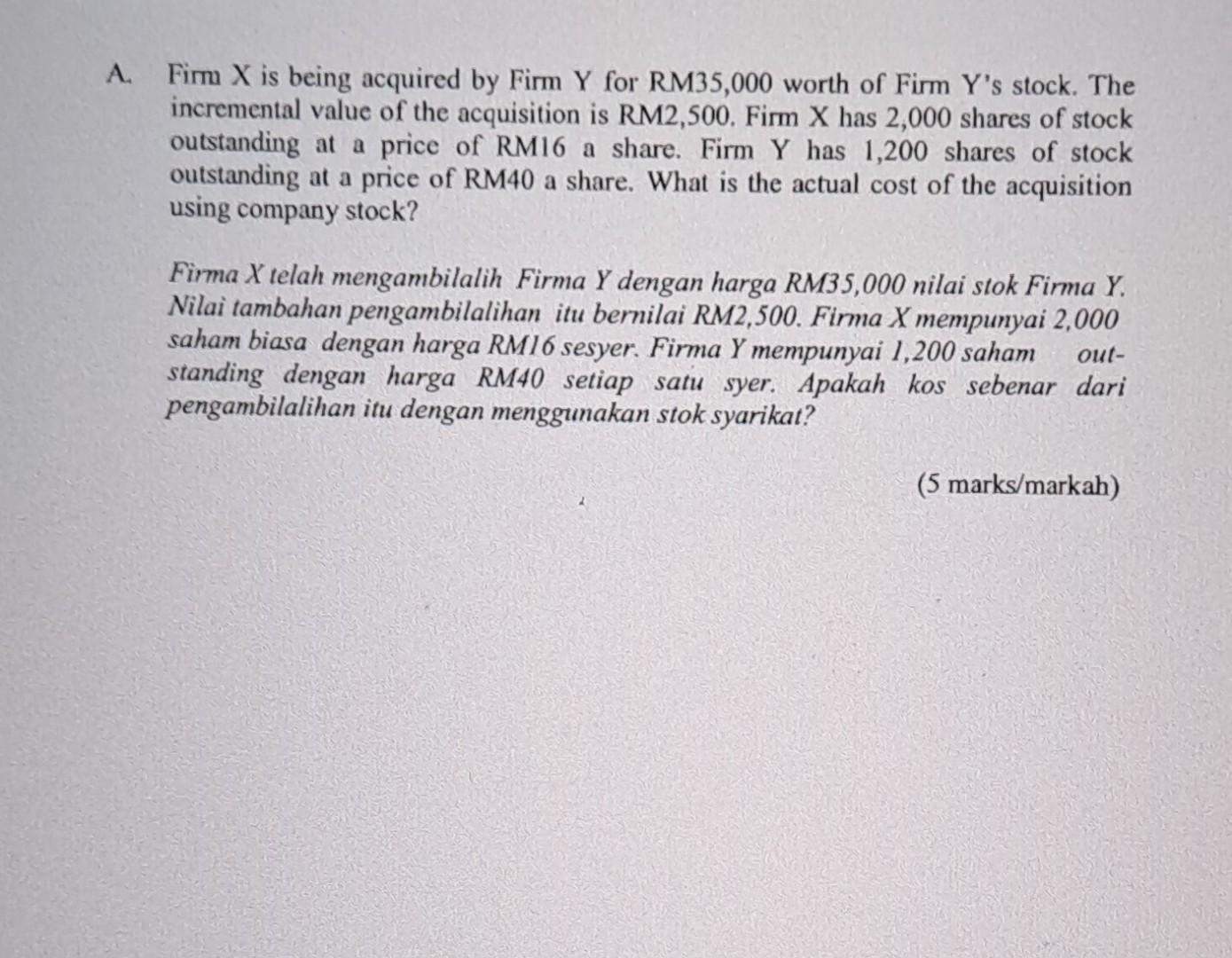

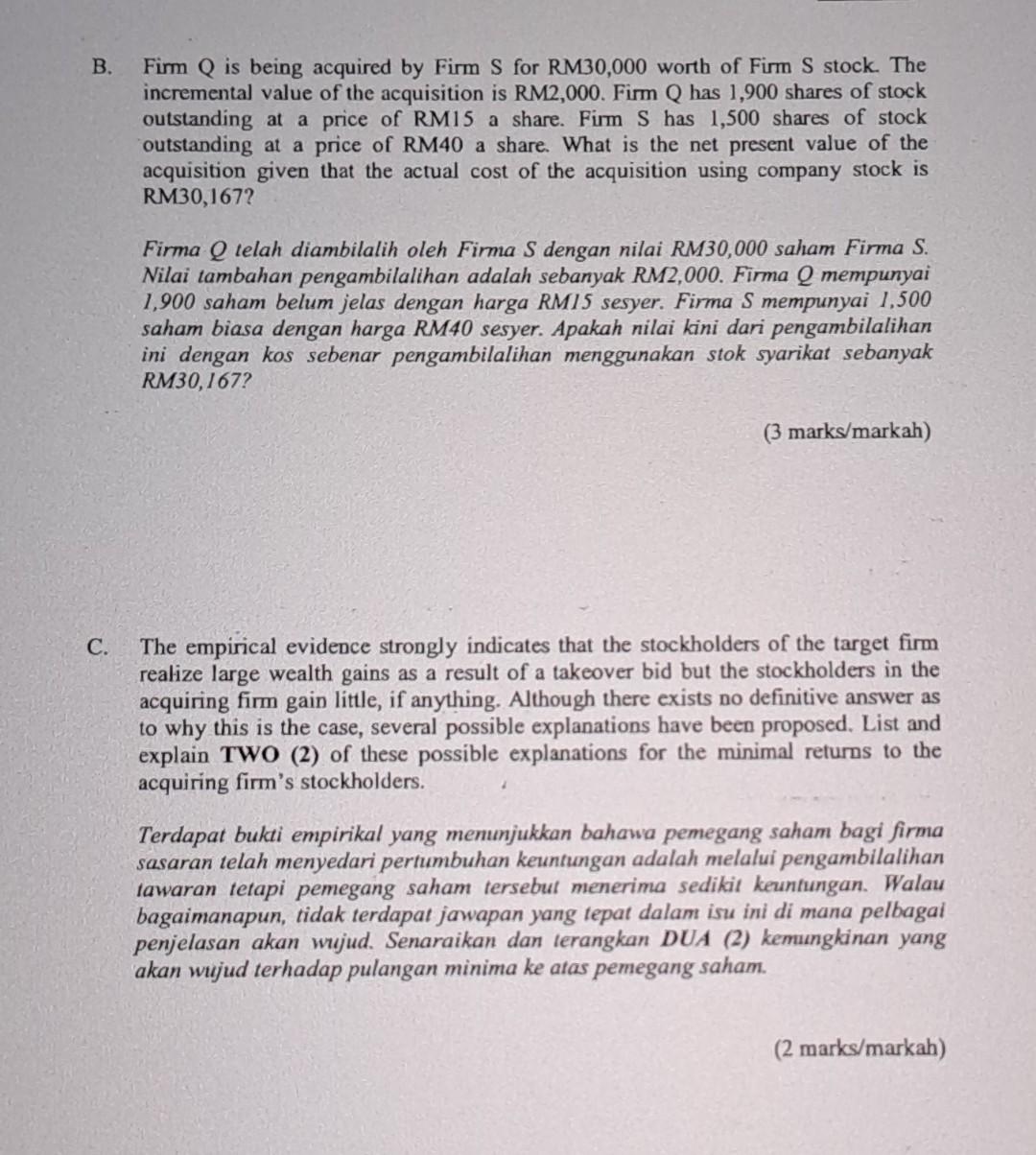

A. Discuss TWO (2) sourees of synergy in merger and acquisition. (6 marks) B. Consider the following information on firm ABC and DEF. Assume that both firms are all-equity firms. Firm ABC has estimated that the value of the synergistic benefits from acquiring firm DEF is RM5,500. i. If firm DEF is willing to be acquired for RM29 per share in cash, calculate the NPV of the merger. (4 marks) ii. What is the price per share of the merged firm assuming the conditions in (i)? (4 marks) iii. Calculate the merger premium. (2 marks) incremental value of the acquisition is RM2,000. Firm Q has 1,900 shares of stock outstanding at a price of RM15 a share. Firm S has 1,500 shares of stock outstanding at a price of RM40 a share. What is the net present value of the acquisition given that the actual cost of the acquisition using company stock is RM30,167? Firma Q telah diambilalih oleh Firma S dengan nilai RM30,000 saham Firma S. Nilai tambahan pengambilalihan adalah sebanyak RM2,000. Firma Q mempunyai 1,900 saham belum jelas dengan harga RMIS sesyer. Firma S mempunyai 1,500 saham biasa dengan harga RM40 sesyer. Apakah nilai kini dari pengambilalihan ini dengan kos sebenar pengambilalihan menggunakan stok syarikat sebanyak RM30, 167? (3 marks/markah) C. The empirical evidence strongly indicates that the stockholders of the target firm realize large wealth gains as a result of a takeover bid but the stockholders in the acquiring firm gain little, if anything. Although there exists no definitive answer as to why this is the case, several possible explanations have been proposed. List and explain