Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Draw a payoff diagram of the company's equity and debt as a function of the company's asset value in 1 year (i.e. the

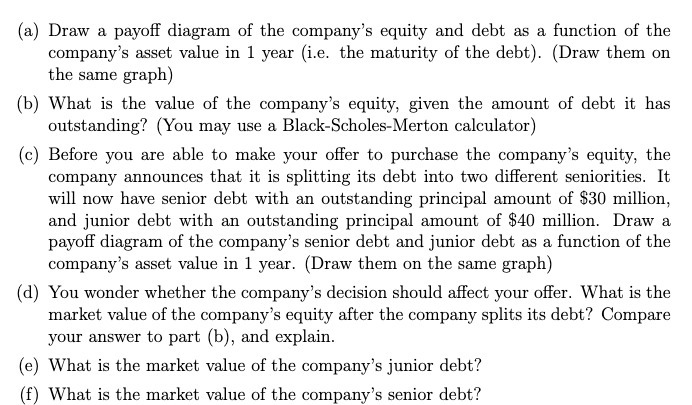

(a) Draw a payoff diagram of the company's equity and debt as a function of the company's asset value in 1 year (i.e. the maturity of the debt). (Draw them on the same graph) (b) What is the value of the company's equity, given the amount of debt it has outstanding? (You may use a Black-Scholes-Merton calculator) (c) Before you are able to make your offer to purchase the company's equity, the company announces that it is splitting its debt into two different seniorities. It will now have senior debt with an outstanding principal amount of $30 million, and junior debt with an outstanding principal amount of $40 million. Draw a payoff diagram of the company's senior debt and junior debt as a function of the company's asset value in 1 year. (Draw them on the same graph) (d) You wonder whether the company's decision should affect your offer. What is the market value of the company's equity after the company splits its debt? Compare your answer to part (b), and explain. (e) What is the market value of the company's junior debt? (f) What is the market value of the company's senior debt?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I can describe the payoff diagrams for the companys equity and debt as a function of the companys asset value in 1 year Payoff Diagram The equity payoff diagram represents the value of the companys eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started