Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Doraemon Sdn. Bhd. just purchased an automatic printing machine for RM 10 000 now with the annual payments of RM 500 per year

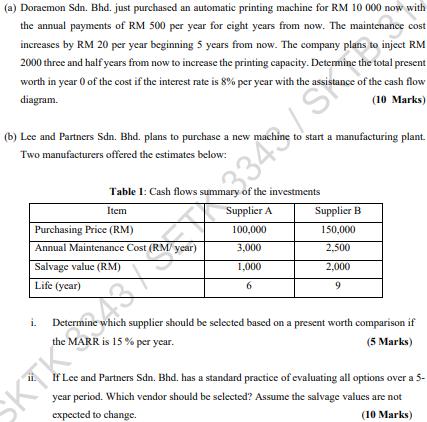

(a) Doraemon Sdn. Bhd. just purchased an automatic printing machine for RM 10 000 now with the annual payments of RM 500 per year for eight years from now. The maintenance cost increases by RM 20 per year beginning 5 years from now. The company plans to inject RM 2000 three and half years from now to increase the printing capacity. Determine the total present worth in year 0 of the cost if the interest rate is 8% per year with the assistance of the cash flow diagram. (10 Marks) (b) Lee and Partners Sdn. Bhd. plans to purchase a new machine to start a manufacturing plant. Two manufacturers offered the estimates below: i. S Table 1: Cash flows summary of the investments Item Supplier A Purchasing Price (RM) 100,000 Annual Maintenance Cost (RM/year) 3,000 Salvage value (RM) 1,000 Life (year) 6 3343 SKTK Supplier B 150,000 2.500 2,000 9 Determi hich supplier should be selected based on a present worth comparison if the MARR is 15% per year. (5 Marks) ii. If Lee and Partners Sdn. Bhd. has a standard practice of evaluating all options over a 5- year period. Which vendor should be selected? Assume the salvage values are not expected to change. (10 Marks)

Step by Step Solution

★★★★★

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

a To determine the total present worth in year 0 of the cost of the printing machine we need to create a cash flow diagram and calculate the present w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started