TWO (2) of these possible explanations for the minimal returns to the acquiring firm's stockholders. Terdapat bukti empirikal yang memunjukkan bahawa pemegang saham bagi firma sasaran telah menyedari pertumbuhan keuntungan adalah melalui pengambilalihan tawaran tetapi pemegang saham tersebut menerima sedikit keuntungan. Walau bagaimanapun, tidak terdapat jawapan yang tepat dalam isu ini di mana pelbagai penjelasan akan wujud. Senaraikan dan terangkan DUA (2) kemungkinan yang akan wujud terhadap pulangan minima ke atas pemegang saham. c) Ekoworld is planning on merging with Setia Construction. Ekoworld will pay Setia Construction's stockholders the current value of their stock in shares of Ekoworld. Currently, Ekoworld has 3,000 shares of stock outstanding at a market price of $15 a share. Setia Construction has 1,000 shares outstanding at a price of $10 a share. i) What is the value per share of the merged firm? (5 marks) ii) How can managers achieve value-enhancing objectives through mergers and acquisitions? (3 marks) Briefly explains the most prominent theory to explain the differential returns between cash and stock offers in acquisition? (2 marks) Share holder of Samson Company has voted in favor of a buyout offer from Noki Corporation. Information about each firm is given below: Samson's shareholders will recieve one share of Noki for every three shares they hold in Samson. i. What will the EPS of Noki be after the merger? (4 marks) ii. What will the PE ratio be if the NPV of the acquisition is zero. (4 marks) ii. What must Noki feel is the value of the synergy between two firms? Explain how your answer can be reconciled with the decision to go ahead with