Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A distant relative has died and left you $27,000 which you wish to invest in the stock market. You want the highest possible return,

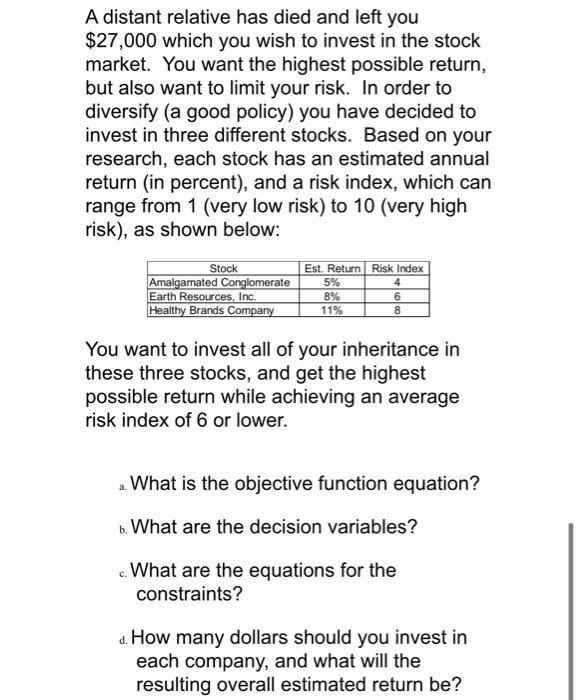

A distant relative has died and left you $27,000 which you wish to invest in the stock market. You want the highest possible return, but also want to limit your risk. In order to diversify (a good policy) you have decided to invest in three different stocks. Based on your research, each stock has an estimated annual return (in percent), and a risk index, which can range from 1 (very low risk) to 10 (very high risk), as shown below: Stock Amalgamated Conglomerate Earth Resources, Inc. Healthy Brands Company Est. Return Risk Index 5% 4 8% 6 11% 8 You want to invest all of your inheritance in these three stocks, and get the highest possible return while achieving an average risk index of 6 or lower. a. What is the objective function equation? b. What are the decision variables? c. What are the equations for the constraints? a. How many dollars should you invest in each company, and what will the resulting overall estimated return be?

Step by Step Solution

★★★★★

3.51 Rating (141 Votes )

There are 3 Steps involved in it

Step: 1

Okay here are the steps to solve this optimization problem a The objective functi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started