Answered step by step

Verified Expert Solution

Question

1 Approved Answer

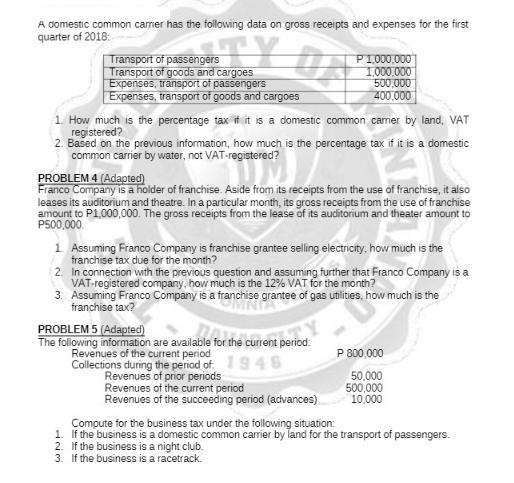

A domestic common camer has the following data on gross receipts and expenses for the first quarter of 2018: TV Transport of passengers Transport

A domestic common camer has the following data on gross receipts and expenses for the first quarter of 2018: TV Transport of passengers Transport of goods and cargoes Expenses, transport of passengers Expenses, transport of goods and cargoes 1. How much is the percentage tax if it is a domestic common carrier by land, VAT registered? 2. Based on the previous information, how much is the percentage tax if it is a domestic common carrier by water, not VAT-registered? PROBLEM 4 (Adapted) Franco Company is a holder of franchise. Aside from its receipts from the use of franchise, it also leases its auditorium and theatre. In a particular month, its gross receipts from the use of franchise amount to P1,000,000. The gross receipts from the lease of its auditorium and theater amount to P500,000 P 1,000,000 1.000.000 500,000 400,000 1. Assuming Franco Company is franchise grantee selling electricity, how much is the franchise tax due for the month? 2. In connection with the previous question and assuming further that Franco Company is a VAT-registered company, how much is the 12% VAT for the month? 3. Assuming Franco Company is a franchise grantee of gas utilities, how much is the franchise tax? PROBLEM 5 (Adapted) The following information are available for the current period Revenues of the current period Collections during the period of 1948 Revenues of prior periods Revenues of the current period Revenues of the succeeding period (advances) P 800,000 50,000 500,000 10,000 Compute for the business tax under the following situation: 1. If the business is a domestic common carrier by land for the transport of passengers. 2. If the business is a night club. 3. If the business is a racetrack.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Calculate the taxes for the given scenarios Problem 1 For a domestic common carrier by land VATregistered The Percentage Tax rate for VATregistered do...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started