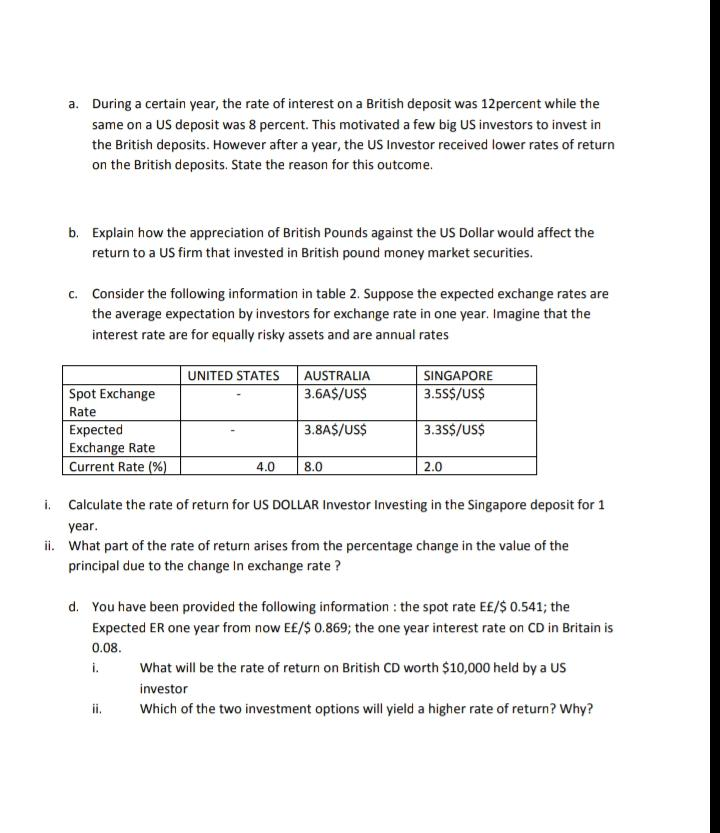

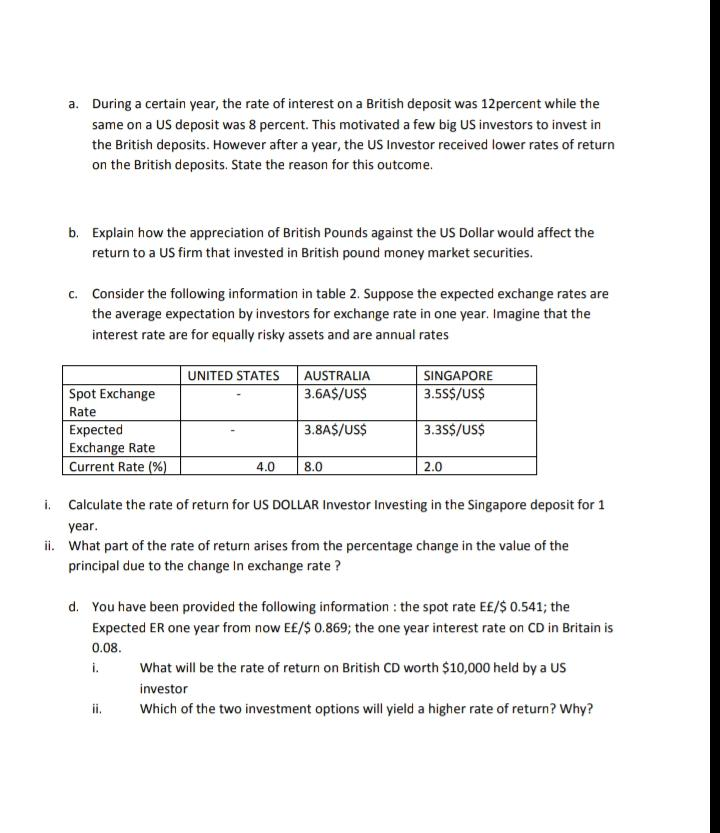

a. During a certain year, the rate of interest on a British deposit was 12 percent while the same on a US deposit was 8 percent. This motivated a few big US investors to invest in the British deposits. However after a year, the US Investor received lower rates of return on the British deposits. State the reason for this outcome b. Explain how the appreciation of British Pounds against the US Dollar would affect the return to a US firm that invested in British pound money market securities. C. Consider the following information in table 2. Suppose the expected exchange rates are the average expectation by investors for exchange rate in one year. Imagine that the interest rate are for equally risky assets and are annual rates UNITED STATES AUSTRALIA 3.6AS/US$ SINGAPORE 3.55$/US$ Spot Exchange Rate Expected Exchange Rate Current Rate (%) 3.8A$/US$ 3.35$/US$ 4.0 8.0 2.0 i. Calculate the rate of return for US DOLLAR Investor Investing in the Singapore deposit for 1 year. ii. What part of the rate of return arises from the percentage change in the value of the principal due to the change in exchange rate ? d. You have been provided the following information : the spot rate EE/$ 0.541; the Expected ER one year from now E/$ 0.869; the one year interest rate on CD in Britain is 0.08. What will be the rate of return on British CD worth $10,000 held by a US investor Which of the two investment options will yield a higher rate of return? Why? a. During a certain year, the rate of interest on a British deposit was 12 percent while the same on a US deposit was 8 percent. This motivated a few big US investors to invest in the British deposits. However after a year, the US Investor received lower rates of return on the British deposits. State the reason for this outcome b. Explain how the appreciation of British Pounds against the US Dollar would affect the return to a US firm that invested in British pound money market securities. C. Consider the following information in table 2. Suppose the expected exchange rates are the average expectation by investors for exchange rate in one year. Imagine that the interest rate are for equally risky assets and are annual rates UNITED STATES AUSTRALIA 3.6AS/US$ SINGAPORE 3.55$/US$ Spot Exchange Rate Expected Exchange Rate Current Rate (%) 3.8A$/US$ 3.35$/US$ 4.0 8.0 2.0 i. Calculate the rate of return for US DOLLAR Investor Investing in the Singapore deposit for 1 year. ii. What part of the rate of return arises from the percentage change in the value of the principal due to the change in exchange rate ? d. You have been provided the following information : the spot rate EE/$ 0.541; the Expected ER one year from now E/$ 0.869; the one year interest rate on CD in Britain is 0.08. What will be the rate of return on British CD worth $10,000 held by a US investor Which of the two investment options will yield a higher rate of return? Why