the takeover. a) Several possible explanations have been proposed following empirical evidence that indicates stockholders of the target firm realize large wealth gains as a result of a takeover bid but the stockholders in the acquiring firm gain little, if anything. Briefly explain ONE (1) possible explanation for the minimal returns to the acquiring firm's stockholders. (2 marks) Describe the THREE (3) basic legal procedures that one firm can use to acquire another and briefly discuss the advantages and disadvantages of each. (3 marks) Firm X is being acquired by Firm Y for RM35,000 worth of Firm Y 's stock. The incremental value of the acquisition is RM2,500. Firm X has 2,000 shares of stock outstanding at a price of RM16 a share. Firm Y has 1,200 shares of stock outstanding at a price of RM40 a share. What is the actual cost of the acquisition using company stock? Firma X telah mengambilalih Firma Y dengan harga RM35,000 nilai stok Firma Y. Nilai tambahan pengambilalihan itu bernilai RM2,500. Firma X mempunyai 2,000 saham biasa dengan harga RMI6 sesyer. Firma Y mempunyai 1,200 saham outstanding dengan harga RM40 setiap satu syer. Apakah kos sebenar dari pengambilalihan itu dengan menggunakan stok syarikat? C. Briefly explain the major difference between friendly takeovers and hostile takeovers. (2 marks) D. Teguh Freight has 100,000 shares of stock outstanding. The firm's value net of debt is RM2 million. Teguh Freight has 1,000 warrants outstanding with an exercise price of RM18, where each warrant entitles the holder to purchase one share of stock. Calculate the gain from exercising a single warrant. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started