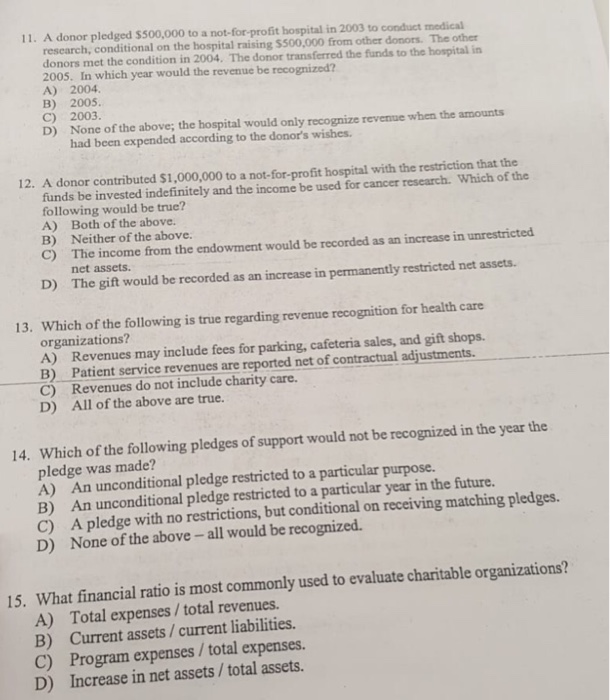

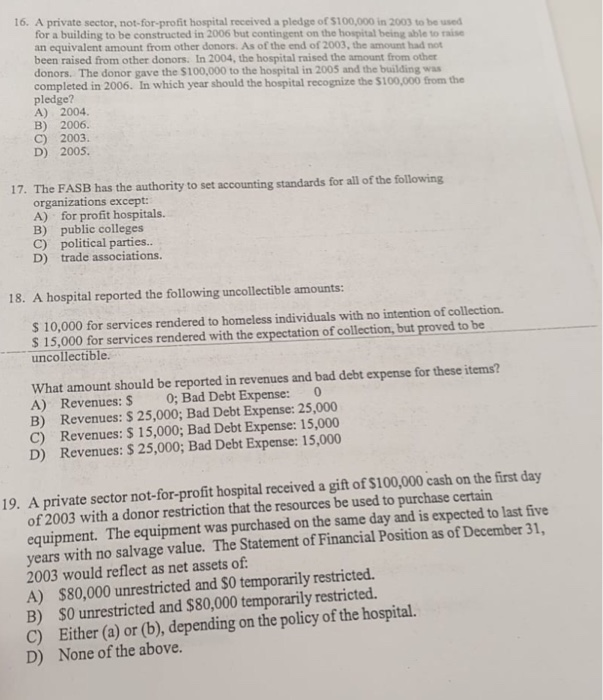

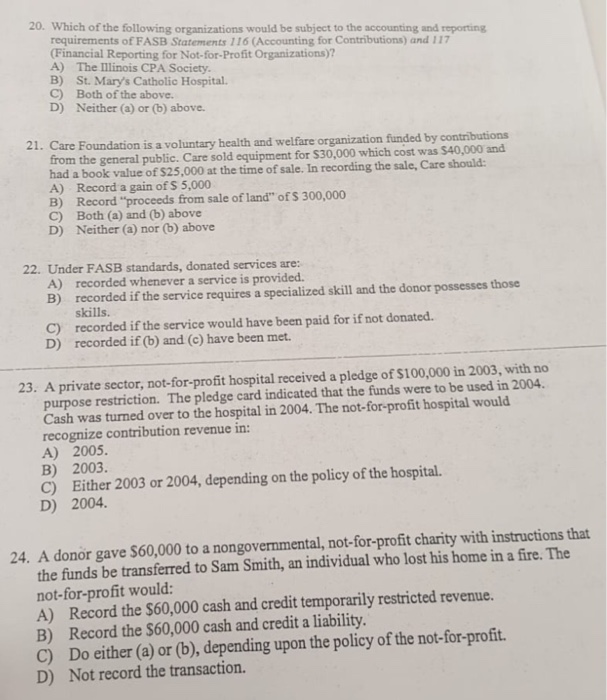

A donor pledged $500,000 to a not-for-profit hospital in 2003 to conduct medical research, conditional on the hospital raising $500,000 from other donors. The other donors met the condition in 2004. The donor transferred the funds to the hospital in 2005. In which year would the revenue be recognized? A) 2004 B) 2005. C) 2003. D) None of the above; the hospital would only recognize revenue when the amounts 11. had been expended according to the donor's wishes. 12. A donor contributed $1,000,000 to a not-for-profit hospital with the restriction that the funds be invested indefinitely and the income be used for cancer research. Which of the following would be true? A) Both of the above. B) Neither of the above C) The income from the endowment would be recorded as an increase in unrestricted net assets D) The gift would be recorded as an increase in permanently restricted net assets 13. Which of the following is true regarding revenue recognition for health care organizations? A) Revenues may include fees for parking, cafeteria sales, and gift shops B) Patient service revenues are reported net of contractual adjustments C) Revenues do not include charity care D) All of the above are true. Which of the following pledges of support would not be recognized in the year the pledge was made? A) An unconditional pledge restricted to a particular purpose. B) An unconditional pledge restricted to a particular year in the future 14. C) D) A pledge with no restrictions, but conditional on receiving matching pledges. None of the above - all would be recognized. 15. What financial ratio is most commonly used to evaluate charitable organizations? A) Total expenses/total revenues. B) Current assets/current liabilities C) Program expenses/total expenses. D) Increase in net assets/ total assets. 16. A private sector, not-for-profit hospital received a pledge of $100,000 in 2003 to be used for a building to be constructed in 2006 but contingent on the hospital being able to raise an equivalent amount from other donors. As of the end of 2003, the amount had not been raised from other donors. In 2004, the hospital raised the amount from other donors. The donor gave the $100,000 to the hospital in 2005 and the building was completed in 2006. In which year should the hospital recognize the $100,000 from the pledge? A) 2004. B) 2006. C) 2003 D) 2005. 17. The FASB has the authority to set accounting standards for all of the following organizations except: A) for profit hospitals. B) public colleges C) political parties.. D) trade associations. 