Question

A dividend of $4 has just been paid on Stock A. It is expected that the company will increase its dividend by 15% in

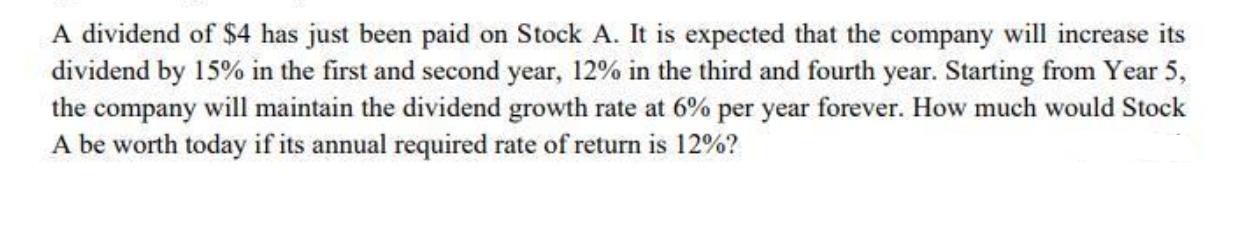

A dividend of $4 has just been paid on Stock A. It is expected that the company will increase its dividend by 15% in the first and second year, 12% in the third and fourth year. Starting from Year 5, the company will maintain the dividend growth rate at 6% per year forever. How much would Stock A be worth today if its annual required rate of return is 12%?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the current value of Stock A we can use the dividend discount model DDM formula which c...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Thomas Beechy, Umashanker Trivedi, Kenneth MacAulay

6th edition

013703038X, 978-0137030385

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App