18. A hospital reported the following uncollectible amounts: $ 10,000 for services rendered to homeless individuals with no intention of collection S 15,000 for services rendered with the expectation of collection, but proved to be uncollectible. What amount should be reported in revenues and bad debt expense for these items? A) Revenues: S0; Bad Debt Expense: 0 B) Revenues: $ 25,000; Bad Debt Expense: 25,000 C) Revenues: $ 15,000; Bad Debt Expense: 15,000 D) Revenues:$ 25,000; Bad Debt Expense: 15,000 19. A private sector not-for-profit hospital received a gift of S100,000 cash on the first day of 2003 with a donor restriction that the resources be used to purchase certain equipment. The equipment was purchased on the same day and is expected to last five years with no salvage value. The Statement of Financial Position as of December 31 2003 would reflect as net assets of. A) $80,000 unrestricted and $0 temporarily restricted. B) S0 unrestricted and $80,000 temporarily restricted. C) Either (a) or (b), depending on the policy of the hospital. D) None of the above. 20. Which of the following organizations would be subject to the accounting and reporting requirements of FASB Statements 116 (Accounting for Contributions) and 117 Financial Reporting for Not-for-Profit Organizations)? A) The Illinois CPA Society B) St. Mary's Catholic Hospital. C) Both of the above. D) Neither (a) or (b) above. 21. Care Foundation is a voluntary health and welfare organization funded by contributions from the general public. Care sold equipment for $30,000 which cost was $40,000 and had a book value of $25,000 at the time of sale. In recording the sale, Care should: A) Record a gain of S 5,000 B) Record "proceeds from sale of land" of S 300,000 C) Both (a) and (b) above D) Neither (a) nor (b) above 22. Under FASB standards, donated services are: A) recorded whenever a service is provided. recorded if the service requires a specialized skill and the donor possesses those skills. B) C) recorded if the service would have been paid for if not donated D) recorded if (b) and (c) have been met. 23. A private sector, not-for-profit hospital received a pledge of $100,000 in 2003, with no purpose restriction. The pledge card indicated that the funds were to be used in 2004. Cash was turned over to the hospital in 2004. The not-for-profit hospital would recognize contribution revenue in: A) 2005. B) 2003. C) Either 2003 or 2004, depending on the policy of the hospital. D) 2004. 24. A donor gave $60,000 to a nongovernmental, not-for-profit charity with instructions that the funds be transferred to Sam Smith, an individual who lost his home in a fire. The not-for-profit would: A) Record the $60,000 cash and credit temporarily restricted revenue. B) Record the $60,000 cash and credit a liability C) Do either (a) or (b), depending upon the policy of the not-for-profit D) Not record the transaction